Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves

The issue surfaced after the dramatic removal of Venezuela’s longtime leader, Nicolás Maduro, who was captured by U.S. forces and transferred to New York to face criminal charges. In the aftermath, claims began circulating that Venezuela controls a massive Bitcoin reserve — estimates running as high as 600,000 BTC, a figure that would place the country among the world’s largest holders of the asset.

Key takeaways:

- Reports claim Venezuela may hold up to 600,000 Bitcoin, though no on-chain confirmation exists.

- U.S. officials have not ruled out potential action if state-linked crypto holdings are verified.

- Any seizure decision would likely fall outside the SEC’s authority and involve broader national security agencies.

- The situation highlights how digital assets complicate traditional sanctions and asset seizure frameworks.

Speaking in a television interview this week, Paul Atkins, chairman of the U.S. Securities and Exchange Commission, declined to rule out the idea that U.S. authorities could attempt to seize any such holdings if they were confirmed. He stressed, however, that decisions of that nature would fall outside the SEC’s remit and would be handled elsewhere within the administration.

Atkins’ comments underscore how digital assets are increasingly complicating traditional concepts of state property and sanctions enforcement. Unlike gold reserves or foreign bank accounts, Bitcoin is not stored in a vault that can be physically secured. Control depends entirely on access to private keys — a fact that makes both verification and seizure far more complex.

So far, blockchain intelligence firms have been unable to identify wallets conclusively linked to the Venezuelan state that would support the multibillion-dollar estimates. That uncertainty has not stopped speculation, in part because the Maduro government previously experimented with digital assets. In 2018, Venezuela launched an oil-backed token in an attempt to bypass sanctions and shore up collapsing finances, reinforcing the perception that crypto has played a role in the country’s economic strategy.

Bitcoin, regime change, and unanswered legal questions

The episode raises broader questions with no clear precedent. If a government secretly accumulated Bitcoin and then lost power, who would have a legitimate claim to those assets? Could they be treated as proceeds of crime? Or would they be considered national property belonging to the Venezuelan people, regardless of who held the keys?

READ MORE:

Strategy Invests Another $1.25B in Bitcoin, Pushing Holdings Toward 687,000 BTC

These uncertainties arrive at a sensitive moment for U.S. crypto policy. Later this week, the Senate Banking Committee is expected to advance work on the Digital Asset Market Clarity Act, a sweeping proposal intended to define regulatory responsibilities across the crypto sector. The bill has already passed the House but stalled in the Senate amid a government shutdown and growing political disputes.

Lawmakers are divided on several fronts, including how stablecoin rewards should be handled and whether decentralized finance requires stronger ethical safeguards. Early drafts of the legislation suggest an effort to expand the role of the Commodity Futures Trading Commission in overseeing digital assets — a move that could reshape how crypto is policed in the U.S.

Against that backdrop, the Venezuela question highlights a new dimension of crypto regulation: digital assets as instruments of state power. Whether or not the rumored Bitcoin trove exists, the mere discussion signals a shift in how governments view crypto — no longer just as a market or a technology, but as something that could one day be treated like strategic reserves.

For now, officials are keeping their distance from firm conclusions. But as geopolitical conflicts increasingly intersect with blockchain-based assets, scenarios once considered hypothetical are quickly becoming matters of policy, law, and international precedent.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves appeared first on Coindoo.

추천 콘텐츠

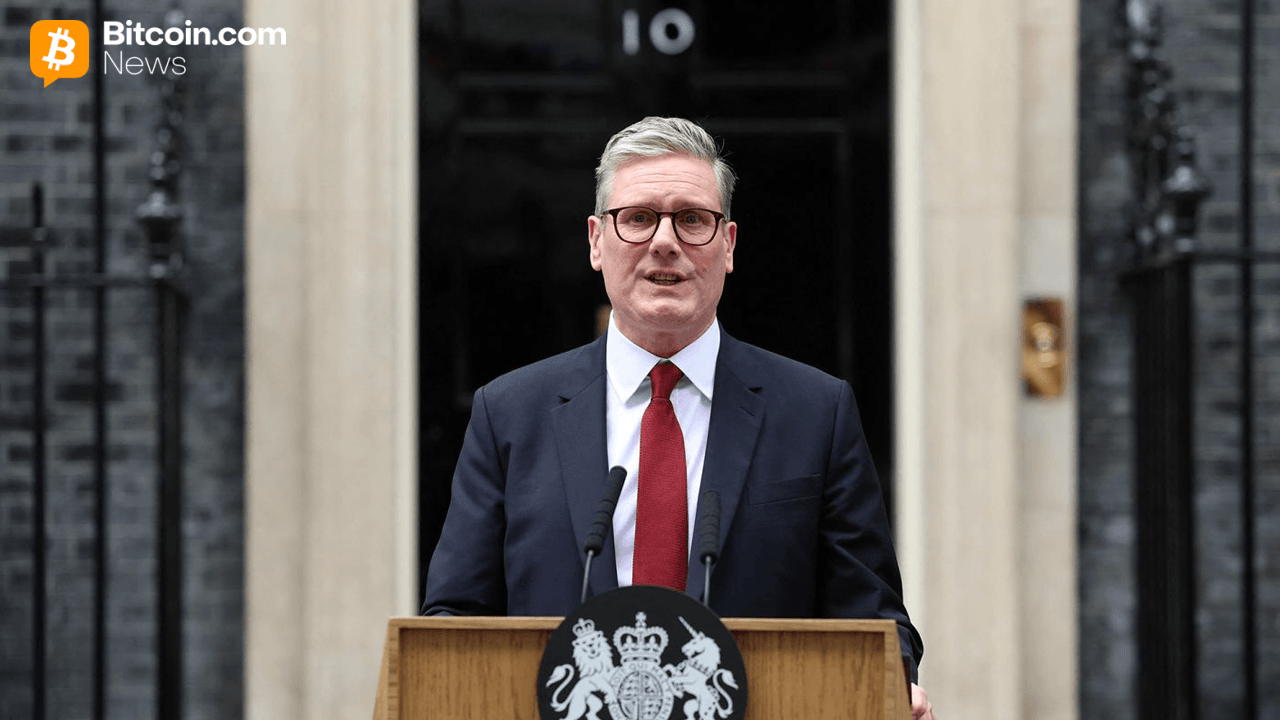

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

Kalshi debuts ecosystem hub with Solana and Base