👨🏿🚀TechCabal Daily – ‘How to raid a bank’

Happy midweek.

Yesterday, we published the latest edition of our newsletter, Francophone Weekly. If you’ve not had the chance to read it, go check it out. This week, we’ll be publishing our Predictions article, featuring insights from business leaders and operators across Africa’s tech ecosystem on what lies ahead.

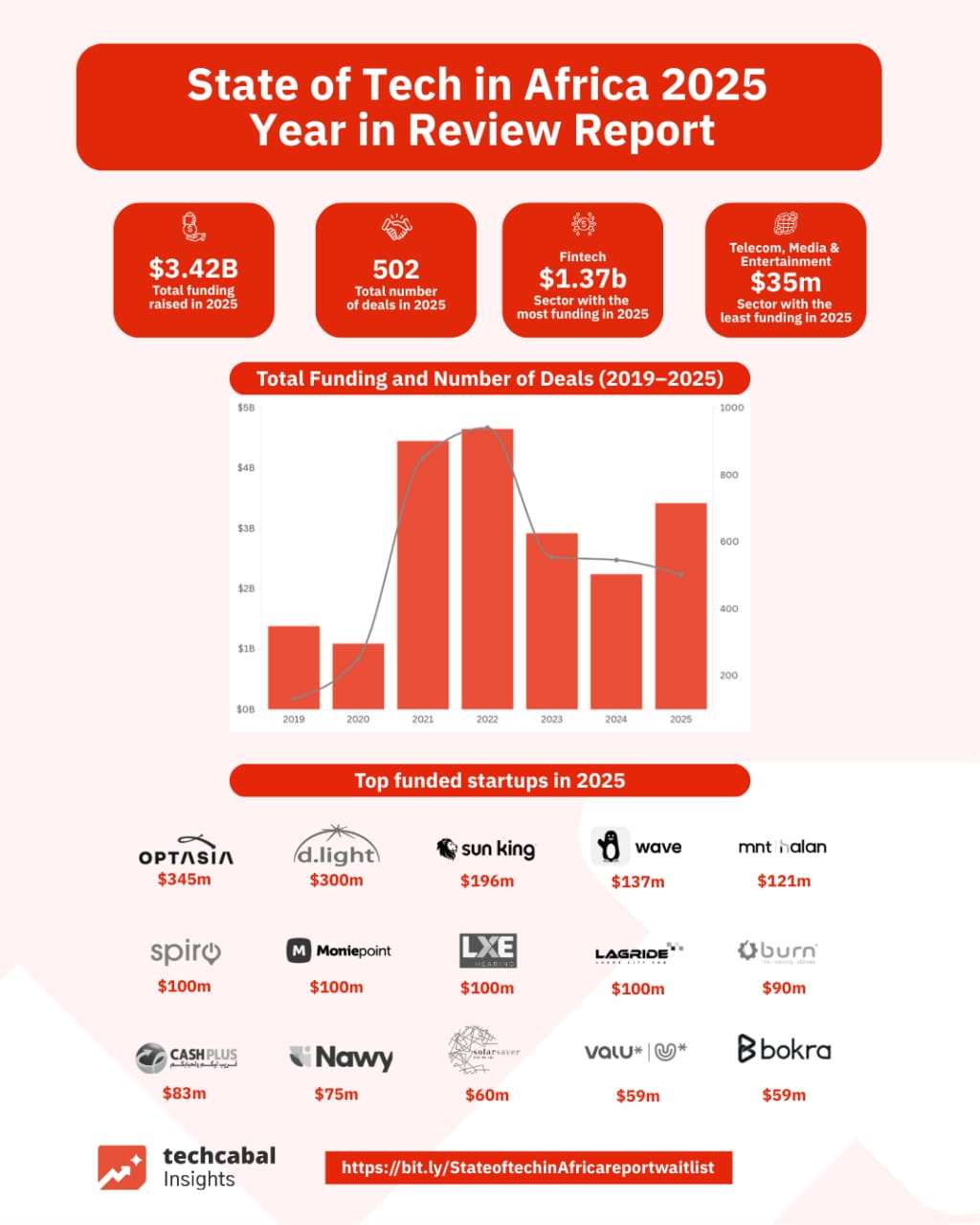

But before looking forward, it is worth pausing on how active the market already is. In 2025, African tech startups raised $3.42 billion across the 502 deals we tracked. That works out to roughly 1.38 deals every single day of the year. The ecosystem was, quite literally, the busy bee always doing deals.

This pace tells a more nuanced story than funding totals alone. Even in a tighter capital environment, founders and investors kept negotiating, and the deals never stopped. This year has continued that same deal-making pace, and we’re here for it. But first, we want to help you make sense of last year’s momentum and why it matters; we’re launching our “State of Tech in Africa 2025: A Year in Review” report.

Join the waitlist to receive the report as soon as it drops; get early access by clicking this link ( broken link fixed).

broken link fixed).

- Paystack’s holdco structure

- Banks exchange executives

- Ugandans locked out of mobile money access

- World Wide Web 3

- Opportunities

Fintech

Paystack has restructured its businesses under a new holding company

Image Sourc: The Stack Group

Image Sourc: The Stack Group

On Tuesday, the Stripe-owned Nigerian fintech reorganised its businesses under a holding company structure called The Stack Group (TSG), a nod to what employees have long called themselves: “The Stacks.”

If this sounds familiar, it’s because it’s becoming the standard playbook. As fintechs grow large enough to operate multiple products with different regulatory and commercial needs, they increasingly adopt holding company structures that centralise control while allowing subsidiaries to scale independently.

Moniepoint Inc. operates as the holding company over Moniepoint Microfinance Bank and other units, while Interswitch Group sits above its payments, switching, and digital commerce businesses. More recently, Egypt’s Fawry, one of the continent’s most profitable fintechs, restructured into a holding company in 2025 as it expanded beyond payments.

The creation of The Stack Group followed Paystack’s acquisition of Ladder Microfinance Bank, which gave the fintech company a microfinance licence to operate Paystack MFB.

Why does a holdco structure matter? Operating a holdco allows the company’s businesses to run independently under The Stack Group (TSG) umbrella. Following its venture into consumer payments and microfinance, The Stack Group now controls Paystack (the fintech), Paystack MFB (its microfinance bank), Zap by Paystack (its consumer payments app), and a venture studio, TSG Labs.

Stripe still owns Paystack following its $200 million acquisition in 2020, but this new structure introduces shared ownership between Stripe, Paystack’s CEO, and existing Paystack employees.

Why is the company doing this? Over the past year, Paystack launched Zap and secured a microfinance banking licence. Banking, consumer payments, and investments come with very different regulatory and operational demands. A holding company allows each business to run its own race without tripping the others. If one unit gets fined or slowed by regulation, the rest keep moving.

By putting its businesses under TSG, Paystack can keep its core merchant payments engine focused, while giving newer bets like Zap, Paystack MFB, and TSG Labs the freedom to grow or even fail without dragging the entire company with them. This has worked for other payment companies, and it might just work for Paystack.

Restructuring into a holding company is a signal that Paystack The Stack Group is ushering a more mature phase of its business.

Your 2026 demands disciplined financial operations

Fincra powers the payments infrastructure businesses rely on to collect, pay, and settle across local and major African currencies with confidence. Get started.

Banking

Absa poaches executives from Standard Bank, again

Nollywood Nemes/”This is business” Pawpaw meme. Image source: Zikoko Memes

Nollywood Nemes/”This is business” Pawpaw meme. Image source: Zikoko Memes

There are no shortcuts in life and business banking. If you doubt us, ask Absa, the tier-1 South African bank with R2.16 trillion ($110 billion) in assets.

Absa is poaching top executives from competitor Standard Bank, South Africa’s largest bank by assets. This week, Absa’s investment-banking unit appointed the head of client coverage for the same division at Standard Bank as managing executive for client coverage. The head of legal at Standard Bank will also join the Absa team as the deputy general group counsel.

In 2025, Absa hired multiple senior leaders from Standard Bank, including its current Group CEO, Kenny Fihla, who previously served as deputy CEO at Standard Bank and ran its Corporate and Investment Banking (CIB) division. Under Fihla, Absa has poached other former Standard Bank executives to key roles in CIB and group risk, as part of a broader turnaround and pan‑African growth strategy.

This has intentionality written all over it: In October 2025, Absa’s Ugandan subsidiary acquired Standard Chartered Bank Uganda’s Wealth and Retail Banking (WRB) business, which will see the transfer of all its clients and staff to Absa. And now, it’s cherry-picking off executives from Standard Bank’s South African branch.

Why would two top banks be exchanging senior talent?

When people with decades at one institution decide to move together, it’s rarely about money alone. Absa’s smaller size makes it appear like a bank in rebuild-and-attack mode. Senior leaders with deep institutional memory are choosing to jump ship from Africa’s biggest bank (Standard Bank) to a smaller rival that suddenly feels more energetic or feels like a place where they can make a faster impact.

When it comes to business magnitude, however, Standard Bank still dwarfs Absa, with about $195 billion in assets compared to Absa’s $110 billion. Absa is still smaller than Standard Bank, but right now, it looks hungrier, and talent—experienced executives who’ve seen it all at the top level—can sense that.

Get access to logistics providers across Africa

The Logistics Marketplace connects health buyers – governments, partners, humanitarian organisations & manufacturers with logistics providers across Africa. Backed by Global Fund & Gates Foundation, join for free with Access Code WELCOME2026!

Mobile money

Ugandans are crossing the border to access their own money

Ugandan President Yoweri Museveni. Image Source: AP

Ugandan President Yoweri Museveni. Image Source: AP

When your internet stops working, you complain. But when your money stops working, you walk across a border.

That is what is playing out in Eastern Uganda, where residents are crossing into Kenya to access cash after Uganda’s post-election restrictions kept mobile money services offline, even as broader internet access was restored. In border towns like Busia, users are transferring funds from Ugandan MTN and Airtel wallets into Kenyan platforms such as M-PESA, withdrawing Kenyan shillings, and converting them back into Ugandan currency to keep daily life moving.

We saw a similar workaround play out when Tanzania restricted the internet during elections in October 2025. The stowaway process is keeping households afloat, but it is hollowing out Uganda’s local economy. Mobile money agents, small traders, and transport operators who depend on high-volume, low-value transactions are losing daily income, while Kenyan agents quietly pick up the spillover. Telecoms say their hands are tied, pointing to regulatory directives with no clear timeline for full restoration.

Uganda’s communications regulator has framed the shutdown as a security measure tied to elections, citing misinformation risks and public order concerns. But mobile money in Uganda, with over 33 million subscribers, is not social media. It is infrastructure. It underpins transport fares, food purchases, school fees, and micro-business cash flow. Turning it off freezes commerce in ways that ripple far beyond politics.

The deeper lesson is regional. East Africa’s payments systems are more interconnected than policymakers admit. When one country pulls the plug, liquidity leaks across borders. Kenya benefits in the short term, but the episode exposes how fragile trust becomes when digital money can be switched off overnight. For users, the message is blunt: resilience now means optionality, even if that option is a walk to another country.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $89,109 |

– 3.57% |

+ 0.59% |

| Ether | $2,964 |

– 6.78% |

– 1.46% |

| RollX | $0.1431 |

– 6.14% |

+ 42.30% |

| Solana | $137.21 |

– 5.09% |

+ 1.43% |

* Data as of 03.30 AM WAT, January 21, 2026.

Opportunities

- Detty December is getting more expensive, but young Africans are not backing down from the vibes. A 2025 Accrue report surveyed 631 people across Ghana, Nigeria, and Kenya—86% of them Gen Zs and late millennials aged 18–34—most living in moderately sized households with at least one income source, yet only 4% earn above $5,000 in total monthly household income. Yet, 60% say they planned to spend more in 2025, with outdoor events, concerts, house parties, travel, dining out, and leisure activities taking the biggest share of their budgets as Detty December cements itself as both culture and economic force. Many rely on money from abroad, receiving funds via mobile money, bank transfers, and virtual USD accounts, while navigating fees and delays. They plan ahead, stretch budgets, borrow, or sell assets just to keep the Detty December tradition alive. Download the report.

- Over 50 companies in Africa have transformed their team members into business growth operators with alGROWithm’s Growth Talent Accelerator Programme. Nominate your team members for the February cohort today.

- TechCabal is conducting a short survey to help audit Africa’s tech ecosystem performance, capital conditions, choices, and trade-offs we made in 2025. You can also share this poll with anyone that works in African tech. We would appreciate your participation; fill the form here.

- Francophone Africa’s guide to scaling and exits from startups that did it

- Safaricom defends Ethiopia strategy as share sale pricing remains sticky point Navigating Lagos without a white cane showed me what assistive tech can and can’t do

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

Adoption Leads Traders to Snorter Token

Lovable AI’s Astonishing Rise: Anton Osika Reveals Startup Secrets at Bitcoin World Disrupt 2025