Bitcoin Accumulation Addresses Hit Record Inflows Before Fed Interest Rate Verdict, Another Major Rally Brewing?

On Wednesday, Bitcoin, the largest digital asset, experienced slight bearish pressure as news about the Federal Reserve (Fed) rate cut flooded the broader cryptocurrency sector. Even though BTC experienced price fluctuations, there was still a significant buying pressure observed among retail and institutional investors in the market.

Market Bets On Bitcoin Are Heavily Heating Up

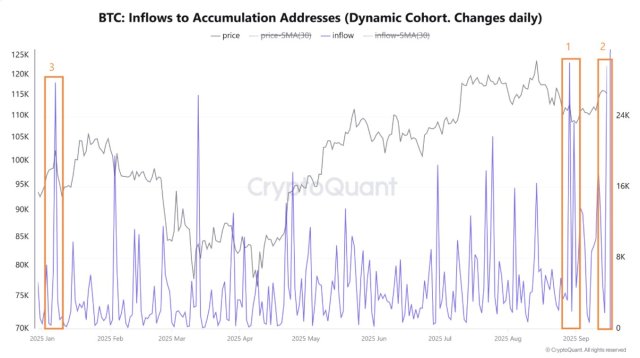

Bitcoin’s renewed upward strength may have slowed down, but investors’ sentiment was not thwarted by the negative price action. CryptoQuant, a leading on-chain data analytics platform, has released a report indicating that buying pressure has experienced a significant surge despite a slight pullback in BTC’s price.

In the quick-take post, Burak Kesmeci, a market expert, highlighted that Bitcoin is witnessing a sharp surge of inflows into accumulation addresses. These accumulation addresses, which are frequently regarded as powerful players in the market, are consuming huge quantities of BTC even in the face of persistent macroeconomic uncertainty.

According to the report, this powerful wave of accumulation was identified prior to the United States Federal Reserve’s interest rate decision. Such a buying spree ahead of the Fed’s decision suggests that market players are acting strategically by choosing to stack more BTC in anticipation of increased volatility and possible macroeconomic changes.

Burak Kesmeci noted that over 29,685 BTC were seen flowing into accumulation addresses just hours before the Fed’s rate decision. Data shared by the expert reveals that the massive inflows mark the second-largest single-day inflow of 2025. With long-term holders placing themselves ahead of potential catalysts that could define the next phase of the market cycle, this pattern is indicative of growing confidence in Bitcoin’s resiliency.

Following this buying spree by key investors, the total amount of BTC held in accumulation addresses has now reached approximately 2.84 million BTC. At the same time, the average realized price cost basis of these addresses has increased to $72,437 per BTC.

A Rapid Buying In The Option Market

The ongoing buying pressure currently observed around Bitcoin is also displayed in other key metrics. In a recent post on the X platform, Glassnode, a financial and on-chain platform, reported that the Bitcoin options market is booming as traders scramble to get positions.

Glassnode revealed this wave of fresh optimism after examining the BTC Options Net Premium Strike Heatmap. BTC’s buying pressure comes as the flagship asset gains traction, with its price only 6.8% away from its all-time high, heading into the most anticipated FOMC meeting of this cycle.

In the meantime, Glassnode highlighted that options traders are rapidly buying options in order to protect or position themselves for a volatility spike. This trend reflects the uncertainty of the market and the anticipation of a major move in the future.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

WTI drifts higher above $59.50 on Kazakh supply disruptions