What is Infinex (INX)? Complete Guide to the Keyless Multi-Chain DeFi Platform

- Infinex is a keyless, non-custodial multi-chain wallet that eliminates seed phrases while maintaining full user control over crypto assets.

- INX token provides holders with automatic gas subsidies, governance voting rights, and fee discounts across the Infinex DeFi platform.

- The platform integrates DEX aggregation, perpetual futures trading, and cross-chain access into a single unified interface for simplified DeFi participation.

- INX has a total supply of 10 billion tokens with strategic distribution across Patron NFT holders, team, treasury, and community incentives.

- Infinex launched its Token Generation Event (TGE) on January 30, 2026, with INX tokens immediately tradable on major exchanges like MEXC.

What is Infinex Crypto (INX Token)?

Infinex Platform vs INX Token: Key Differences

Aspect | Infinex | INX Token |

Nature | Platform/Ecosystem | Native Utility Token |

Function | Multi-chain DeFi wallet and interface | Medium of exchange and utility |

Purpose | Provide access to DeFi protocols, trading, and cross-chain operations | Enable gas subsidies, governance, and platform benefits |

Relationship | The complete infrastructure | The economic layer powering the infrastructure |

Analogy | Similar to Ethereum (the blockchain) | Similar to ETH (the native token) |

Launch | Public launch May 2024 | TGE January 30, 2026 |

Key Features | Keyless authentication, multi-chain support, unified interface | Gas subsidies, governance voting, fee discounts |

What Problem Does Infinex DeFi Platform Solve?

1. Complexity Barrier in DeFi

2. Fragmented Multi-Chain Experience

3. High Transaction Costs

4. Lack of DeFi Integration

The Story Behind Infinex Crypto Project

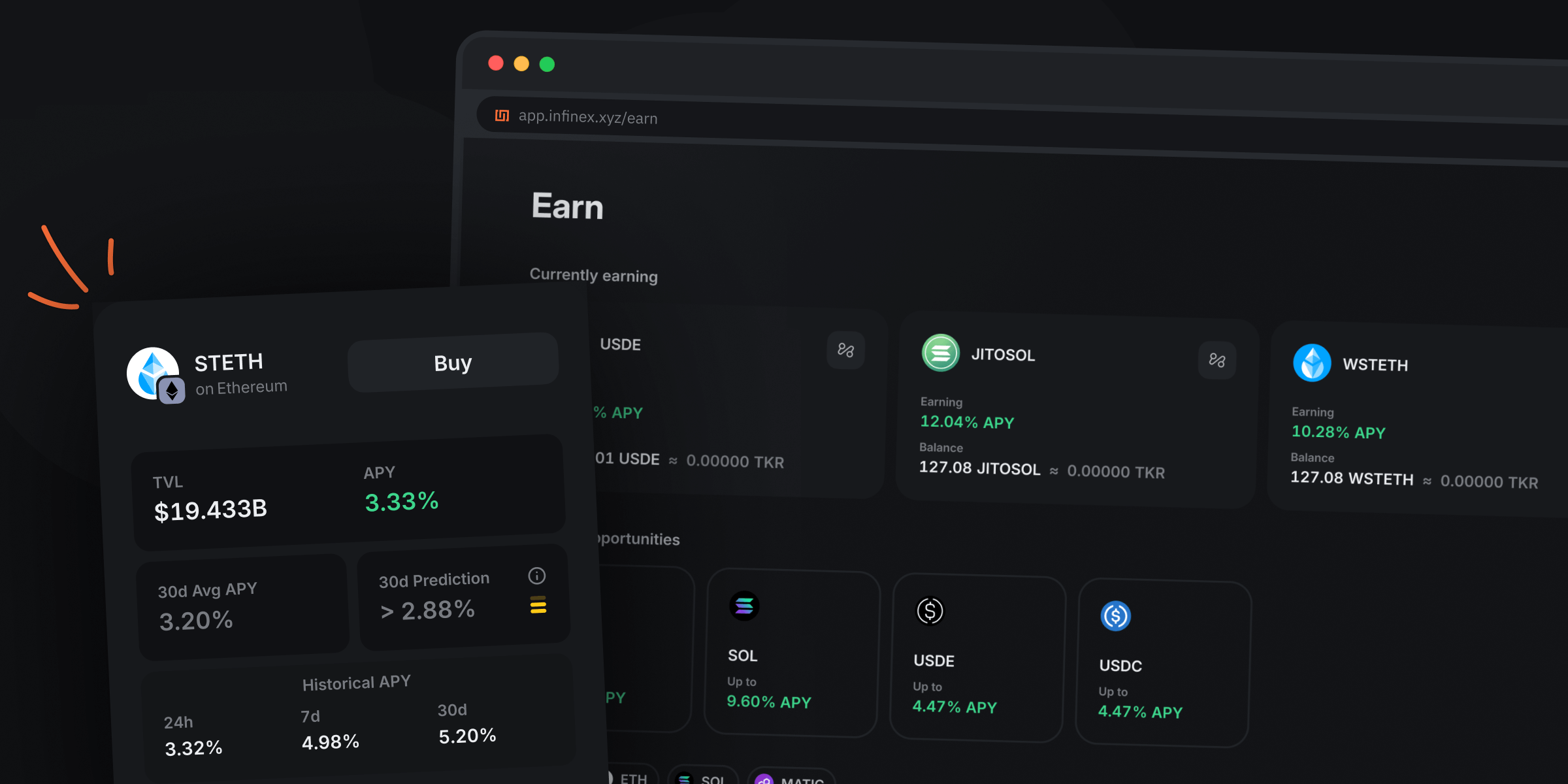

Key Features of Infinex Wallet and DeFi Platform

1. Keyless, Non-Custodial Technology

2. Multi-Chain Support

3. Unified DeFi Access

4. Gas Subsidies Through INX

5. Revenue-Driven Buyback Mechanism

How Does Infinex Work? Technical Architecture Explained

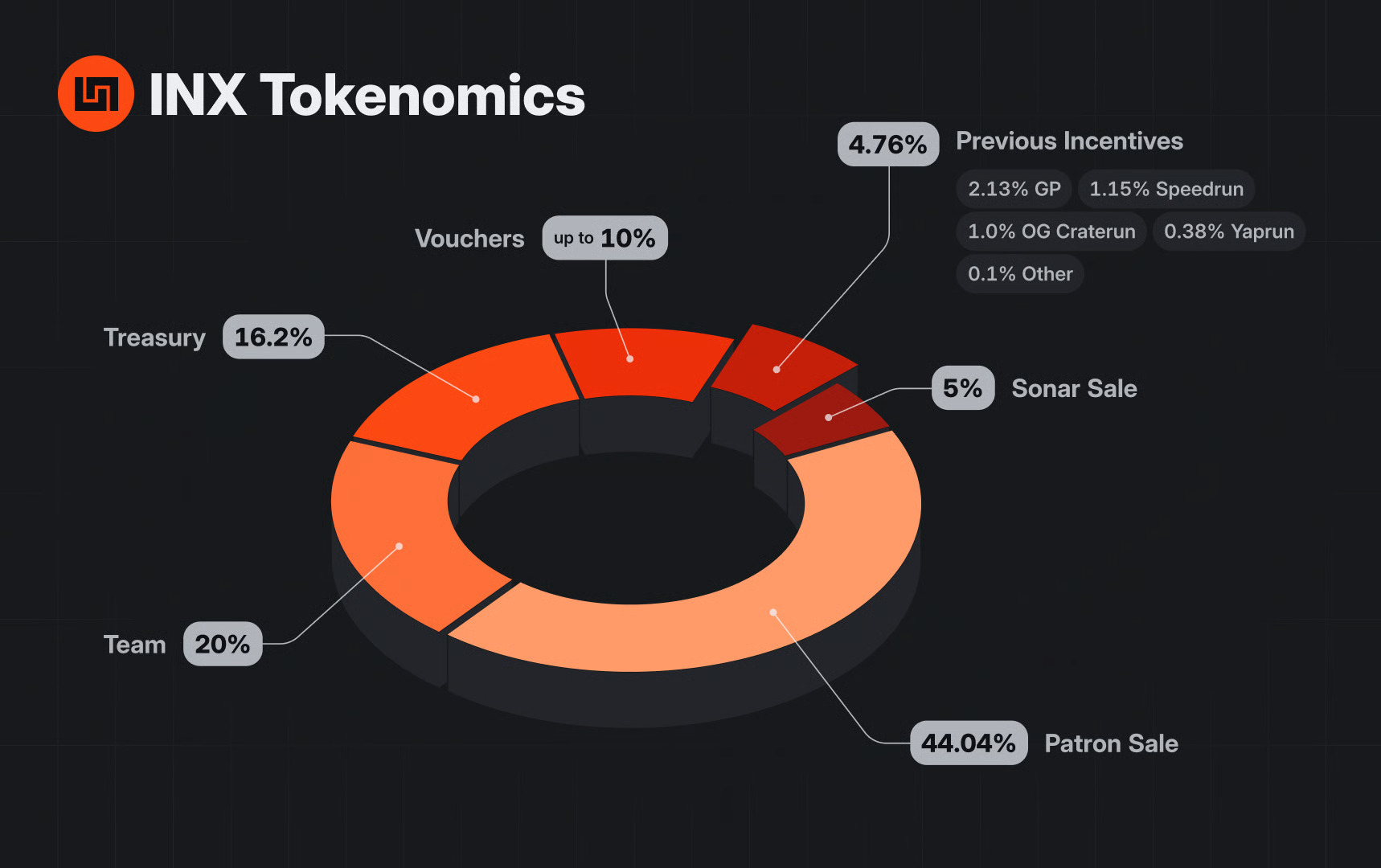

INX Token Tokenomics and Distribution

Total Supply and Distribution

- Patron Sale: 44.04% (4,404,000,000 INX) - Allocated to Patron NFT holders with various vesting schedules

- Team: 20% (2,000,000,000 INX) - Locked until October 2026, then 12-month linear vesting

- Treasury: 16.2% (1,620,000,000 INX) - Fully unlocked at TGE for ecosystem development

- Craterun Vouchers: Up to 10% (Up to 1,000,000,000 INX) - Claimable as users redeem vouchers

- Sonar Sale: 5% (500,000,000 INX) - Locked for 12 months from TGE with early unlock option

- Previous Incentives: 4.76% (476,000,000 INX) - Fully unlocked, distributed to GP holders, Speedrun, OG Craterun, Yaprun, and Bullrun participants

Vesting and Unlock Schedule

- Month 1 (Feb 2026): 2,221,302,273 INX (22.2%)

- Month 6 (Jul 2026): 3,356,313,636 INX (33.6%)

- Month 12 (Jan 2027): 5,812,266,667 INX (58.1%)

- Month 21 (Sep 2027): 10,000,000,000 INX (100% - full unlock)

INX Coin Functions and Utility

1. Gas Subsidies

2. Governance Rights

3. Fee Discounts

4. Early Access to Features

5. Future Utility Expansion

The Future of Infinex and INX Token Development

Infinex vs Competitors: DeFi Platform Comparison

Where to Buy INX Token on MEXC Exchange

How to Buy Infinex (INX) on MEXC

- Register a MEXC Account - Visit the official MEXC website and complete the signup process using your email address.

- Complete KYC Verification - Submit required identity documents to verify your account and unlock full trading capabilities.

- Deposit Funds - Transfer USDT to your MEXC wallet from an external source or purchase USDT directly on the platform.

- Navigate to INX Trading Pair - Search for "INX" in the trading section and select the INX/USDT pair.

- Place Your Order - Choose between a market order (immediate purchase at current price) or limit order (set your desired price).

- Confirm Transaction - Review the order details including quantity and total cost, then execute the purchase.

- Secure Your Tokens - After purchase, your INX tokens will appear in your MEXC wallet

Conclusion

Popular Articles

Why Smart Money Trades Copper (XCU) Perps on MEXC

When investors think of Copper, they often think of physical bars or slow-moving ETFs. That is how the "Old World" trades.But for the modern crypto trader on MEXC, the launch of COPPER (XCU) USDT Perp

Staking Rewards Crunch,Why ETH Yields Can Fall Even When Activity Looks “Fine”

Ethereum staking rewards come from a mix of protocol issuance (new ETH minted) and variable fee-driven components (priority fees and MEV). Over the past two years, the composition of that mix has shif

NFT Market Radar: Utility Narratives Re-enter the Conversation (Late Jan 2026)

Scope note (what this piece is—and isn’t)This “radar” summarizes what three recent articles reported about NFT-adjacent tokens and utility-themed use cases around mid-to-late January 2026. It does not

Is Bitcoin Safe? A Complete Guide to Bitcoin Security and Investment Risks

Bitcoin's safety remains one of the most searched questions as the cryptocurrency market continues to evolve in 2026.This guide breaks down what makes Bitcoin secure at the network level while identif

Hot Crypto Updates

View More

USAT High-Yield Savings on MEXC: Earn Up to 300% APR with Flexible Deposits and Withdrawals

MEXC Exchange launches exclusive USAT high-yield flexible savings with up to 300% APR. This comprehensive guide explores USAT earning mechanisms, yield calculation methods, and participation

Lighter (LIT) 2026 Price Prediction: Professional Analysis of the DeFi Rising Star's Investment Value

Meta Description In-depth analysis of Lighter (LIT) token price trends for 2026: comprehensive predictions based on technical indicators, fundamentals, market trends, and industry development. Learn

MEXC Wallet: Comprehensive Web3 Asset Management Solution

MEXC Wallet positions itself as a comprehensive Web3 asset management solution that evolved from early wallet offerings into a full-featured, multi-chain self-custody platform serving millions of

2025 Crypto Wealth Freedom Guide: 12-Month Explosive Investment Opportunities Revealed

Key Takeaways 2025 presents unprecedented crypto investment opportunities with returns ranging from 400x to 1500x across various tokens Meme coins, AI tokens, and DeFi projects emerged as the hottest

Trending News

View More

Vitalik Buterin Withdraws 16,384 ETH for Ethereum Goals

Ethereum's Vitalik Buterin withdraws 16,384 ETH to support Ethereum's high-performance roadmap and staking goals.Read more...

Vitalik Buterin Withdraws 16,384 ETH to Fund Open-Source Technology and Privacy Projects

TLDR: Buterin withdrew 16,384 ETH to personally fund open-source projects as Ethereum Foundation reduces spending. The initiative supports secure hardware, privacy

What is the most promising crypto right now? A practical checklist

Crypto interest often spikes after headlines. This guide helps everyday readers turn curiosity into repeatable checks that limit obvious execution risks. We focus

‘We buy real Bitcoin’- Michael Saylor rejects ‘paper BTC’ claims

The post ‘We buy real Bitcoin’- Michael Saylor rejects ‘paper BTC’ claims appeared on BitcoinEthereumNews.com. After dealing with the threat of MSCI index exclusion

Related Articles

Why Smart Money Trades Copper (XCU) Perps on MEXC

When investors think of Copper, they often think of physical bars or slow-moving ETFs. That is how the "Old World" trades.But for the modern crypto trader on MEXC, the launch of COPPER (XCU) USDT Perp

Staking Rewards Crunch,Why ETH Yields Can Fall Even When Activity Looks “Fine”

Ethereum staking rewards come from a mix of protocol issuance (new ETH minted) and variable fee-driven components (priority fees and MEV). Over the past two years, the composition of that mix has shif

NFT Market Radar: Utility Narratives Re-enter the Conversation (Late Jan 2026)

Scope note (what this piece is—and isn’t)This “radar” summarizes what three recent articles reported about NFT-adjacent tokens and utility-themed use cases around mid-to-late January 2026. It does not

What is Infinex (INX)? Complete Guide to the Keyless Multi-Chain DeFi Platform

Infinex is a keyless, non-custodial multi-chain wallet designed to simplify decentralized finance access. This comprehensive guide explores Infinex's platform architecture and its native INX token. Yo