Analysts Look Beyond Bitcoin’s Price As Tom Lee Flags a Structural Shift

Bitcoin’s price may still dominate headlines, but among analysts and institutional strategists, attention is quietly shifting elsewhere.

Instead of debating whether Bitcoin can reclaim upside momentum in the near term, market observers are increasingly focused on a deeper question: whether the structural signals that once reliably guided Bitcoin’s four-year cycle are beginning to fracture.

Analysts Are No Longer Looking at Bitcoin Price As Demand Signals Quietly Deteriorate

The shift comes on the backdrop of fading demand indicators, rising exchange flows, and a growing divide between analysts.

On the one hand, some believe Bitcoin is entering a traditional post-peak correction. On the other hand, others argue that the pioneer crypto may be breaking free from its historical cycle altogether.

Analyst Daan Crypto Trades argues that recent price behavior has already challenged one of Bitcoin’s most dependable seasonal assumptions.

Rather than signaling a definitive breakdown, the underperformance suggests friction. ETF inflows and corporate accumulation are being absorbed by long-term holder distribution, muting the impact those inflows once had on BTC price.

That structural tension is also visible in US spot market data. According to Kyle Doops, the Coinbase Bitcoin premium, often used as a proxy for US institutional demand, has remained negative for an extended period.

The message is not capitulation, but hesitation, which means capital is present, yet unwilling to chase.

Exchange Flows Point to Distribution, Not Accumulation

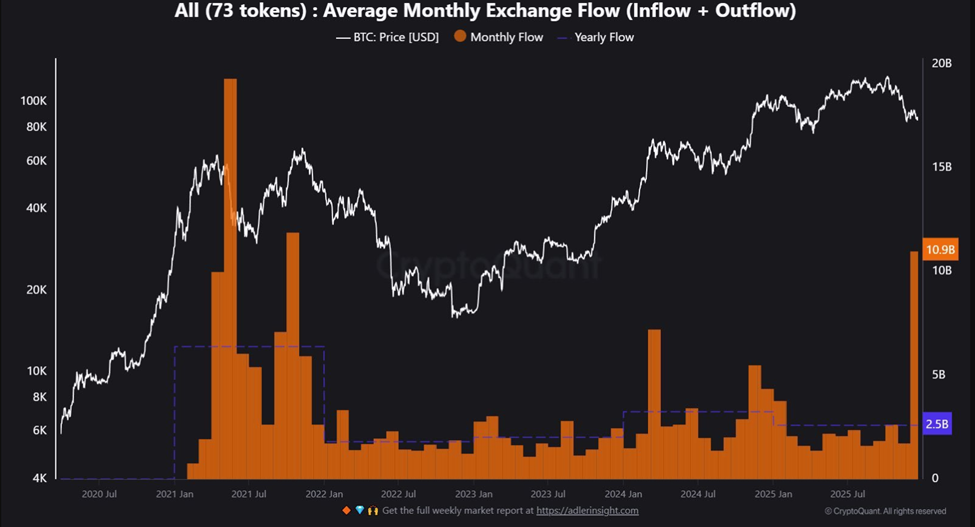

On-chain data highlights the need for cautious interpretation, as Bitcoin exchange inflows surge to levels historically associated with late-cycle behavior.

Historically, similar spikes have coincided with profit-taking phases rather than early accumulation periods.

Monthly Exchange Flow. Source: CryptoQuant

Monthly Exchange Flow. Source: CryptoQuant

If History Holds, Cycle Math Still Points Lower with Institutions Split but Disciplined

On-chain analyst Ali Charts argues that despite structural changes, Bitcoin’s timing symmetry remains striking.

If that pattern persists, the analyst suggests that the market may now be inside its corrective window. Historical retracements imply further downside before a durable reset.

At the institutional level, views are diverging without turning chaotic. Fundstrat’s Head of Crypto Strategy Sean Farrell acknowledged near-term pressures while maintaining a longer-term bullish framework.

The Cycle Debate Is Now Institutional

That possibility is echoed by Tom Lee, whose view has been amplified across crypto commentary, suggesting that Bitcoin will soon break its 4-year cycle.

Fidelity’s Jurrien Timmer takes the opposite stance. According to Lark Davis, Timmer believes Bitcoin’s October peak marked both a price and time top, with “2026… a down year” and support forming in the $65,000–$75,000 range.

Together, these perspectives show why analysts are no longer fixated solely on Bitcoin price. The pioneer crypto’s next move may not decide who was bullish or bearish, but whether the framework that has defined its market for over a decade still applies at all.

You May Also Like

What We Know So Far About Reported Tensions at Bitmain

Galaxy Digital’s head of research explains why bitcoin’s outlook is so uncertain in 2026

Copy linkX (Twitter)LinkedInFacebookEmail