Bitcoin Price Heads for Its Weakest Year Since 2018

This article was first published on The Bit Journal.

Bitcoin price is returning below the $90,000 level. The move has offered the crypto market a temporary lift. Analysts say the recent recovery, however, still lacks the sort of oomph that would mark a genuine turn after months in which it was in decline.

BTC price action remains range-bound and uncertain. The asset has traded between $85,000 and $90,000 for more than a week. Traders say this narrow band reflects hesitation rather than confidence.

$3 Trillion Market Cap Acts as Resistance as Bitcoin Trades Sideways

The total crypto market capitalization climbed back above $3 trillion. This level has repeatedly acted as a key psychological zone for traders. Analysts warn that moves above it have failed to hold in recent weeks.

Market observers note that the rebound followed weeks of steady selling. As a result, many view the move as a technical reaction instead of fresh demand entering the market.

Bitcoin Price Lift Driven by Technical Factors

Alex Kuptsikevich, chief market analyst at FxPro, said the recent strength in Bitcoin price is mostly technical. He explained that the market is rebounding from a very low base.

Also Read: Michael Saylor’s Bitcoin Bank Idea Aims to Attract $20-$50 Trillion in Global Capital

The crypto market is making a new attempt at growth, but this is not yet a recovery, Kuptsikevich said. He added that sentiment has only improved slightly. The fear and greed index has risen to 25, signaling reduced panic but limited appetite for risk.

Sentiment Remains Fragile Despite Gains

Bitcoin price is still about 30% below its 2025 peak. It also trades below levels seen at the start of the year. Analysts say these facts limit optimism around the current rebound.

Kuptsikevich noted that efforts to return year-to-date performance toward zero offer little comfort. He said disappointment has replaced the optimism that defined earlier months. Many traders now prefer to stay defensive.

Seasonal Trends Add to Caution

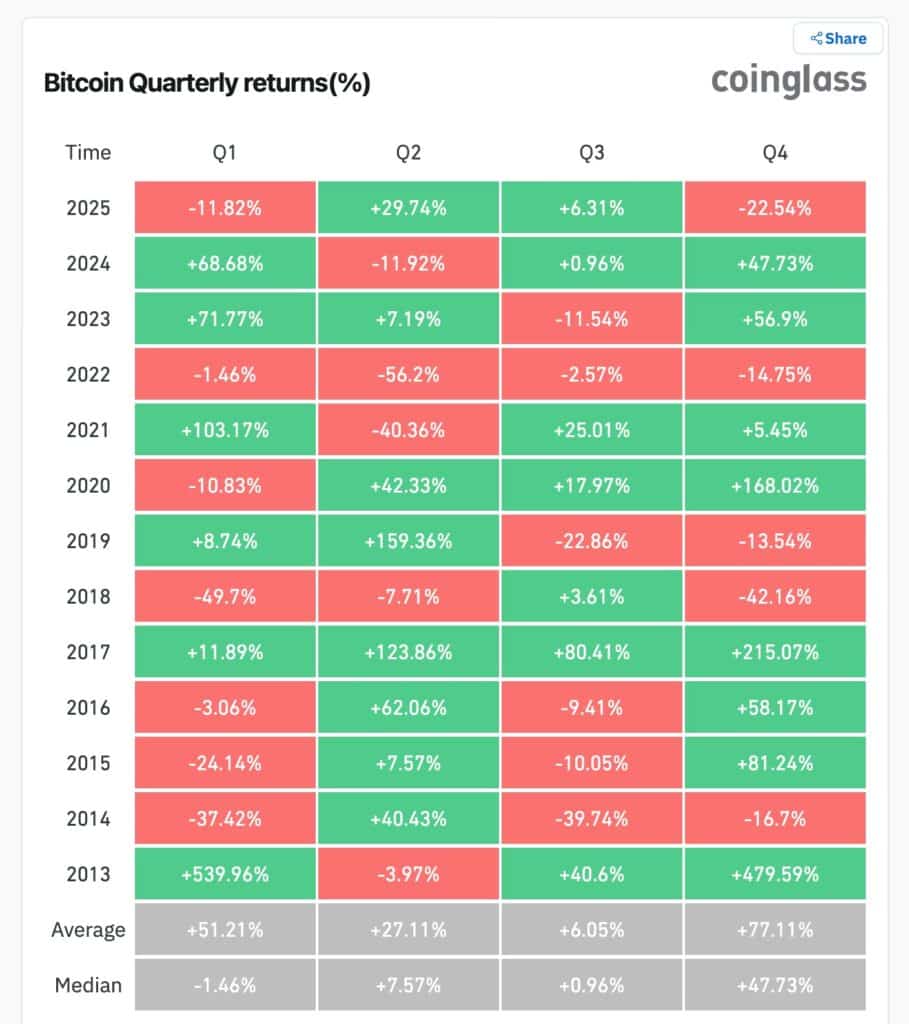

Seasonal data paints a challenging picture for Bitcoin price. CoinGlass data shows bitcoin is down more than 22% in the fourth quarter. This makes 2025 one of the weakest year-end periods outside of major bear markets.

Source: Coinglass

Source: Coinglass

Historically, the fourth quarter can deliver strong rallies. It can also bring sharp declines when liquidity tightens. Analysts say the current environment resembles past periods marked by macro uncertainty and fading speculative interest.

Regional Trading Patterns Signal Weak Demand

Recent trading sessions highlight another concern for Bitcoin price. Gains built during Asian and European hours have often faded once U.S. markets open.

This pattern suggests weak follow-through from North American investors. Analysts say sustained recoveries usually require strong U.S. participation. Without it, rallies tend to stall quickly.

On-Chain Data Shows Changing Behavior

Earlier in the year, quarterly gains suggested Bitcoin price was holding up well. The sharp losses concentrated in the fourth quarter now suggest a shift in behavior.

On-chain data shows declining speculative activity. New capital inflows appear weaker than earlier in the year. Historically, similar conditions have led to prolonged consolidation phases rather than rapid rebounds.

Current Price Levels and Volatility Risks

At the time of writing, the Bitcoin price was trading below $89,000. It was up just over 2.5% in the past 24 hours. Over the last month, it has gained close to 6%.

Despite that rise, the asset remains down about 7% on a yearly basis. It also trades nearly 29% below its all-time high near $126,000 set in early October. Analysts expect volatility to remain elevated in the near term.

Conclusion

Bitcoin price approaching $90,000 has lifted the market briefly, but analysts see little evidence of a lasting turnaround. Without stronger sentiment and fresh capital, the rebound is likely to remain fragile and vulnerable to sharp reversals.

Also Read: Bitcoin Price Outlook for 2026: Key Drivers From Grayscale’s Investment Themes Report

Appendix: Glossary of Key Terms

Market capitalization: The value of all cryptocurrencies in circulation.

Technical rebound: A temporary jump in prices caused by trading signals rather than fundamentals.

Trading in a range: Price action contained between consistent upper and lower boundaries.

Fear and Greed Index: Investor sentiment is measured on a scale from extreme fear to extreme greed.

On-chain data: Information that comes from the blockchain that can be analyzed to assess network activity.

Liquidity conditions: How easy it is to buy or sell assets, without affecting (or changing) the price significantly.

Short-term trading, short-term profit expectation-based, long-term demand-driven trades are not justified. Trading interest tends toward the short side.

Frequently Asked Questions About Bitcoin Price

1- What is driving the recent Bitcoin price rebound?

The rebound is mainly technical, driven by short-covering and relief after extended selling pressure.

2- Is this a confirmed recovery?

Most experts say no, citing weak sentiment and limited new inflows.

3- Why is $3 trillion market cap important?

It is a psychological level that often separates bullish and bearish phases.

4- How weak has Q4 been for Bitcoin?

Data shows it is among the weakest fourth quarters outside major bear markets.

References

CoinDesk

CryptoPotato

Read More: Bitcoin Price Heads for Its Weakest Year Since 2018">Bitcoin Price Heads for Its Weakest Year Since 2018

You May Also Like

“Oversold” Solana Mirroring Previous Bottoms

XRP Takes Hit as Whales Sell 1 Billion Coins, But Pro-Ripple Attorney Says XRP Will ‘Shock the World in 2026’