Crypto ETF Update: This Altcoin Could 1000x by 2026

The SEC has approved a framework for the streamlined adoption of digital asset products in the United States on Wednesday, allowing exchanges to list and trade commodity-based trust shares without requiring a rule change to be filed first.

This marks a significant milestone, opening the door for a surge in spot altcoin ETFs in the coming months. As a result, anticipation is building around institutional liquidity flows to the altcoin market – but which projects could perform the best?

Many analysts are betting on Bitcoin Hyper (HYPER) as a potential 1000x opportunity. It has not yet launched on exchanges, so it’s not immediately eligible for a spot ETF like some of the larger altcoins. That said, its use case positions it at the forefront of blockchain innovation, which signals huge potential for price gains as institutional capital rotates through the altcoin market.

The project is developing the world’s first ZK-rollup-powered Bitcoin Layer 2 blockchain, addressing Bitcoin’s key issues of slow speeds and limited functionality while maintaining its renowned characteristics of security and immutability.

SEC Approves Generic ETF Listing Standards

The SEC has approved a proposed 19b-4 rule change from Cboe’s BZX exchange, Nasdaq, and NYSE Arca to standardize listing requirements for crypto exchange-traded products (ETPs) and streamline the process for public trading.

According to Bloomberg ETF expert James Seyffart, this move paves the way for a “wave of spot crypto ETP launches in the coming weeks and months.”

Under the new listing standards, commodities must meet one of three conditions to be eligible for a spot ETF:

- Trade on a market that is an ISG member.

- Serve as the basis for a futures contract listed on a designated exchange for at least six months.

- Be linked to an ETF with at least 40% exposure to the asset.

Seyffart summarized this by saying, “Basically, if the asset has a futures contract trading on a regulated exchange (i.e., Coinbase derivative) for 6 months, it will be allowed to become a spot ETF.”

Which Altcoins Are Now Eligible for ETFs?

Some of the other top names include Solana, Litecoin, and Cardano – and you can see the full list of crypto assets with Coinbase futures contract listings below:

If a slew of altcoin ETF launches occur in the next few weeks, this could fuel a hype-driven surge across altcoin prices – but the real impact might be much longer-lasting as institutional capital pours in.

Regarding which project could be poised for the strongest performance, many traders are betting on Bitcoin Hyper. Let’s take a closer look at why this is.

Expert Tips Bitcoin Hyper as the Next 1000x Crypto

Bitcoin proved itself as a world-leading asset after the launch of its spot ETFs in 2024, with BlackRock’s IBIT product being the fastest-growing ETF in history – currently holding $60 billion in assets under management.

Yet, Bitcoin continues to face issues such as limited transaction speeds and functionality constrained to sending, receiving, and storing value.

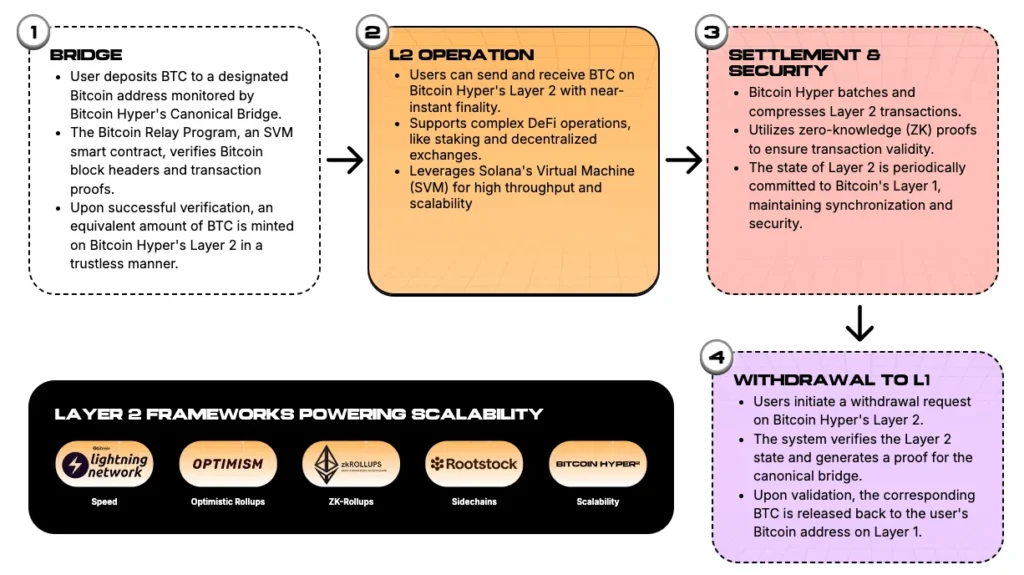

In response, Bitcoin Hyper is developing a Bitcoin Layer 2 blockchain to address these problems. It’s built using a Solana Virtual Machine execution layer to compute thousands of transactions per second, support smart contracts, and establish interoperability with the Solana blockchain.

Holders can securely transfer their BTC to the Bitcoin Hyper ecosystem through its trustless canonical bridge, and the Layer 2’s state will be periodically reported back to Layer 1 to maintain Bitcoin’s immutability and neutrality.

If successful, this setup could unlock new markets for Bitcoin, including DeFi, payments, meme coins, and more. It could draw liquidity, create new BTC utilities, and strengthen the network’s position as a leader in financial technology. That’s why analysts like Umar Khan speculate that HYPER could generate up to 1000x gains.

Currently, Bitcoin Hyper is in presale and has raised approximately $16.6 million, demonstrating strong market interest. There’s also demand from whales, with one trader investing $18,000 on Wednesday.

Smart money traders know that HYPER could massively outperform the market – so they’re pouring huge amounts of capital into the presale while it’s still in its early days.

Visit Bitcoin Hyper Presale

This article is not intended as financial advice. Educational purposes only.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Pound Sterling softens as traders eye BoE rate cut next week