- Bitcoin is tied to parabolic structure

- Bitcoin’s recovery attempt

Michael Burry has responded to critics who continue to cite his early-2021 bearish calls, including on Bitcoin, as evidence that his current warnings should be dismissed. According to Burry, commentators and journalists, including Bloomberg’s, have repeatedly used those 2021 examples to argue that he has been “wrong again and again.” Burry argues that this framing is both misleading and demonstrates a misunderstanding of how short positioning is supposed to function.

Bitcoin is tied to parabolic structure

Burry highlighted that his well-publicized caution toward Bitcoin in early 2021 was tied to what he viewed as a textbook parabolic structure. Bitcoin went on to suffer a series of sharp corrections, first in mid-2021 and then far more severely through 2022, when it declined over 70% from its peak.

BTC/USDT Chart by TradingViewBurry’s point is that the correction he anticipated did occur, and judging the validity of a short thesis years after the fact misrepresents the nature of trading. “You really think any short seller holds those positions for 5 or 10 years?” his post argued.

Bitcoin’s recovery attempt

He contrasted this with his stance during the 2023 regional banking crisis, when market sentiment turned aggressively bearish. Burry publicly stated at the time that he was not seeing evidence of genuine systemic danger and expected the situation to stabilize. The crisis ultimately resolved far more quickly than the prevailing panic suggested, reinforcing, in his view, that his critics selectively remember only the parts of his track record that fit their narrative.

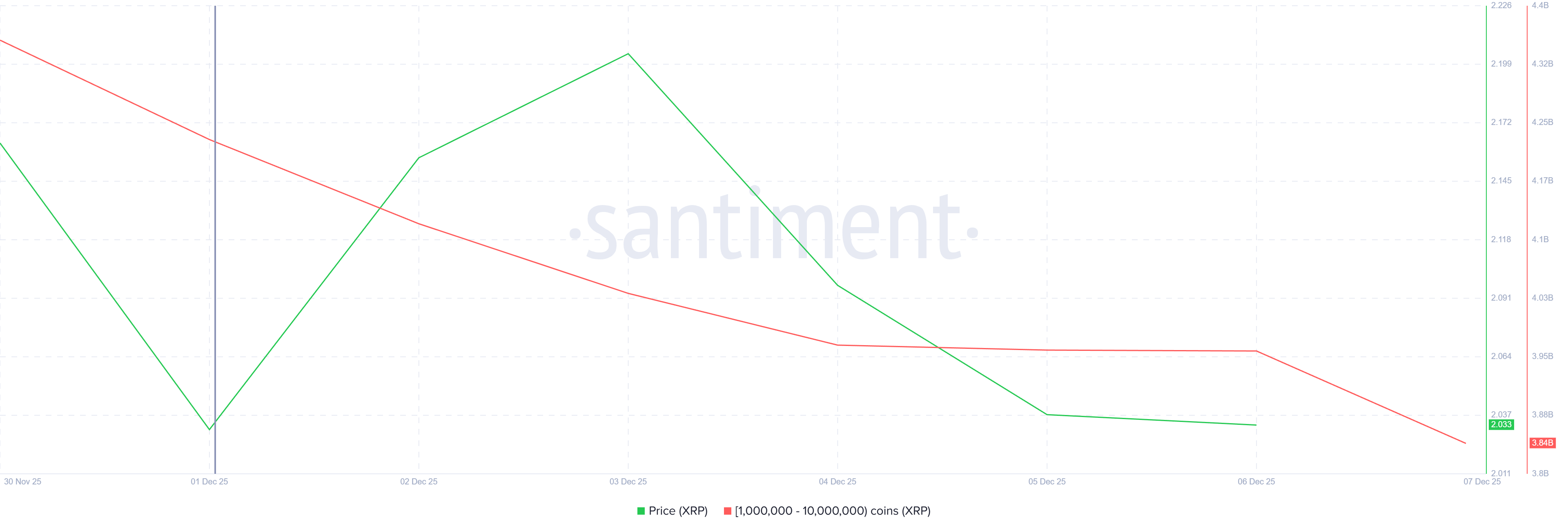

Burry’s renewed comments come as Bitcoin attempts to recover from its latest drawdown. The current chart shows the asset still trading below major moving averages after a steep fall sell-off, a structure that, if anything, makes his 2021 warnings look more grounded than revisionist commentary implies.

The broader message from Burry’s post is less about victory laps and more about context: short calls are time-sensitive by design, and retroactively judging them years later, he argues, reflects storytelling, not market literacy.

Source: https://u.today/how-wrong-i-have-been-michael-burry-slams-his-bitcoin-position-critics