What are Take-Profit/Stop-Loss Orders? Your Automated Tool for Risk Management and Profit Locking

1. What Is a Take-Profit/Stop-Loss Order?

A Take-Profit/Stop-Loss order lets users set a trigger price in advance, along with the price and quantity to buy or sell once the trigger is reached. When the market’s latest price hits the trigger price, the system automatically submits the preset order.

On MEXC Spot, this feature includes two types of conditional orders: Limit Take-Profit/Stop-Loss and Market Take-Profit/Stop-Loss. These orders help traders lock in gains when the market moves in their favor or limit losses when it moves against them.

2. Key Parameters of a Take-Profit/Stop-Loss Order

1)Trigger Price: The price level that must be reached for your preset order to activate.

2)Buy Price / Sell Price: The price at which you want to buy or sell the asset (for limit orders).

3)Buy Amount / Sell Amount: The quantity you want to buy or sell.

4)Order Amount: The total amount of the cryptocurrency you want to buy or sell.

Important notes:

- For Market Take-Profit/Stop-Loss Orders, users do not need to enter a buy/sell price. The order will execute at the best available market price once triggered.

- Market orders are placed based on the users' specified amount or total. Final execution price and quantity depend on actual market conditions.

3. Market vs Limit vs Take-Profit/Stop-Loss

| Market Order | Limit Order | Take-Profit/Stop-Loss | |

| Primary Goal | Fast execution | Control over price | Secure gains or control risk |

| Price Control | None. Executes at market price. | Yes. Executes at your set price or better. | Limit TP/SL: Price control Market TP/SL: No price control |

| Execution Certainty | Guaranteed to fill | Not guaranteed to fill | Market TP/SL: Fills but price may vary Limit TP/SL: Price fixed but may not fill |

| How to Set | Enter only amount or total | Enter price + amount or total | Enter trigger price + amount or total (limit price optional) |

4. Four Key Advantages of Take-Profit/Stop-Loss Orders

Secure Profits in Advance: Take-Profit orders help you close a position automatically when the price reaches your target. This avoids missing the ideal exit due to hesitation and avoids letting earlier gains slip away.

Control Risk and Protect Capital: Crypto markets are volatile and unpredictable. Stop-Loss orders help limit downside by closing your position when the market moves against you, preventing further losses.

Automate Trades and Reduce Emotional Bias: Fear and greed often impact trading decisions. Conditional orders execute strictly according to preset rules, helping you stay disciplined and objective.

Reduce Monitoring Pressure: You do not need to watch the market continuously. Once your order is set, the system executes it automatically when conditions are met.

Take-Profit/Stop-Loss Orders are essential tools for managing risk in crypto trading. By setting clear trigger prices and order parameters, you can better protect your funds while capturing opportunities in a fast-moving market. Whether you are experienced or new to trading, using TP/SL helps build a more disciplined and structured approach.

Recommended Readings:

- How to Use MEXC Take-Profit/Stop-Loss Orders

- What Is a Market Order

- What Is a Limit Order

- What Is an OCO Order

Disclaimer: The information provided in this material does not constitute advice on investment, taxation, legal, financial, accounting, or any other related services, nor does it serve as a recommendation to purchase, sell, or hold any assets. MEXC Learn offers this information for reference purposes only and does not provide investment advice. Please ensure you fully understand the risks involved and exercise caution when investing. MEXC is not responsible for users' investment decisions.

Popular Articles

Hyperliquid(HYPE) Tokenomics: Understanding the HYPE Token

HYPE is the native cryptocurrency of Hyperliquid, a Layer 1 decentralized exchange (DEX). As a key component of Hyperliquid’s ecosystem, the HYPE token plays a crucial role in governance, staking, and

How to Bridge to Hyperliquid(HYPE): Step-by-Step Deposit Guide

Bridging to Hyperliquid is a straightforward process that enables you to deposit funds and start trading on the platform. This step-by-step guide walks you through the process of transferring assets t

What is the Hyperliquid L1 Blockchain? Appchain Explained

The Hyperliquid L1 blockchain operates as a specialized Appchain optimized for high-performance, fully on-chain order book trading of spot and perpetual markets. Built around its HyperCore engine for

Ethereum Wallet: What It Is, How It Works, and How to Choose the Best One

If you just bought ETH for the first time, one question comes up fast: where do you keep it?An Ethereum wallet is the answer. Think of it as your personal key to the Ethereum blockchain — a tool that

Hot Crypto Updates

View More

DoubleZero (2Z) Stop Loss Mastery: Lock in Profits

Understanding the Importance of Stop Loss and Take Profit in DoubleZero (2Z) Trading Risk management is crucial in volatile DoubleZero (2Z) markets, where price swings of 5–20% within a single day

BNBHOLDER Stop Loss Strategy: Protect Your Profits

Introduction to Risk Management in BNBHOLDER Trading Understanding the importance of risk management when trading BNBHOLDER Overview of how stop-loss and take-profit orders help protect investments

BNBHOLDER Stop Loss Mastery: Lock in Profits

Understanding the Importance of Stop Loss and Take Profit in BNBHOLDER Trading Why risk management is crucial in volatile BNBHOLDER markets How proper stop loss and take profit orders protect capital

Binancelife (formerly BIANRENSHENG) Stop Loss Mastery: Lock in Profits

Understanding the Importance of Stop Loss and Take Profit in 币安人生 (Biancelife) Trading Risk management is crucial in the volatile 币安人生 (Biancelife) market, where daily price swings can exceed 20%[1].

Trending News

View More

Trump put Noem in the corner during 'Shield of the Americas' special envoy debut

Newly appointed “Special Envoy for the Shield of Americas” Kristi Noem made her debut in Florida Saturday morning to witness Donald Trump promote his new “Security

'Mangled and killed by a car': Trump’s Yosemite policy denounced

A longtime conservation advocate warned on Saturday that President Donald Trump’s recent park policies will likely take a toll on an innocent party — Yosemite Park

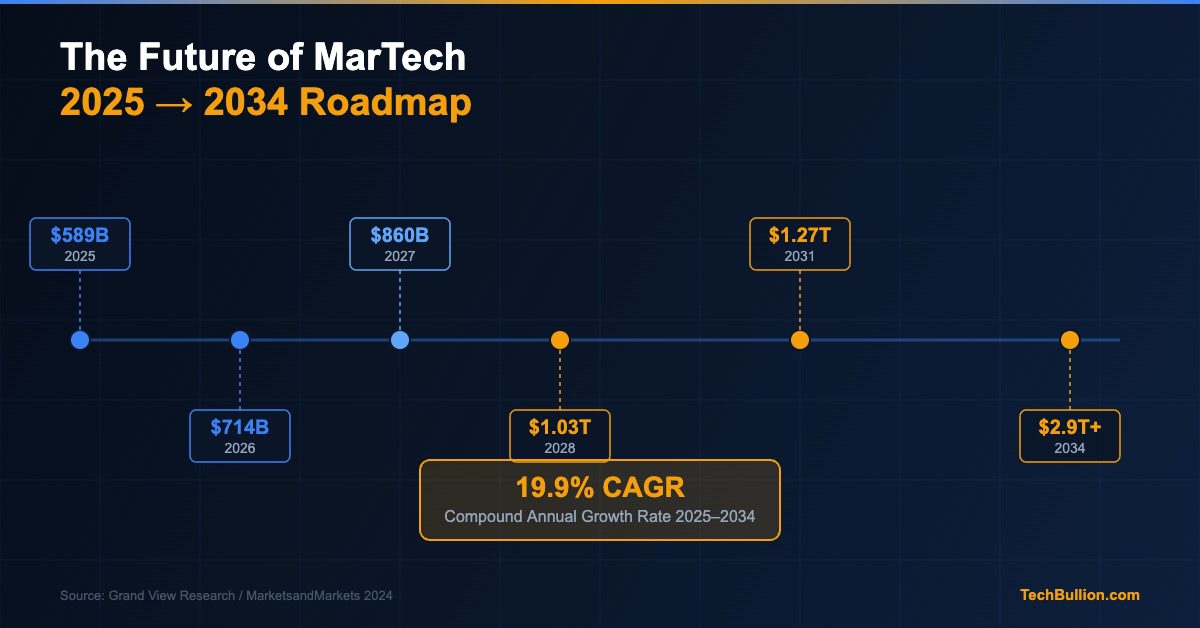

The Future of MarTech: Trends Shaping the Market Through 2034

Forecasting the future of a market growing at nearly 20 percent annually requires a willingness to take the numbers seriously. The global MarTech market reached

Palantir and the Pentagon renew their disgustingly twisted relationship that endangers humanity

The post Palantir and the Pentagon renew their disgustingly twisted relationship that endangers humanity appeared on BitcoinEthereumNews.com. Palantir and the Pentagon

Related Articles

What is Spot Trading in Crypto? Complete MEXC Guide for Beginners

Cryptocurrency trading is typically divided into two categories: spot trading and futures trading. Spot trading is the act of buying or selling digital assets on the market, referring to the exchange

What is Pre-Market Trading?

1. What is Pre-Market Trading?Pre-market trading is an OTC (Over-The-Counter) service provided by MEXC that allows traders to buy and sell new tokens before they are officially listed on the cryptocur

What is MEXC Convert?

MEXC Convert is an exclusive feature that enables users to quickly exchange assets between different cryptocurrencies without the need for traditional order books, order placements, or matching proces

What Is Launchpool?

MEXC Launchpool is an event platform that enables users to earn airdrops of popular or newly listed tokens by staking designated tokens. Staked tokens remain redeemable at any time, and users receive