Best Presales to Buy as SEC New Listing Standards Invites ‘Waves’ for Crypto ETFs

Until now, anyone wanting to offer crypto-pegged ETF products had to submit a separate application with the SEC. This was a slow and cumbersome process that often took nearly a year.

However, under the new generic protocols, such Exchange-Traded Products (ETPs) can list without an extra layer of approvals.

To qualify, a crypto spot ETF must either:

- Hold a commodity that trades on the market or is part of the Intermarket Surveillance Group.

- Be based on an underlying futures contract that has been traded for at least six months.

- Or automatically qualify if it’s already tracked by another ETF with at least 40% exposure.

Let’s take a closer look at what this generic standard could mean for the broader cryptocurrency markets. We’ll also highlight the best crypto presales you can consider buying to capitalize on this opportunity.

The SEC Clears Path for ETFs

On September 10, the SEC had delayed BlackRock’s spot $ETH ETF application as well as Franklin Templeton’s $SOL and $XRP ETF proposals.

Before this, the regulator also postponed other ETF proposals related to Solana and XRP filed by firms such as Bitwise, Canary Capital, and CoinShares.

At the time, senior ETF analyst Eric Balchunas noted that the SEC was developing a broad approval process to make future ETF listings smoother.

That’s exactly what the Commission has now done with these new generic listing standards.

The move provides essential certainty and clarity for the investor community while safeguarding investors’ interests through a rule-based approach.

It also ensures that the U.S. remains a hub of digital asset innovation, as highlighted in the official SEC press release.

Following this broad green light, Balchunas suggested we could see a wave of ETF approvals within the next two months. According to him, at least 12 to 15 crypto-based ETFs already meet the criteria and are effectively ready for launch.

The SEC could start by approving Solana and Litecoin ETFs. However, an $XRP ETF may take longer, since its futures are not yet six months old.

What This Means for Crypto

Crypto ETFs make it significantly easier for both retail and institutional investors to access digital assets in a secure, regulated way, attracting fresh capital and liquidity into the markets.

This is exactly why we believe now’s the best time to build a diversified crypto portfolio to capitalize on this opportunity.

If you’re looking for ideas, here are a few altcoins you should not miss out on.

1. Bitcoin Hyper ($HYPER) – Building a New Bitcoin Layer 2 for Solana-Like Speed, Scalability & Web3 Support

Bitcoin Hyper ($HYPER) is arguably at the top of the ladder if we’re talking about low-cap coins that could explode in Q4 2025.

Mind you, that’s not only because it’s associated with Bitcoin – but because of its game-changing mission to improve the OG blockchain’s real-world utility.

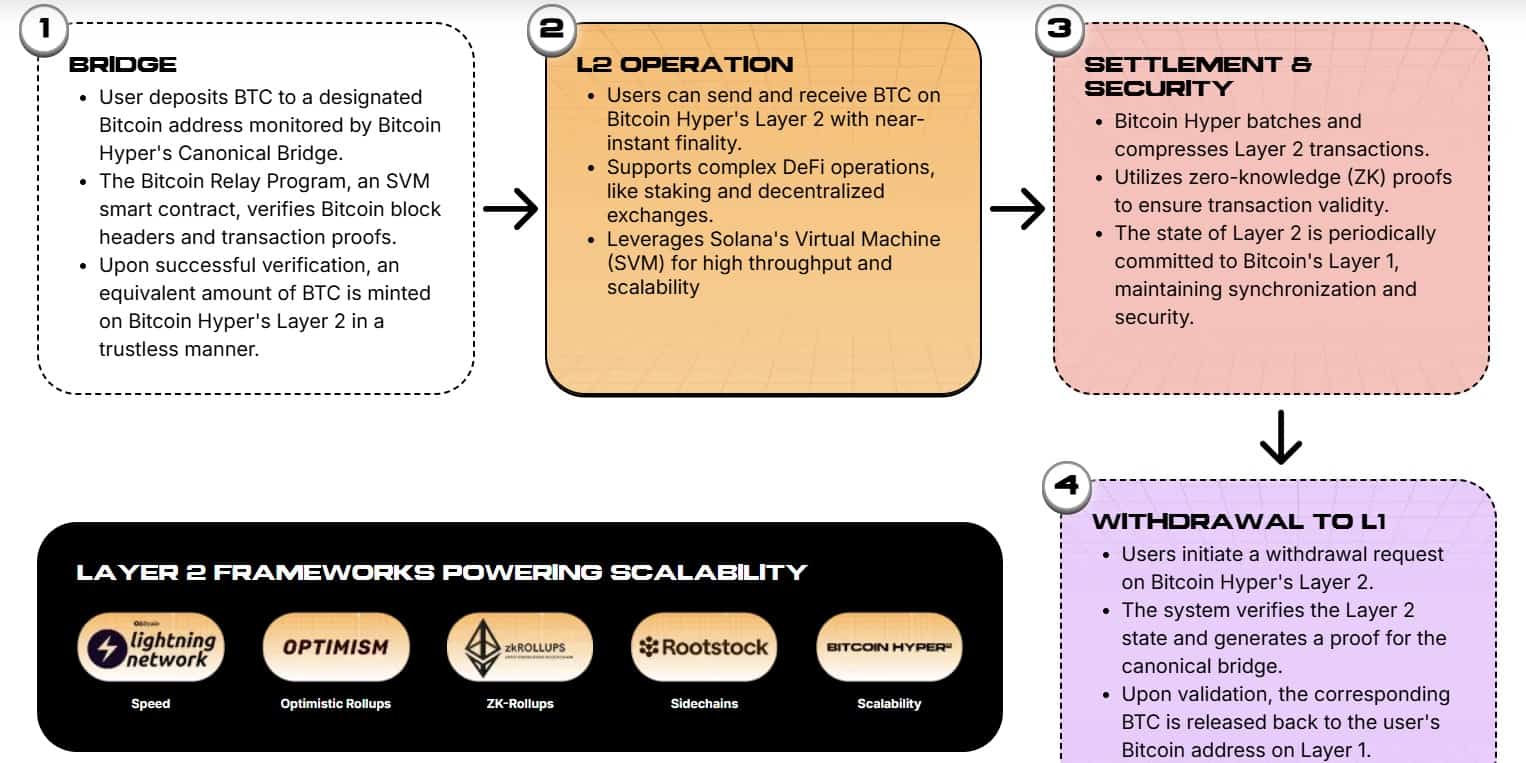

Currently, Bitcoin can process just seven transactions per second (TPS). Compare that to a more modern blockchain like Solana (65K TPS), and it’s easy to see why the $HYPER presale has garnered so much attention.

Think of $HYPER’s new Layer 2 as a quick side lane next to Bitcoin’s busy highway. It helps with faster transactions and lower fees, thanks to its ability to handle thousands of transactions at once.

Furthermore, the Solana Virtual Machine (SVM) integration powers a never-before-seen Web3 environment on Bitcoin, complete with DeFi trading apps, NFT marketplaces, lending, staking, DAOs, and gaming dApps.

At the time of writing, the Bitcoin Hyper presale has already raised over $16.5M, with each token priced at just $0.012935. Here’s our guide on how to buy $HYPER.

According to our $HYPER price prediction, the token could hit $0.20 by year-end, giving you a potential 1,400% ROI.

Visit Bitcoin Hyper’s official website to learn more about how it’s bringing Bitcoin up to modern blockchain standards.

2. Snorter Token ($SNORT) – A Telegram-Based Trading Bot for Meme Coin Sniping

A thriving crypto market typically sends the meme coin space through the roof, which is why Snorter Token ($SNORT) is one of the best cryptos to buy now.

It’s built specifically to bring parity in the Solana meme coin trading world, which, at the moment, is dominated by big-money players with advanced tools.

Simply put, they scoop up all the available liquidity in new meme coins, leaving virtually no profits for the average trader.

Snorter flips the script by letting you place buy/sell limit and stop orders in advance. It then automatically executes those orders the second liquidity kicks in.

The best part? Using Snorter is straightforward. Whether it’s placing orders, managing your portfolio, or copy trading, everything can be done via simple Telegram chat.

If you invest $100 into $SNORT now, you could potentially turn it into $1,000 by the end of 2025. This projection is based on our research-backed Snorter Token price prediction.

1 $SNORT is currently available for just $0.1047, and the project has in total raised over $3.97M from early investors so far.

Visit Snorter Token’s official website to learn more about its top-notch security and usability benefits.

3. Remittix ($RTX) – Next-Generation PayFi Solution Bridging Fiat & Crypto

Probably the biggest roadblock to crypto’s growing adoption is how difficult traditional banks make it to receive crypto payments. Think unnecessary (and multiple) verification, scrutiny, and whatnot.

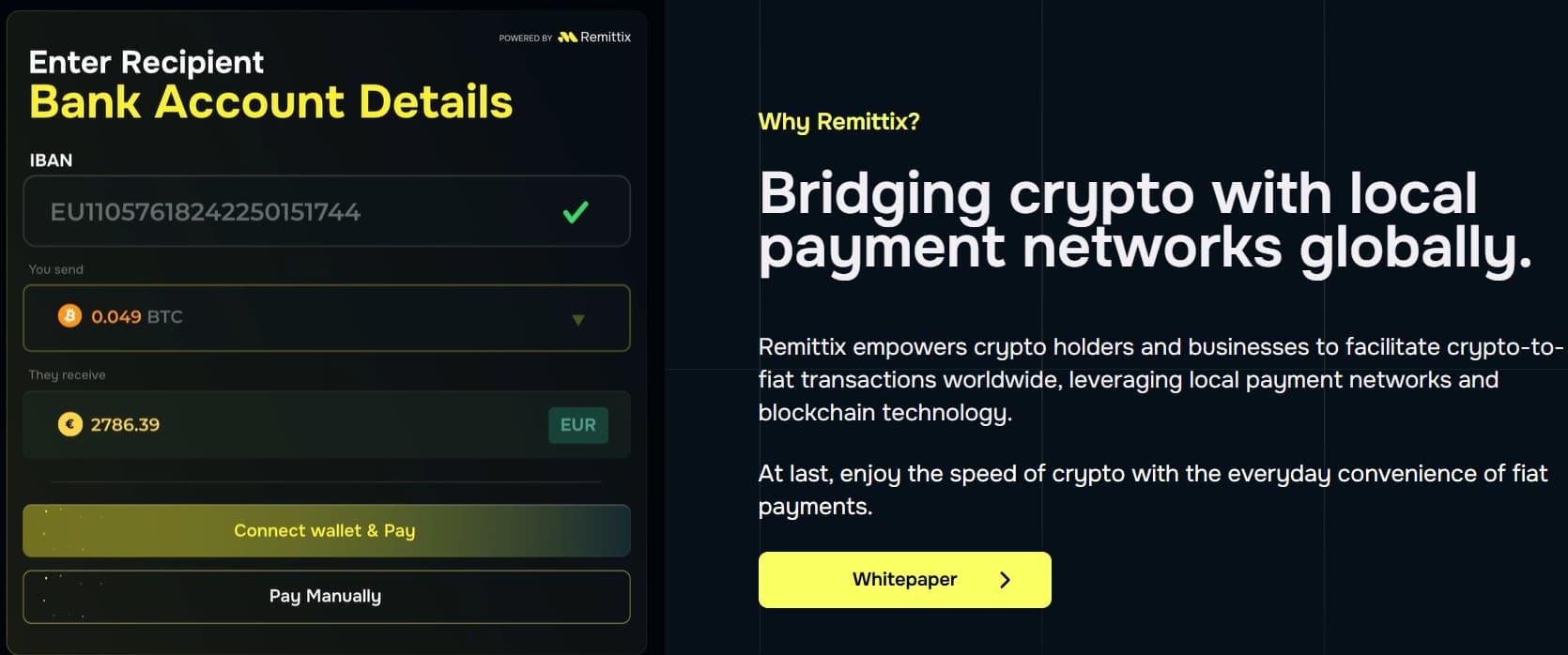

This is where Remittix ($RTX) comes in. This new cryptocurrency project will let you send crypto payments to bank accounts all over the world.

The receiving banks and even customers will have no clue that the fiat payment they received started as a crypto transaction.

Even better, Remittix’s unique crypto-to-fiat bridge also offers lightning-fast transactions and zero FX fees, solving yet another issue posed by the traditional banking infrastructure.

Remittix is currently in presale, where it has so far accumulated a whopping $25.98M from early investors. Each token is still priced at just $0.1080, so hurry up.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions