XRP Created Before Ripple, SMQKE Confirms in New Legal Review

TLDR

- SMQKE reveals that XRP was created before Ripple, shedding light on their distinct histories.

- The SMU Science and Technology Law Review clarifies the separate roles of Ripple and XRP in the financial landscape.

- XRP operates independently on open-source technology, separate from Ripple’s corporate control.

- Ripple focuses on creating financial products, while XRP serves as a decentralized digital asset.

- The research emphasizes that XRP’s governance is distributed, unlike Ripple’s centralized structure.

Crypto researcher SMQKE has revealed that XRP was created before Ripple, the San Francisco-based cross-border payment firm. In a recent post, SMQKE shared an excerpt from the SMU Science and Technology Law Review. The excerpt sheds light on the key differences between Ripple and XRP, emphasizing that XRP existed before Ripple was founded.

XRP Operates Independently from Ripple, Research Shows

SMQKE’s post highlights a passage from the SMU Science and Technology Law Review titled “Difference Between Ripple and XRP.” The passage elaborates on the separate roles of Ripple and XRP. It explains that while Ripple focuses on building solutions for global money transfers, XRP serves as an independent cryptocurrency.

Ripple is a privately owned company that designs software to help banks and financial institutions transfer money at a lower cost. XRP, on the other hand, operates as a bridge currency between different platforms. The review makes it clear that XRP functions independently of Ripple, underscoring that the two should not be viewed as the same entity.

Ripple utilizes XRP in its financial products, but it does not control the technology behind XRP. XRP runs on an open-source technology that allows anyone to use it or modify it. The SMU review highlights this separation, which is vital to understanding the legal distinctions between the two.

Ripple’s Governance vs. XRP’s Open Structure

The review also emphasizes the difference in governance between Ripple and XRP. Ripple is controlled by its founders, directors, and investors. In contrast, XRP operates on a decentralized structure that is open to anyone who wishes to participate.

XRP’s governance is distributed, unlike Ripple’s, which remains controlled by a central entity. The review asserts that Ripple builds financial products, while XRP is a digital asset that operates independently. This distinction has significant implications for the regulatory and financial discussions surrounding XRP and Ripple.

By sharing this information, SMQKE draws attention to the fact that XRP predates Ripple. He highlights the importance of understanding this historical context, particularly in the broader financial and regulatory landscape. The review concludes that XRP’s role and function should always be considered separately from Ripple’s corporate operations.

The post XRP Created Before Ripple, SMQKE Confirms in New Legal Review appeared first on CoinCentral.

You May Also Like

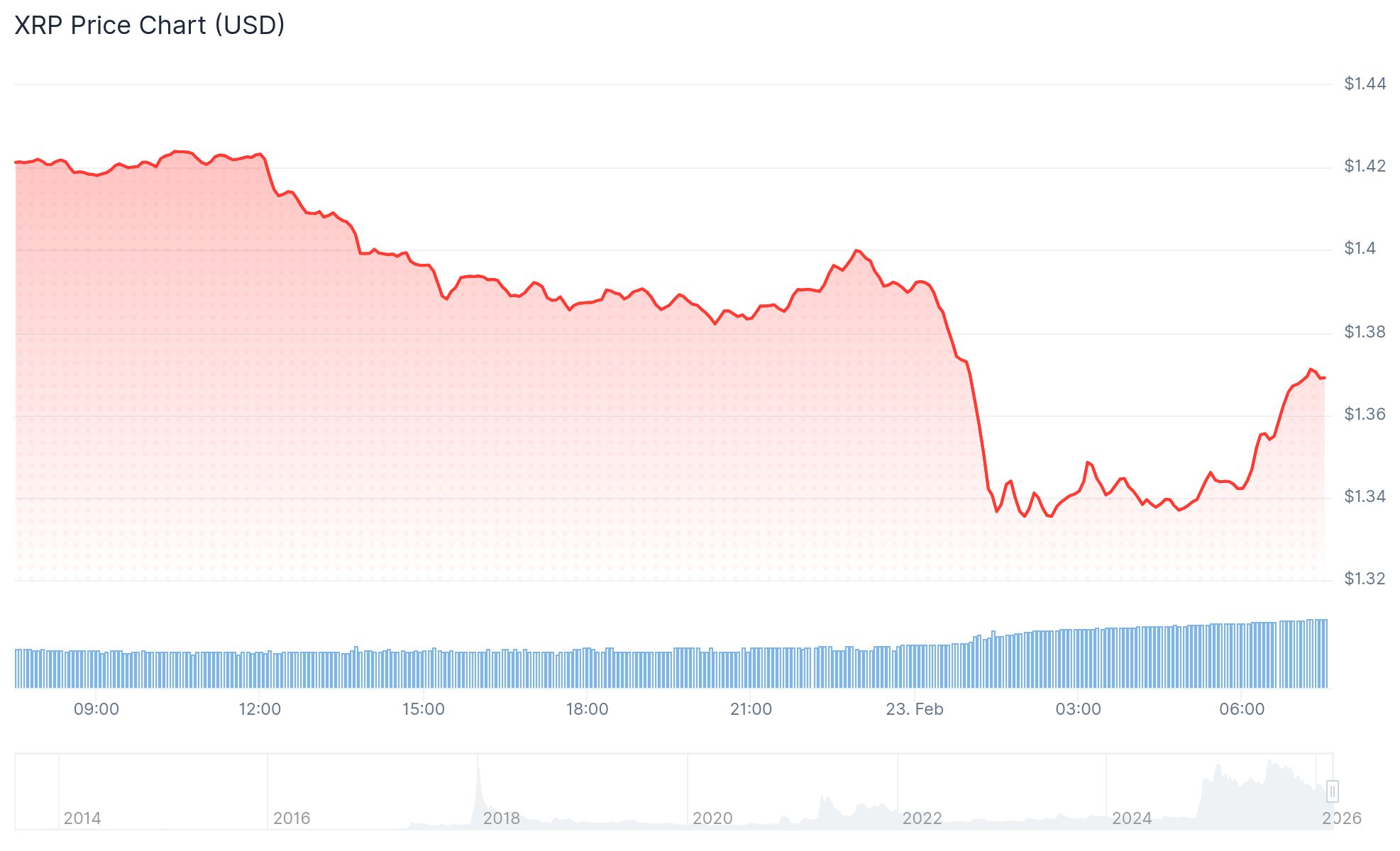

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels