Why is XRP Down Today?

TLDR

- XRP fell 3.14% to $2.0412 on December 10 after the Federal Reserve cut interest rates but signaled fewer rate cuts in 2026 than previously expected.

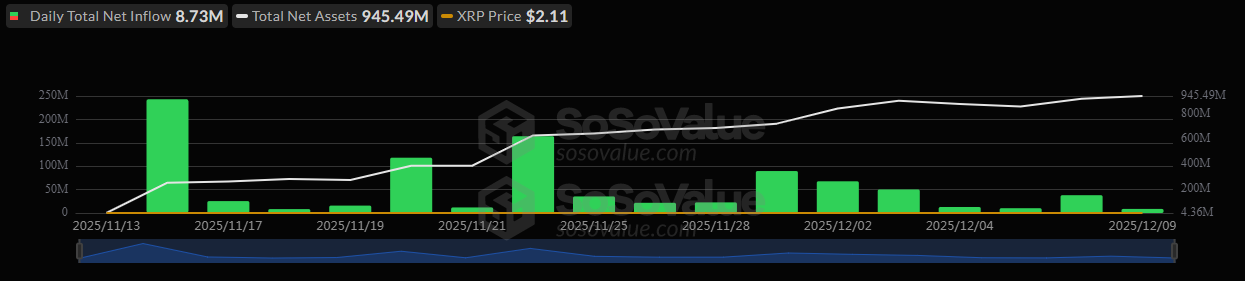

- XRP-spot ETF inflows dropped sharply to $8.73 million on December 9, down from $38.04 million the previous day, with Franklin’s XRPZ ETF reporting zero inflows for the first time.

- The crypto market structure bill faces delays as Democrats and Republicans continue negotiations over key provisions including token classification and stablecoin regulations.

- XRP traded below both its 50-day and 200-day moving averages, with key support at $2.00 and resistance at $2.05 to $2.10.

- Ripple’s pending application for a US-chartered banking license and potential bipartisan support for crypto legislation could drive prices toward $2.35 to $2.50 in coming weeks.

XRP dropped over 3% on December 10 following a Federal Reserve rate decision that delivered mixed signals to crypto traders. The token closed at $2.0412 after briefly rallying to $2.1097 immediately following the Fed’s announcement.

XRP Price

XRP Price

The Federal Reserve cut interest rates by 25 basis points to a 3.50%-3.75% target range. Traders initially reacted positively to the widely expected cut. However, the Fed’s economic projections showed inflation staying above the 2% target until 2028.

The dot plot projections revealed a more hawkish stance than markets anticipated. Committee members now expect just one rate cut in 2026 and another in 2027. This represents a shift from September projections that showed two rate cuts in 2026.

XRP fell to a session low of $1.9936 after the projections were released. The token now trades below its 100-hour simple moving average and faces resistance near $2.05.

ETF Inflows Decline Sharply

XRP-spot ETF inflows slowed dramatically on December 9, dropping to $8.73 million from $38.04 million the previous day. Franklin’s XRPZ ETF reported zero net flows for the first time since launch after seeing $31.7 million in inflows on December 8.

Source: SoSoValue

Source: SoSoValue

The slowdown came ahead of the Fed decision as institutional investors appeared to take a cautious approach. Bitcoin spot ETFs outperformed XRP ETFs on December 9 with $151.9 million in net inflows.

For December, XRP-spot ETFs have attracted $277.5 million in total inflows compared to just $3.8 million for Bitcoin spot ETFs. The strong overall performance reflects growing institutional interest in XRP despite the recent single-day slowdown.

Vanguard recently opened its brokerage accounts to crypto-spot ETF investments. This move could expand the potential investor base for XRP products in the coming weeks.

Legislative Progress Stalls

Negotiations over crypto market structure legislation continue on Capitol Hill with Democrats and Republicans working to resolve key differences. Democrats released a three-page counteroffer outlining their priorities on token classification, illicit finance rules, ethics standards, and stablecoin yield restrictions.

Crypto journalist Eleanor Terrett reported that Democrats have accepted portions of the Senate Banking Committee’s text. However, significant gaps remain between the two parties on core principles.

XRP rallied 14.69% in July when the House of Representatives passed the market structure bill. The token reached an all-time high of $3.66 but has since fallen 44% from that peak. The government shutdown and resulting legislative delays contributed to the reversal.

Banking License Application Pending

Ripple’s application for a US-chartered banking license with the Office of the Comptroller of the Currency remains under review. Approval would mark a turning point for Ripple’s regulatory standing in the United States.

The Fed will resume buying Treasuries on December 12 after ending quantitative tightening on December 1. The return to quantitative easing typically adds liquidity to financial markets and can boost demand for risk assets including cryptocurrencies.

XRP now tests key support at the $2.00 level. Technical resistance sits at $2.05 with additional barriers at $2.10 and $2.22. A break below $2.00 could push the token toward $1.9850 support.

The post Why is XRP Down Today? appeared first on CoinCentral.

You May Also Like

Trump Announced the Launch of the Trump Gold Card

How High Can Avantis (AVNT) Spike This Bull Run?