Check Out the Best Crypto Presales to Buy as Market Remains Bullish on Bitcoin Despite ETF Outflows

Quick Facts:

Amberdata says nearly $4B in Oct–Nov U.S. spot BTC ETF outflows mainly reflect basis-trade unwinds, not long-term investor capitulation.

Amberdata says nearly $4B in Oct–Nov U.S. spot BTC ETF outflows mainly reflect basis-trade unwinds, not long-term investor capitulation. ETF holdings remain around 1.43M $BTC and redemptions were concentrated in a few issuers, so the broader macro bull case for bitcoin stays intact.

ETF holdings remain around 1.43M $BTC and redemptions were concentrated in a few issuers, so the broader macro bull case for bitcoin stays intact. Bitcoin Hyper brings SVM-style, low-latency smart-contract execution to Bitcoin, targeting DeFi, gaming, and payments on top of BTC settlement security.

Bitcoin Hyper brings SVM-style, low-latency smart-contract execution to Bitcoin, targeting DeFi, gaming, and payments on top of BTC settlement security. PEPENODE launches a ‘mine-to-earn’ memecoin model where users run virtual nodes, progress through tiers, and earn gamified token rewards.

PEPENODE launches a ‘mine-to-earn’ memecoin model where users run virtual nodes, progress through tiers, and earn gamified token rewards.

US spot Bitcoin ($BTC) ETFs just saw roughly $4B in outflows since it reached an ATH in October.

However, research suggests most of that was basis trades unwinding, not real capitulation. These were crowded arbitrage and carry trades shutting down as funding flipped, not long-term allocators fleeing Bitcoin for good.

That distinction matters. If institutions aren’t dumping spot exposure en masse, the core bull thesis around Bitcoin as a macro asset remains intact.

That distinction matters. If institutions aren’t dumping spot exposure en masse, the core bull thesis around Bitcoin as a macro asset remains intact.

Structural demand from ETFs, corporates, and high-net-worth investors still underpins the market, even as leverage and short-term positioning reset in the background.

For you, that backdrop favors asymmetric upside rather than chasing large-cap beta. The ETF bid can support Bitcoin, while the most explosive gains tend to come from early-stage infrastructure, AI, and high-throughput plays quietly building into the next cycle.

Crypto presales are exactly where that risk/reward skew can be most extreme if you’re selective.

Below are three presales positioned at key narratives: Bitcoin Hyper ($HYPER) for Bitcoin scalability, PEPENODE ($PEPENODE) for mine-to-earn memes, and Ionix Chain ($IONX) for AI-powered blockchains.

They stand out in the current market as some of the best crypto presales to watch, alongside other leading early-stage plays.

1. Bitcoin Hyper ($HYPER) – First SVM-Powered Bitcoin Layer 2

Bitcoin Hyper ($HYPER) positions itself as the first true Bitcoin Layer 2 integrating the Solana Virtual Machine (SVM), aiming to deliver execution that’s even faster than Solana while anchoring settlement to Bitcoin.

The modular design separates Bitcoin L1 for security and finality from a real-time SVM Layer 2 for high-throughput execution.

On the technical side, Bitcoin Hyper uses a single trusted sequencer that batches and orders transactions, then periodically anchors state commitments back to Bitcoin.

The core pitch is simple: bring fast, scalable smart contracts to Bitcoin without sacrificing its brand and security. That unlocks high-speed payments in wrapped $BTC with low fees, DeFi protocols for swaps, lending, and staking, plus NFT and gaming dApps.

Our ‘What is Bitcoin Hyper?’ guide covers everything you need to know about the project, from its tokenomics to community sentiment.

Our ‘What is Bitcoin Hyper?’ guide covers everything you need to know about the project, from its tokenomics to community sentiment.

The market has responded positively to the project. The Bitcoin Hyper presale has already raised $29M, with tokens priced at $0.013375.

Whales are also scrambling to get their slice of the pie, including one that bought over $500K of tokens. That kind of early conviction can signal confidence in the tech and tokenomics.

Staking is a major part of the value proposition. You can stake yours immediately after purchasing so you can enjoy rewards that are currently at 40% APY.

To get your share of tokens, head on to our Bitcoin Hyper buying guide for more details.

If Bitcoin’s L2 race heats up, a performant SVM-based solution like Bitcoin Hyper could be one of the clearest leveraged plays.

Join the $HYPER presale today.

2. PEPENODE ($PEPENODE) – First Mine-to-Earn Memecoin Infrastructure

If Bitcoin Hyper is a pure infrastructure bet, PEPENODE ($PEPENODE) leans into the speculative energy of memes, but with a twist. It brands itself as the world’s first ‘mine-to-earn’ memecoin, combining viral culture with a virtual mining and node system that gamifies participation.

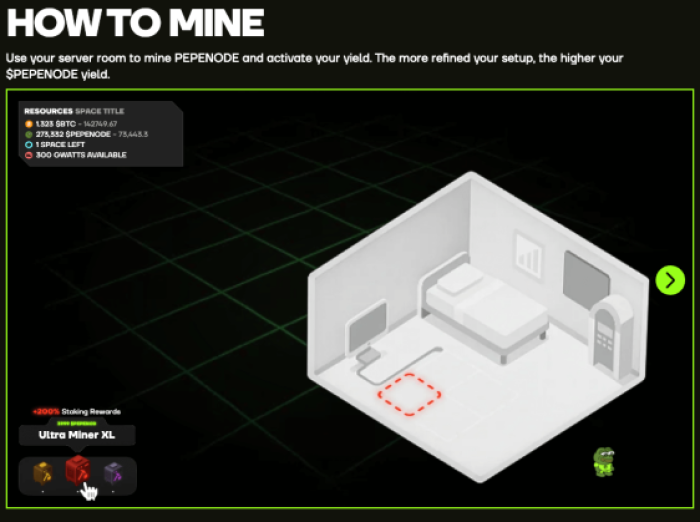

Instead of relying solely on hype and social media, PEPENODE introduces a Virtual Mining System where you can deploy and upgrade nodes to earn token rewards.

A tiered node structure sets different earning bands, effectively creating a gamified yield ladder. A dedicated dashboard wraps all of this in a simple interface designed that’s easy to understand even if you’re a complete beginner.

This model turns what’s usually passive memecoin holding into something more interactive. If the narrative catches on, miners and speculators are incentivized to keep the system spinning.

This model turns what’s usually passive memecoin holding into something more interactive. If the narrative catches on, miners and speculators are incentivized to keep the system spinning.

On the numbers, the PEPENODE presale has raised over $2.2M so far, with tokens priced at $0.0011778. That leaves plenty of room for upside if the mine-to-earn meme gains traction across other traders.

You can also stake tokens to get dynamic rewards that are currently at a whopping 570% APY.

We’ll show you how to purchase $PEPENODE in our ‘How to Buy PEPENODE’ page.

We’ll show you how to purchase $PEPENODE in our ‘How to Buy PEPENODE’ page.

The project’s medium-term prospects look bright, as long as it ticks off all the items in its roadmap and attracts more participants. When that happens, the token’s value could reach a high of $0.0072 by the end of 2026, or a 511% increase from the current price.

Explore the PEPENODE presale now.

3. Ionix Chain ($IONX) – AI-Powered Layer 1 With Quantum Consensus

Rounding out the list is Ionix Chain, an AI-powered Layer 1 targeting the intersection of high-performance smart contracts and machine learning.

It uses a hybrid Proof-of-Stake engine with Directed Acyclic Graph architecture combined with what it calls Quantum AI Consensus, designed to self-optimize throughput, latency, and security parameters in real time.

Ionix Chain’s performance targets are aggressive. The team claims up to 500K transactions per second with sub-second finality, positioning it squarely against high-throughput leaders rather than legacy L1s.

Its adaptive smart contracts use AI to optimize gas usage, routing, and resource allocation, aiming to help dApps scale predictably as volumes spike.

Cross-chain support is another core pillar. Ionix is building interoperability with Ethereum, Solana, and BNB Chain, giving developers a way to bridge assets and deploy applications that can tap liquidity across multiple ecosystems.

That’s particularly relevant if multi-chain liquidity routing becomes standard for DeFi and AI-driven protocols.

At the moment, Ionix Chain is running a multi-stage token presale that has raised over $6.3M so far. Another stage is coming in about four days, which will increase the price up another notch, so it’s always best to get in early.

At the moment, Ionix Chain is running a multi-stage token presale that has raised over $6.3M so far. Another stage is coming in about four days, which will increase the price up another notch, so it’s always best to get in early.

Early exchange partners have also been teased, positioning IONX as a notable AI-blockchain contender rather than a niche experiment. If you’re an investor betting on AI as a core crypto theme next cycle, Ionix offers direct infrastructure exposure.

Learn more on the official Ionix whitepaper.

With ETF outflows driven by basis trade unwinds rather than true capitulation, the broader Bitcoin bull case still stands.

Recap: Bitcoin Hyper, PEPENODE, and Ionix Chain each target major narratives: Bitcoin scalability, gamified memes, and AI L1s. If you’re looking for alternative bets in the current market atmosphere, the three are worth a look.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice; always do your own research.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/best-crypto-presales-to-buy-as-bitcoin-etf-outflows-signal-bullish-sentiment

You May Also Like

Missed Bitcoin’s ICO? BullZilla’s Explosive Stage 13 Surge Is Your Second Shot

US SEC Chairman: Many types of cryptocurrency ICOs are not under the SEC's jurisdiction.