Crypto Losses Hit $3.35 Billion in 2025: CertiK Security Report

Annual theft figures reveal persistent vulnerabilities across DeFi protocols, bridges, and exchanges despite security improvements

Cryptocurrency losses from hacks, exploits, and scams reached $3.35 billion in 2025, according to blockchain security firm CertiK, marking a significant increase from the previous year and highlighting ongoing security challenges as the digital asset ecosystem continues expanding despite improved defensive measures and heightened awareness of vulnerabilities affecting decentralized finance protocols, cross-chain bridges, centralized exchanges, and individual users.

Understanding the $3.35 Billion Loss Figure

The total encompasses multiple attack categories affecting different segments of the cryptocurrency ecosystem throughout 2025.

Smart contract exploits targeting DeFi protocols likely represent the largest category, with hackers identifying vulnerabilities in lending platforms, decentralized exchanges, and yield farming protocols to drain funds through logic errors, reentrancy attacks, and oracle manipulation.

Bridge hacks attacking cross-chain infrastructure contributed substantially to losses as these protocols holding locked value for asset transfers between blockchains create attractive targets for sophisticated attackers.

Exchange breaches affected both centralized and decentralized platforms through hot wallet compromises, private key theft, and withdrawal system exploits enabling unauthorized fund extraction.

Scams and rug pulls added hundreds of millions as fraudulent projects disappeared with investor capital, fake tokens mimicked legitimate assets, and phishing campaigns convinced victims to approve malicious transactions.

Individual theft through phishing, malware, and social engineering targeted personal wallets without requiring protocol-level vulnerabilities.

The diverse attack surface reflects cryptocurrency's complexity where protocols, platforms, and users all face distinct security challenges requiring different protective approaches.

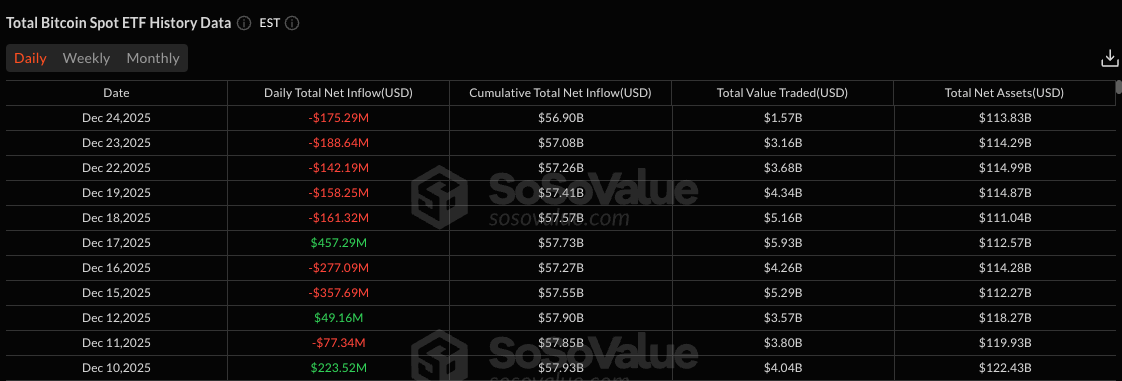

Year-Over-Year Comparison

Comparing 2025 losses to previous years provides context for security trend analysis.

2024 saw approximately $2.2 billion in cryptocurrency theft according to various security firms, meaning 2025 represents roughly 52% increase in absolute dollar terms.

2022 recorded $3.8 billion in losses including massive incidents like Ronin Bridge ($625 million) and Wormhole ($325 million), making it the worst year for cryptocurrency security.

2023 registered about $1.8 billion across similar attack vectors with notable DeFi exploits and bridge hacks dominating headlines.

2021 totaled $1.3 billion as DeFi summer attracted both legitimate users and malicious actors exploiting rapidly deployed protocols.

The 2025 increase versus 2024 suggests security improvements haven't kept pace with ecosystem growth and rising asset values, though remaining below 2022's record indicates some defensive progress despite persistent threats.

Major Attack Categories

Several exploit types contributed disproportionately to the annual total based on historical patterns.

DeFi protocol hacks target smart contract vulnerabilities including reentrancy bugs where attackers recursively call functions before state updates complete, integer overflow issues, and access control failures enabling unauthorized administrative actions.

Flash loan attacks exploit DeFi composability by borrowing millions, manipulating protocol states, and repaying loans within single transactions to extract profits without capital requirements.

Bridge exploits compromise validator sets through multi-signature scheme attacks, exploit cross-chain messaging vulnerabilities, or manipulate consensus mechanisms to authorize fraudulent transfers.

Exchange compromises access hot wallets through private key theft, employee social engineering, or system vulnerabilities bypassing withdrawal controls and approval workflows.

Phishing campaigns create fake websites, impersonate support staff, or send malicious tokens to trick users into revealing credentials or approving fund-draining transactions.

Rug pulls involve developers abandoning projects after collecting investor capital, often through liquidity removal, minting excessive tokens, or implementing hidden backdoors in smart contracts.

The distribution typically sees a few massive incidents accounting for the majority of losses while hundreds of smaller attacks contribute the remainder.

CertiK's Monitoring Methodology

Understanding how CertiK calculates the $3.35 billion requires examining their data collection approach.

Blockchain forensics enables tracking stolen funds on-chain by identifying theft addresses, following flows through mixers and exchanges, and attributing attacks based on transaction patterns.

Incident reporting from affected protocols, exchanges, and users provides direct confirmation of breaches, though not all victims publicly disclose incidents creating potential underreporting.

Automated monitoring through smart contract analysis tools detects unusual transactions, exploit patterns, and emergency pause activations indicating security incidents.

Community intelligence from security researchers, white hat hackers, and blockchain investigators contributes to comprehensive incident tracking across diverse protocols.

Cross-verification against other security firms including Chainalysis, SlowMist, and PeckShield ensures accuracy and prevents double-counting.

Methodology variations between security vendors create discrepancies in annual totals, with different firms reporting ranges from $3-4 billion for 2025 depending on inclusion criteria and classification standards.

North Korean State-Sponsored Attacks

Sophisticated threat actors including North Korean groups contributed significantly to 2025 losses.

Lazarus Group and associated organizations historically execute the largest and most sophisticated cryptocurrency thefts using custom malware, extensive social engineering, and patient reconnaissance.

State-level resources enable North Korean hackers to develop advanced persistent threat capabilities bypassing security measures that stop typical financially-motivated criminals.

Sanction evasion motivates persistent attacks as stolen cryptocurrency helps North Korea fund programs despite international restrictions, creating determination beyond typical profit motives.

Historical attacks attributed to these groups include Ronin Bridge ($625M), Harmony Horizon Bridge ($100M), and Atomic Wallet ($100M) demonstrating consistent high-value targeting.

Laundering infrastructure involving mixers like Tornado Cash, chain-hopping across blockchains, and nested exchange accounts enables converting stolen funds despite blockchain transparency.

Evolving tactics show continuous adaptation as groups shift from centralized exchanges toward DeFi protocols and bridges reflecting improved security at traditional targets.

International cooperation between U.S. FBI, South Korean agencies, and others has improved attribution but hasn't deterred attacks given regime-level backing.

DeFi Vulnerabilities

Decentralized finance applications represent particularly vulnerable infrastructure contributing substantially to annual losses.

Smart contract complexity creates numerous potential vulnerability points as protocols interact with multiple external contracts, oracles, and user inputs requiring flawless logic.

Oracle manipulation exploits price feeds by temporarily distorting spot prices on low-liquidity exchanges to trigger profitable liquidations or enable arbitrage extraction.

Economic exploits take advantage of protocol design flaws where intended mechanisms create unintended manipulation opportunities requiring no code vulnerabilities.

Governance attacks accumulate voting tokens to pass malicious proposals upgrading contracts to vulnerable versions or extracting treasury funds through authorized but harmful actions.

Composability risks emerge as protocols build on other protocols, where vulnerabilities cascade and interactions create unexpected exploit opportunities.

Rapid deployment pressure leads some teams to launch without comprehensive audits or testing, prioritizing speed over security with predictable consequences.

The permissionless innovation enabling DeFi's rapid growth simultaneously creates security challenges as unaudited code manages billions in user assets.

Cross-Chain Bridge Security

Bridge protocols facilitating asset transfers between blockchains suffered major exploits throughout 2025.

Concentrated value in bridge contracts creates attractive targets as successful attacks immediately access hundreds of millions held in escrow.

Validator compromises exploit multi-signature schemes by obtaining threshold keys through phishing, social engineering, or technical vulnerabilities.

Smart contract bugs in bridge logic enable unauthorized minting on destination chains or withdrawals from source chain escrows without proper validation.

Consensus manipulation attacks bridge validators to confirm fraudulent messages through eclipse attacks isolating nodes or Sybil attacks creating fake validators.

Complexity challenges arise from coordinating state across multiple chains with different security models, finality guarantees, and consensus mechanisms.

Notable bridge incidents in previous years suggest 2025 likely included at least one $100+ million theft from cross-chain infrastructure based on historical patterns.

Exchange Security Challenges

Centralized platforms managing customer funds continued experiencing breaches despite improving practices.

Hot wallet exposure creates vulnerability as internet-connected wallets used for daily operations and withdrawals require balancing accessibility against security.

Employee targeting through social engineering convinces staff with privileged access to approve malicious actions or reveal credentials via executive impersonation.

Withdrawal system exploits manipulate verification processes or accounting systems to authorize fraudulent withdrawals exceeding actual balances.

Infrastructure attacks target cloud providers, DNS services, or network infrastructure to intercept communications or redirect deposits.

Insider threats from malicious employees with system access represent persistent risk requiring background checks, access controls, and monitoring.

Major exchanges like Coinbase, Kraken, and Binance maintain stronger security than smaller platforms, concentrating breaches in services with less robust controls.

You May Also Like

My Furnace is Making a Strange Noise. A Modesto HVAC Diagnostic Guide

The Importance of a Carbon Monoxide Check During a Furnace Repair in Abingdon, VA