What is Bollinger Bands (BOLL) indicator?

If you’ve ever stared at a chart, watched three lines slide up and down, and wondered what they mean, you’ve probably been discussing Bollinger Bands. In trading crypto or stocks, when someone mentions the “BOLL indicator,” it’s one of the first go-to tools for measuring volatility, spotting breakouts, or mapping overbought/oversold zones. But knowing what they are is just the start. To use Bollinger Bands as part of your toolkit, you need to understand how they were created, how they work, what they tell you in real-world conditions, and how you combine them with other tools.

What Are Bollinger Bands (BOLL)?

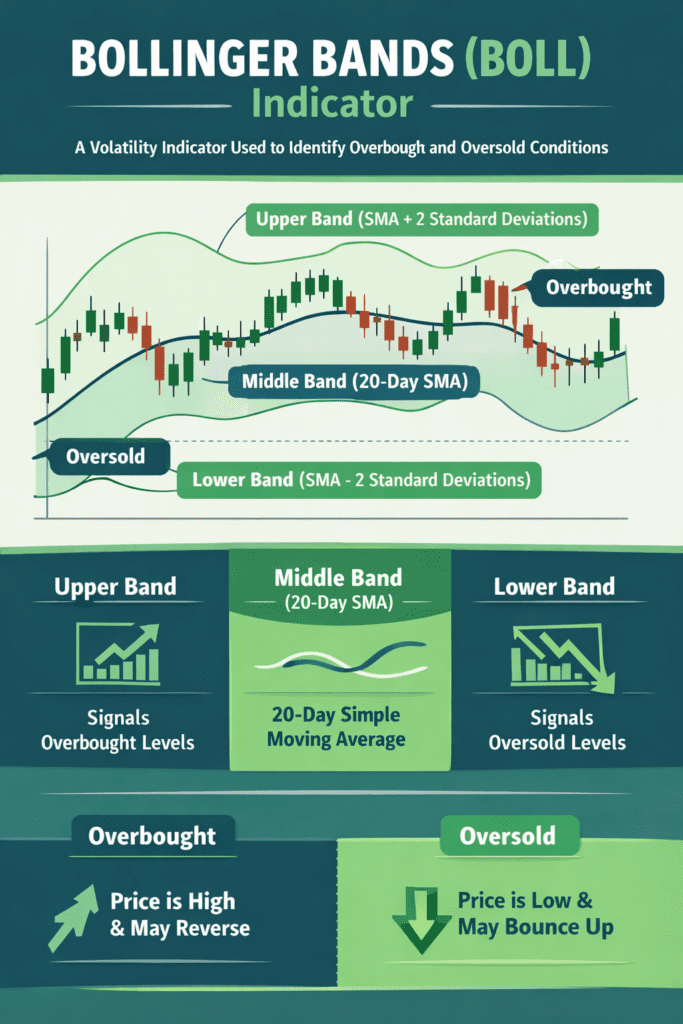

Bollinger Bands are a type of visual envelope plotted around price data that reflects volatility and relative pricing extremes. They consist of three lines: a middle band (typically a 20-period simple moving average), an upper band (that moving average plus a multiple of standard deviation), and a lower band (moving average minus that same multiple). When the bands widen, you’re seeing a rise in volatility; when they contract, the market is calm, often waiting for its next move.

History and Origin of the Bollinger Bands Indicator

The story begins in the early 1980s with John Bollinger, a technical analyst who observed something others were missing: markets don’t always follow a fixed volatility pattern. Volatility ebbs and flows. Fixed bands around a moving average often failed when the market changed pace. Bollinger set out to build an envelope system that adapted to volatility. He used standard deviation in conjunction with a moving average to create bands that automatically widen or contract depending on recent price variation. He introduced these to the public in the 1980s and eventually trademarked the term “Bollinger Bands”.

Read More: Relative Strength Index (RSI): Full Form, Strategy Indicator

How Bollinger Bands Work?

At the core of Bollinger Bands is the concept of volatility and mean-reversion (or breakout) potential. The middle band tracks the recent average price. The upper and lower bands sit above and below, at a distance defined by standard deviation. Essentially, when the price moves away from the average, it pushes into the outer bands. That tells the trader: “Hey, price may be stretched.” If the bands are narrow, the market is quiet. Quite often precedes a breakout. Wide bands mean big moves have already occurred, and the market may be fatigued. Using the bands involves watching not just where the price is, but how bands move: band contraction signals buildup; band expansion signals execution.

Key Components of Bollinger Bands

Let’s break down the definitions:

- Middle Band (MB): Often the 20-period simple moving average (SMA) of the closing price.

- Upper Band (UB): MB + (K × standard deviation over N periods). Default: K = 2, N = 20.

- Lower Band (LB): MB − (K × standard deviation over N periods).

The formula can be expressed as:

MB = SMA(price, N)

Upper Band = MB + K * σ

Lower Band = MB − K * σ

Where σ is the standard deviation of the price over the last N periods.

How to Interpret Bollinger Bands

Interpreting Bollinger Bands is less about guessing extremes and more about reading context. If the price touches or exceeds the upper band, it may indicate overbought conditions; touching the lower band may signal oversold conditions. But context matters: in strong up-trends, price may hug the upper band for long periods; in down-trends, price may ride the lower band.

Read More: Supertrend Indicators: How Do Generate Buy & Sell Signals?

Common Trading Strategies Using Bollinger Bands

Here are several ways traders use Bollinger Bands in crypto markets:

Mean-Reversion Strategy: When the market is range-bound and the price touches the lower band, take a long trade toward the middle band or upper band. Conversely, short near the upper band toward the middle.

Breakout Strategy: During a squeeze (very narrow bands), expect a directional breakout. Wait for the price to break out above the upper band with volume or below the lower band with volume and ride the move.

Trend-Following with Bands: In trending markets, the price may ride the upper band (in an uptrend) or the lower band (in a downtrend). Use the middle band as a dynamic stop or exit.

Bollinger Band Squeeze: Identifying Breakouts

One of the most powerful setups with Bollinger Bands is the squeeze: when the upper and lower bands converge tightly, volatility is compressed, and often a big move is waiting. Traders monitor the bandwidth (distance between upper and lower bands) to identify squeezes. When bandwidth reaches historical lows and price starts to breakout with volume, that signals the likely start of a trend. In crypto markets, where volatility is high and breakout moves are frequent, the squeeze setup can trigger sharp moves in minutes or hours rather than days.

Overbought and Oversold Conditions Explained

When price touches the upper band and the market is slow to break through, some traders see it as an overbought warning. When it touches the lower band repeatedly with a weak bounce, it may be oversold. But remember: in strong directional markets, price can remain at the outer bands for extended periods. Thus, you must check price action signals (candles, volume, momentum) in conjunction. An oversold touch on the lower band may not result in an instant rebound; it could simply signal continuation of a down move.

Advantages of Using Bollinger Bands in Crypto Trading

For crypto traders, Bollinger Bands bring clear benefits. First, they adapt: volatility in crypto can spike or collapse within hours, and the bands expand/contract accordingly, giving you a real-time gauge of market mood. Second, they help standardize levels: rather than subjective support/resistance, you have statistical bands guiding expectations. Third, they work across timeframes and assets, whether you’re trading Bitcoin on a daily chart or a smaller altcoin on 15-minute frames.

Limitations and False Signals

No indicator is perfect. The Bollinger Bands indicator also has its limitations. They can give false signals if used standalone, e.g., price breaks the band and continues in the same direction rather than mean-reverts. During strong trending moves, the bands may be misleading: price hugging the upper band isn’t always ‘overbought’, it might just be momentum. The use of standard deviation assumes certain statistical distributions, which don’t always hold in crypto markets; fat tails and extreme moves are common.

Combining Bollinger Bands with Other Indicators

To increase reliability, traders combine Bollinger Bands with other tools. Popular pairs include: Relative Strength Index (RSI), for momentum and overbought/oversold confirmation; Volume patterns, confirming breakout strength; Moving Average Convergence Divergence (MACD) or Stochastic Oscillator, for trend strength or reversal cues. For example, a squeeze in Bollinger Bands plus RSI below 30 may suggest a strong rebound soon. Conversely, a price hit at the upper band with RSI above 70 and falling volume may signal a weakening advance.

Best Timeframes and Assets for Bollinger Bands

In crypto markets, courtesy of 24/7 trading and high volatility, Bollinger Bands work beautifully on multiple timeframes, from 5-minute intraday charts to 4-hour and daily frames. For day traders or scalpers, using 15-minute or 30-minute charts on high-liquidity coins like BTC, ETH, or SOL gives plenty of setups. Swing traders may use daily charts with a 20-period SMA and two standard deviation bands.

Practical Example: Using BOLL in a Live Chart (2025 Market)

Imagine you’re trading Ethereum (ETH) on a daily chart in mid-2025. You apply Bollinger Bands with settings 20/2. You notice: the bands have been narrowing for five days. Bandwidth hits a new low compared to last month. That signals consolidation and low volatility. You set alerts for a breakout above the upper band or a break below the lower band. The next morning, ETH breaks above the upper band with a volume spike. You enter long. You set the stop-loss at the middle band. As the price moves up, the upper band also widens. You trail stop just below the middle band. You exit when the price hits the upper band again and the volume lag shows signs of exhaustion.

Conclusion

Bollinger Bands remain one of the most practical tools in trading, be it stocks or crypto. They give you a visual framework of volatility, relative price levels, trend vs. range, and breakout probability. But as with everything in trading, the indicator itself isn’t magic. It works best when you understand its strengths and limitations, and when you combine it with other signals.

FAQs

1. What are Bollinger Bands in trading?

Bollinger Bands are three lines plotted around a moving average of price: the middle band (the moving average), an upper band above by a multiple of standard deviation, and a lower band below by that same factor. They adapt to volatility and help traders identify relative price extremes.

2. Who created the Bollinger Bands indicator?

The indicator was created by John Bollinger in the early 1980s. He developed it to build volatility-adaptive trading envelopes rather than fixed-width channels.

3. How do Bollinger Bands work?

They work by placing a moving average at the center and then adding and subtracting multiples of the standard deviation to create upper and lower bands.

4. What do the upper, middle, and lower bands represent?

The middle band represents the simple moving average of price (trend). The upper band represents a threshold typically two standard deviations above the average (possible overbought or breakout zone).

The post What is Bollinger Bands (BOLL) indicator? appeared first on CoinSwitch.

The post What is Bollinger Bands (BOLL) indicator? appeared first on CoinSwitch.

You May Also Like

Tether Launches PearPass, a Peer-to-Peer Password Manager Without Cloud Storage

Waves and Tidal Energy Market to Approach USD 1.85 Billion by 2032 as Governments Scale Predictable Ocean Power for Grid Stability and Energy Security