Different Types of Spot Orders

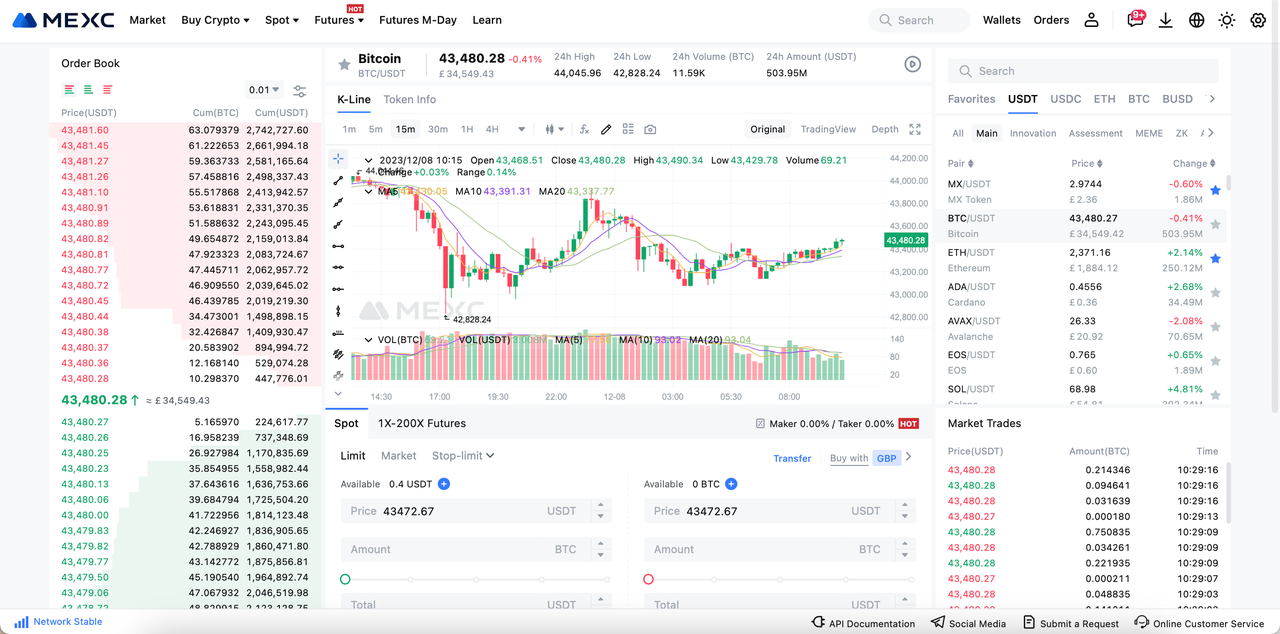

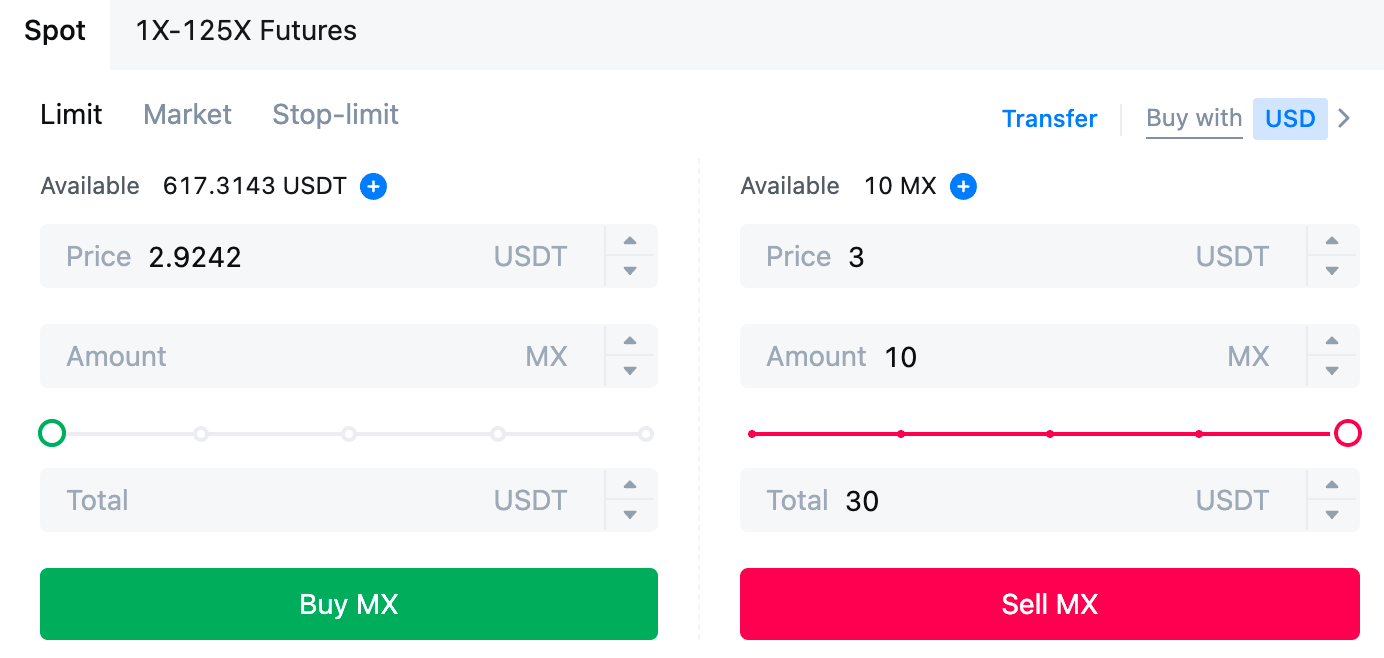

1. Limit Order

2. Market Order

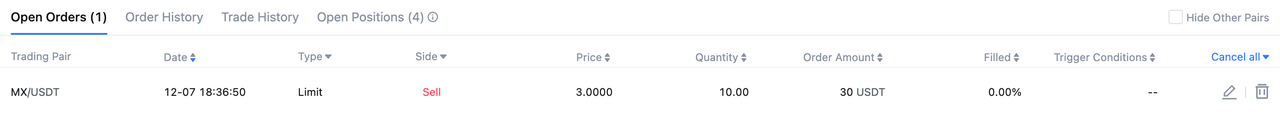

3. Take-Profit / Stop-Loss (TP/SL) Orders

- Limit TP/SL: You set both a trigger price and a limit price. When the market price reaches the trigger price, the system places a limit order at your preset price.

- Market TP/SL: You only need to set a trigger price. When the market price reaches the trigger price, the system submits a market order and executes at the best available price.

Example 1 (Stop-Limit + Stop-Loss)

You hold BTC and set a trigger price of 110,000 USDT with a limit sell price of 100,000 USDT. When the market price falls to 110,000 USDT, the system automatically places a limit sell order at 100,000 USDT, attempting to execute the stop-loss at that price.

Example 2 (Market Take-Profit)

You hold ETH and set a trigger price of 5,000 USDT. When the market price rises to 5,000 USDT, the system submits a market sell order and executes at the best available price to lock in profits.

To learn more about TP/SL orders, refer to: What Is a Take-Profit/Stop-Loss Order?

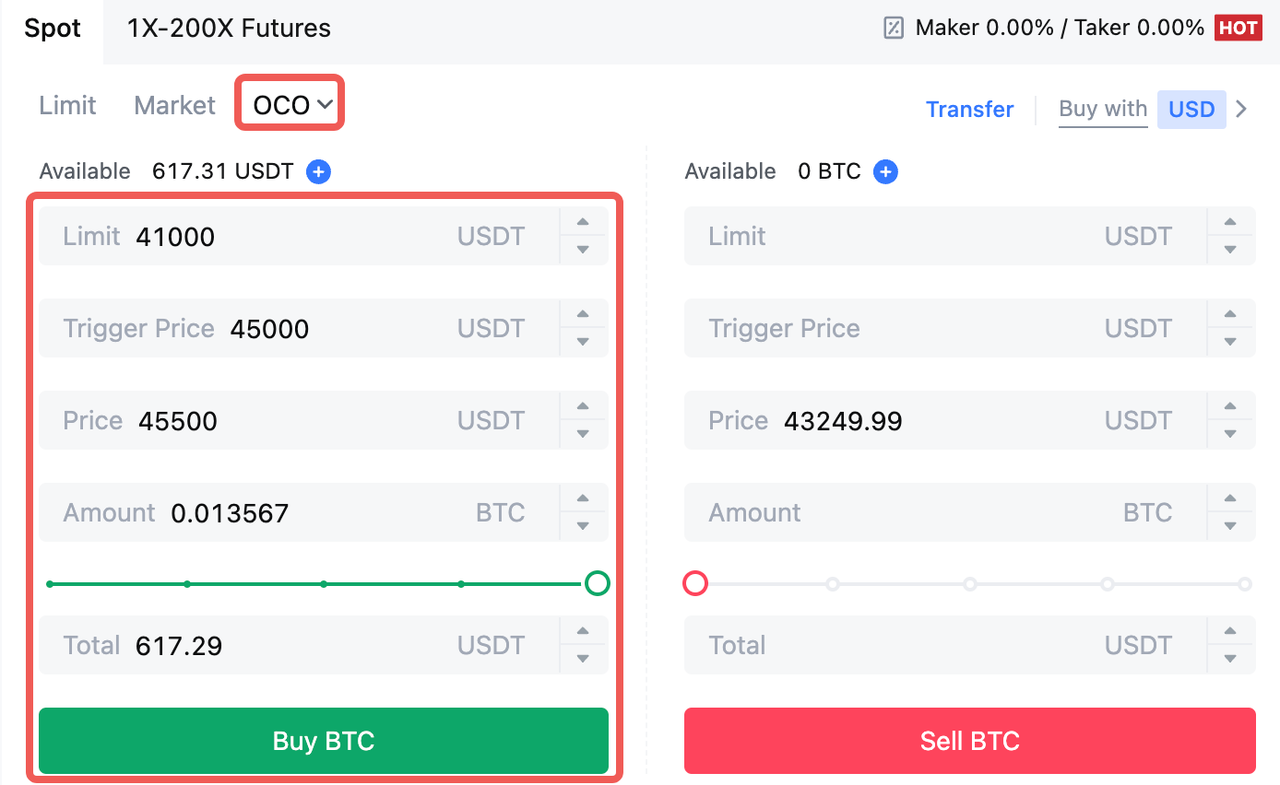

4. One-Cancels-the-Other (OCO) Order

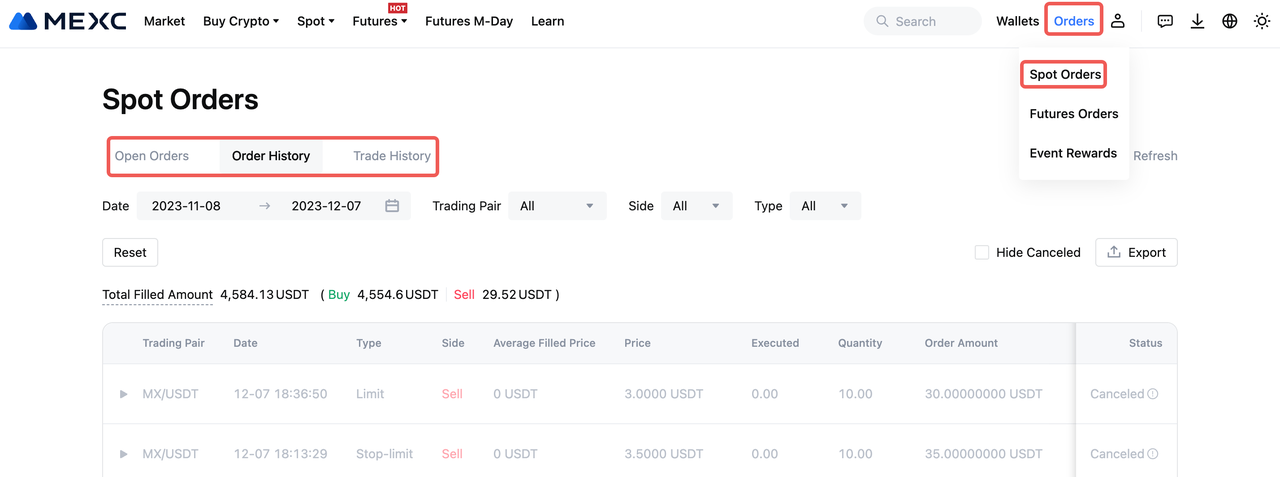

5. How To Check Order History

Popular Articles

Should I Sell XRP? A Realistic Look at Your Investment Decision

XRP's price swings have many investors asking a tough question: should I sell my XRP now, or hold tight?This isn't an easy call. XRP has delivered impressive long-term gains but faces real competitive

What Banks Use XRP? Complete List of Financial Institutions Using Ripple

Sending money across borders traditionally meant waiting days and paying steep fees. Today, financial institutions worldwide are turning to XRP to revolutionize international payments.This guide answe

Who Created XRP? The Complete Story Behind Ripple's Digital Asset

XRP regularly ranks among the top 10 cryptocurrencies by market capitalization, yet many investors don't know the story behind its creation.Unlike Bitcoin, which emerged from a mysterious creator, XRP

How Does XRP Work? A Beginner's Guide to Ripple's Cryptocurrency

Sending money across borders shouldn't cost a fortune or take days to arrive.XRP offers a different approach to global payments, settling transactions in seconds rather than days.This guide explains h

Hot Crypto Updates

View More

OVERTAKE (TAKE) Futures Trading: Risks and Rewards

Introduction to OVERTAKE (TAKE) Futures Trading OVERTAKE (TAKE) futures contracts allow traders to buy or sell TAKE at a predetermined price on a future date without owning the actual tokens. Unlike

A Complete Guide to the OVERTAKE (TAKE) Transaction Process

Introduction to OVERTAKE (TAKE) Transactions Understanding the basics of OVERTAKE (TAKE) transactions Importance of transaction knowledge for investors and users Overview of OVERTAKE (TAKE)

OVERTAKE (TAKE) Price History: Patterns Every Trader Should Know

What is Historical Price Analysis and Why It Matters for OVERTAKE (TAKE) Investors Historical price analysis in cryptocurrency markets is a fundamental research methodology that examines past price

OVERTAKE (TAKE) Volatility Guide: How to Profit from Price Swings

Understanding OVERTAKE (TAKE) Volatility and Its Importance Price volatility in cryptocurrency refers to the rapid and significant changes in token prices over short periods. This is a defining

Trending News

View MoreBNB Flips XRP to Take 4th in Market Cap - Is a New Layer-1 Leader Emerging?

BNB traded at $900.40 at the time of writing, down 1.32% in the last 24 hours, as its market cap climbed to about $124.02 billion. This move pushed BNB ahead of

Brazilian Crypto Industry to Sue if Government Pursues Stablecoin Taxation

The post Brazilian Crypto Industry to Sue if Government Pursues Stablecoin Taxation appeared on BitcoinEthereumNews.com. Julia Rosin, President of Abcripto, the

What Would It Take for Silver to Reach $100?

The post What Would It Take for Silver to Reach $100? appeared on BitcoinEthereumNews.com. The XAG price remains on the radar for most investors as Silver leads

‘Remains to be seen‘ Whether US will Seize Venezuela‘s Bitcoin

The post ‘Remains to be seen‘ Whether US will Seize Venezuela‘s Bitcoin appeared on BitcoinEthereumNews.com. Paul Atkins, chair of the US Securities and Exchange

Related Articles

MEXC Spot Trading Fees: Maker & Taker Rates Calculator

Key Takeaways MEXC charges 0% maker fees and 0.05% taker fees for spot trading, making it highly cost-effective for liquidity providers. MX token holders with 500+ tokens for 24 hours receive a 50

MEXC Loans is Now Live!

MEXC Loans is a cryptocurrency lending solution introduced by MEXC. MEXC Loans allows users to collateralize one of their cryptocurrency assets to borrow another that they can then use for spot tradin

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC

Spot Market Trading Rules

In cryptocurrency spot trading, beyond price analysis and strategy selection, understanding and following the trading platform's market rules is equally crucial. For MEXC users, each trading pair not