Introduction to Ping (PING) Futures Trading

Ping (PING) futures contracts allow traders to buy or sell PING at a predetermined price at a future date without owning the actual tokens. Unlike spot trading, PING futures involve speculating on price movements using contracts that track the asset's value. These contracts utilize leverage options from 1-400x on MEXC and feature cash settlement at expiration or liquidation. The popularity of PING derivatives has grown significantly since 2023, with PING futures trading volumes often exceeding spot markets by 2-3 times. This growth stems from increased institutional participation and retail traders seeking amplified returns through platforms offering various contract types like perpetual futures.

Key Benefits of Trading Ping (PING) Futures

PING futures trading offers substantial leverage, allowing traders to control large positions with minimal capital. For example, with 20x leverage, a trader could control $20,000 worth of PING with just $1,000, potentially multiplying returns on favorable market movements. Unlike spot trading, PING futures enable traders to profit in both bull and bear markets by going long or short depending on price expectations. This flexibility is valuable in volatile cryptocurrency markets, allowing PING traders to capitalize on downward movements without selling actual holdings. Additionally, PING futures markets typically offer superior liquidity compared to spot markets, with tighter spreads and reduced slippage, making them suitable for various trading strategies and portfolio hedging.

Understanding the Risks of Ping (PING) Futures Trading

While leverage can amplify profits, it equally magnifies losses in PING futures. Using 50x leverage means a mere 2% adverse move could result in complete position liquidation. This makes risk management critical when trading volatile assets like PING. During extreme volatility, PING traders face heightened liquidation risks as rapid price changes can trigger automatic position closures. These events can be particularly devastating during cascading liquidations, which can cause exaggerated price movements. For longer PING futures positions, funding rates represent an important consideration affecting profitability. These periodic payments between long and short holders (typically every 8 hours) can significantly affect overall costs depending on market sentiment.

Advanced Trading Strategies for Ping (PING) Futures

Experienced traders employ strategies like basis trading to profit from temporary discrepancies between PING futures and spot prices. When PING futures trade at a premium or discount to spot, traders can take opposing positions in both markets to capture the spread as it converges. For PING investors with spot holdings, strategic hedging with futures provides protection during uncertain markets. By establishing short PING futures positions, investors can neutralize downside risk without selling their actual PING holdings—particularly valuable for avoiding taxable events. Successful PING trading ultimately depends on robust risk management, including appropriate position sizing (typically 1-5% of account), stop-loss orders, and careful leverage monitoring to avoid excessive exposure.

How to Start Trading Ping (PING) Futures on MEXC

- Register for a MEXC account and complete verification procedures

- Navigate to the 'Futures' section and select PING contracts

- Transfer funds from your spot wallet to your futures account

- Choose between USDT-margined or coin-margined PING contracts

- Select your preferred leverage (1-400x based on risk tolerance)

- Place your PING futures order (market, limit, or conditional) specifying direction and size

- Implement risk management using stop-loss, take-profit, and trailing stop tools

Conclusion

PING futures trading offers enhanced returns, market flexibility, and hedging opportunities alongside substantial risks that require careful management. MEXC provides a user-friendly yet sophisticated platform with competitive fees and comprehensive tools for PING futures trading, suitable for both new and experienced traders looking to expand beyond spot trading into PING derivatives.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact [email protected] for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Ping

View More

Senate denies holiday leave requests of Discaya, former DPWH officials

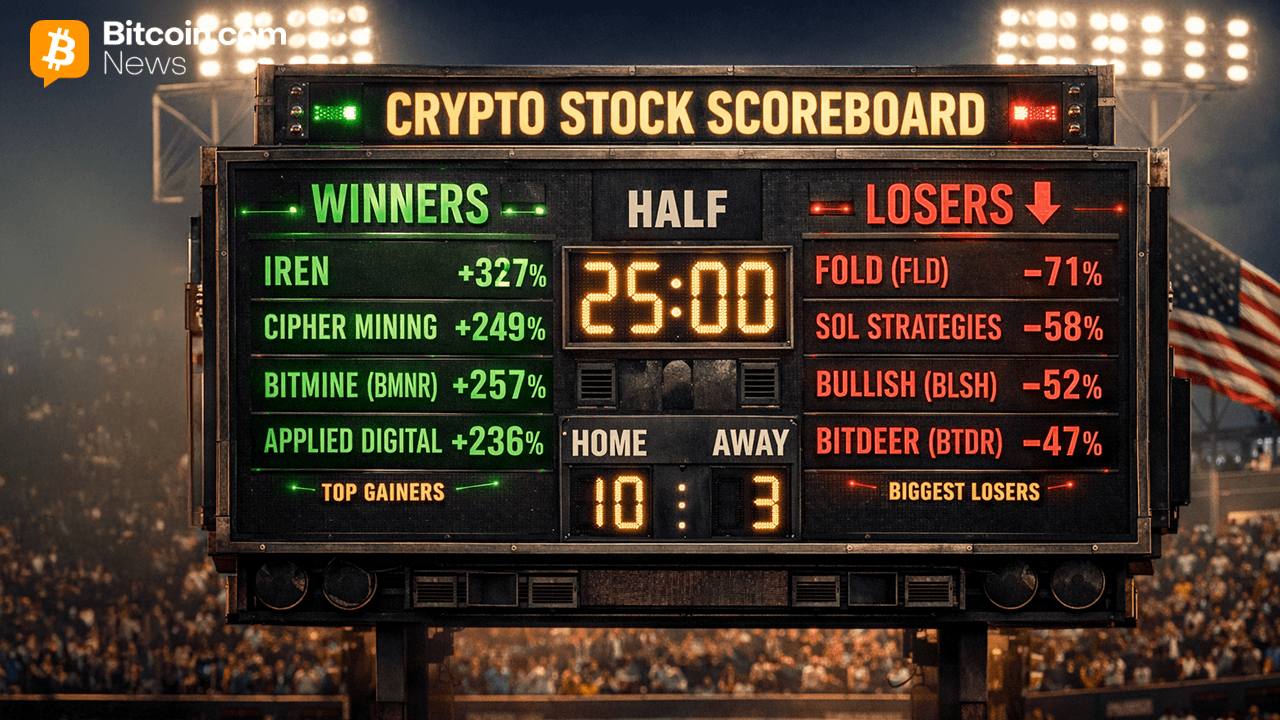

Crypto Stocks in 2025: Eye-Popping Winners, Brutal Losers, and Everything in Between

Senator pushes for heightened vigilance over 2026 budget use

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading