Bitcoin Tries to Reclaim $90K as Altcoins Fight to Rebound: Digitap ($TAP) Might Become the Best Crypto Presale for 2026 Gains

Late-cycle volatility is here, ETF flows are roaring back, Vanguard has finally joined the party, and the majors are starting to bounce across the board.

But where will the next leg of overperformance come from? What are the top altcoins to buy for 2026 gains? Flows to PayFi tokens are ramping up aggressively, and payments-focused crypto presales like Digitap ($TAP) have been crushing it.

Raising nearly $2.3 million in record time, flows are treating Digitap as one of the few banking-focused altcoins with genuine product-market fit. Crypto presales remain the best forward indicator of where capital wants to be in three to six months. And all the signs are flashing that the banking bull run has not even started yet.

Bitcoin (BTC/USD) – 1-Year Market Structure Analysis

Traders are watching to see if BTC forms a lower high or higher high at the end of this impulse. If BTC forms a lower high, it will be a confirmed dead cat bounce, and investors can come back to bid in October 2026—which, according to the 4-year cycle, will mark the next bottom.

The 1-year chart of Bitcoin reveals a broad cyclical pattern marked by a strong mid-year uptrend followed by a pronounced late-year correction. Early in the year, BTC traded within a choppy accumulation range before breaking decisively higher in April, initiating an impulsive rally that carried the price from the mid-$60,000s toward the $120,000–$125,000 resistance zone by late summer. This region formed a clear multi-top structure, indicating profit-taking and weakening bullish momentum.

As volatility increased into autumn, BTC began forming lower highs, a classic early signal of trend exhaustion, ultimately leading to a sharp breakdown below $110,000 and then $100,000—two key psychological and structural support levels. The November selloff accelerated into capitulation territory, driving price briefly toward the low-$80,000s before buyers stepped back in. The recent rebound toward $90,000 shows an attempt to establish a higher low, but the broader structure still reflects a market in recovery rather than a confirmed reversal. Overall, the chart illustrates a completed bull cycle peak followed by a corrective phase, with $88,000–$92,000 now acting as a critical battleground that will help determine whether Bitcoin regains upward momentum or continues its downtrend.

But would Vanguard really open access to crypto ETFs if it thought its client base would get smoked? Large corrections are normal late in the cycle, and while many KOLs on Crypto Twitter are calling that the top is already in, BTC is famous for surprising investors. With BTC flying, some of the best cryptos to buy now are staging a dramatic rebound, and many altcoins look great at their current levels.

Digitap’s Omni-Bank: The Leading Crypto Presale in the Banking Race

Digitap is the world’s first omni-bank. The first financial app where fiat, stablecoins, and crypto live side by side. Already live for download today on iOS and Android, the team behind this fintech-esque altcoin is going for a product-first approach. And judging from inflows, it appears to be working.

Users can currently hold more than 20 fiat currencies and over 100 crypto assets across multiple chains, all within a single dashboard. The days of juggling banking apps, exchanges, and self-custody wallets are over. Instead, everything lives on a single balance and can be swapped, sent, received, and spent in real time.

Digitap features a multi-rail architecture, meaning users can tap into public blockchains and legacy banking rails when they send a transfer. None of this complexity is visible—all users experience is their money moving faster.

Designed for the digital-first age, Digitap makes money instant and borderless. The line between fiat and crypto has blurred, and this crypto presale continues attracting capital.

Why Banking Tokens Like Digitap are the Standout Altcoins to Buy For 2026 Gains

The move into PayFi makes sense. This cycle’s strongest narrative has been stablecoins. Projects that take these digital dollars and make them useful rank as the best cryptos to buy now because of the enormous tailwind. The Trump admin wants $3 trillion of stablecoins on-chain—and that’s the kind of signal investors shouldn’t ignore.

Leading banking and PayFi projects wrap stablecoins in a familiar UX and make them accessible to non-crypto natives. And with volatility increasing in the late stage of the cycle, the altcoins to buy are the ones that behave more like lean fintechs than casino chips.

Digitap is a perfect example. It is not reinventing the wheel, just offering a better product to users and meeting them where they already live. The digital-first app is a clear signal that this team is going after the Gen Z and Millennials demographic, who already manage their finances almost exclusively via mobile.

Why Digitap Could Explode Next Year

Digitap did something that most teams never do. It directed value to token holders. 50% of platform profits are burned permanently, and the other half is distributed to stakers. The result is a simple, powerful flywheel where token holders share in the platform’s growth and success.

As altcoins begin to rebound alongside Bitcoin’s move back above $93,000, asset selection matters more than ever. The best cryptos to buy now are projects with live products, large addressable markets, and an ability to onboard non-crypto natives.

Digitap fits the bull perfectly. It delivers a global money app that lets users see all their value in one place, move it across borders in minutes instead of days, and spend it anywhere Visa is accepted. It is not surprising that $TAP is becoming one of the most interesting altcoins to buy for gains in 2026. Offering exposure to the secular growth of stablecoins and priced at just $0.0361 $TAP could quickly become one of the fastest horses next year.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned.

The post Bitcoin Tries to Reclaim $90K as Altcoins Fight to Rebound: Digitap ($TAP) Might Become the Best Crypto Presale for 2026 Gains appeared first on Coindoo.

You May Also Like

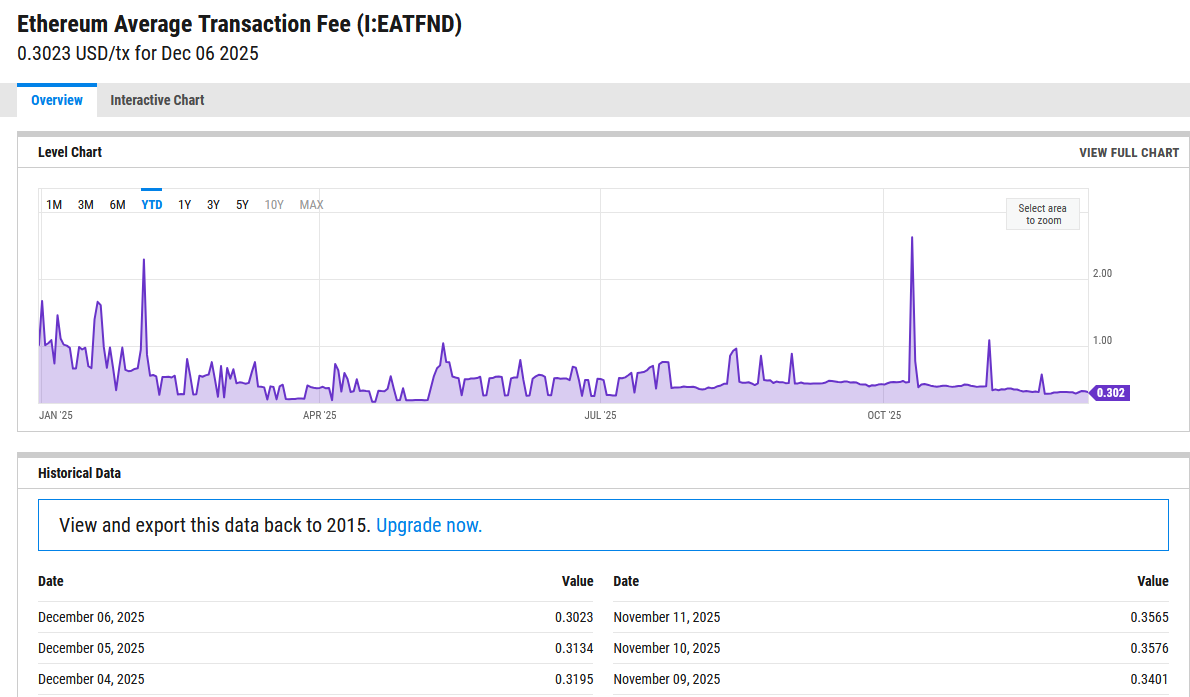

Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

Trading Moment: Markets Enter a Key Week Ending the Year, Bitcoin Holds Key Level at $86,000