Crypto OI Shows Mixed Trend: Bitcoin, Solana Down, While Ethereum, XRP Up

A divergence has formed in the crypto futures market during the past week as Bitcoin and Solana have seen deleveraging against the others.

Bitcoin, Solana Have Seen A Drop In Perpetual Futures Open Interest

In a new post on X, on-chain analytics firm Glassnode has talked about the latest trend in the Open Interest for Bitcoin and other top coins in the cryptocurrency sector.

The “Open Interest” here refers to an indicator that measures the total amount of perpetual futures positions related to a given asset that are currently open on all centralized derivatives exchanges.

When the value of this metric goes up, it means the investors are opening up fresh positions on the perpetual futures market. Generally, the total leverage present in the sector rises when this trend develops, so the asset’s price can become more unstable following it.

On the other hand, the indicator registering a decline implies holders are either closing up positions of their own volition or getting forcibly liquidated by their platform. Such a trend usually leads to a reduction in leverage, which can make the price act in a more stable manner.

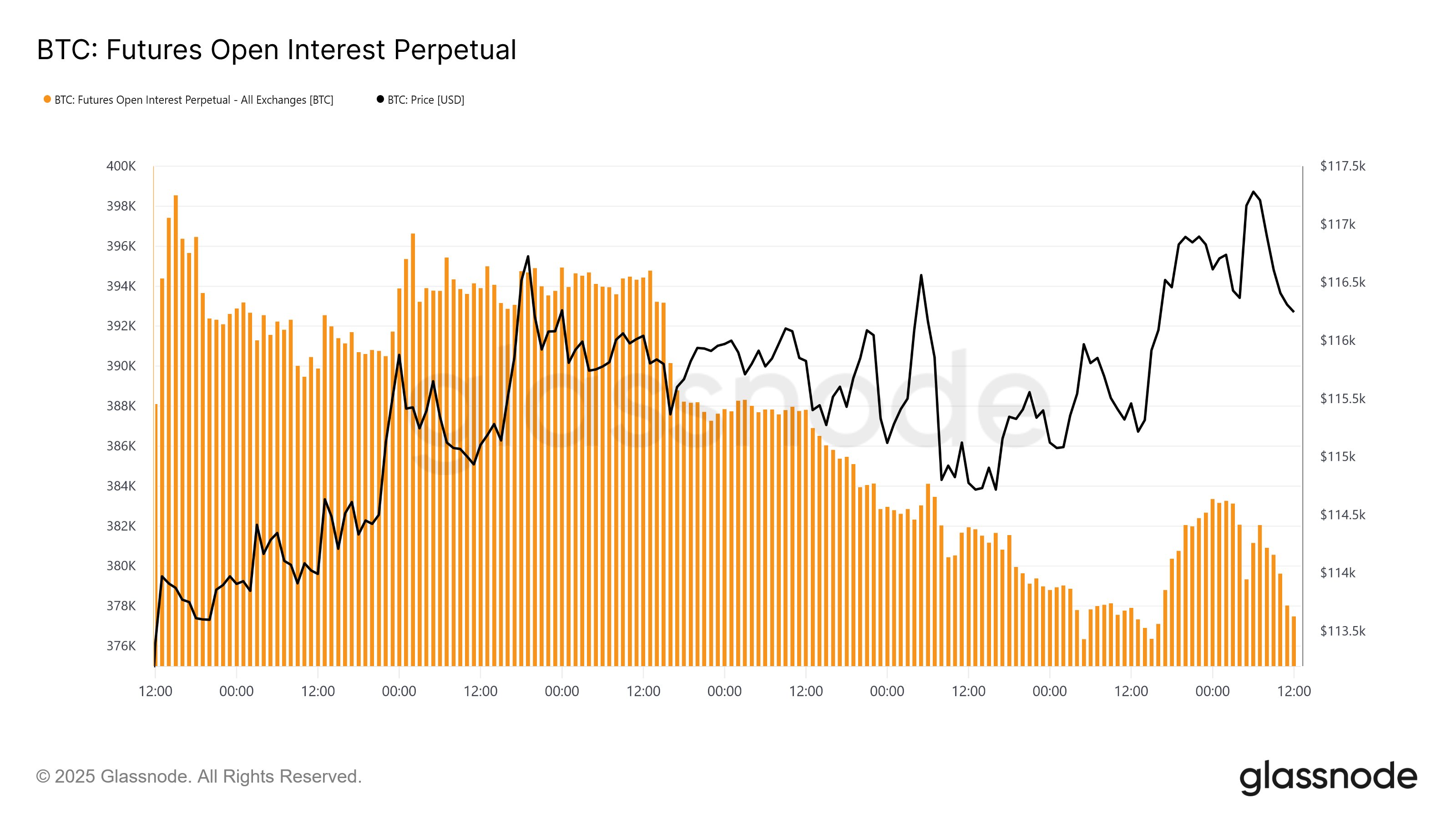

Now, first, here’s a chart that shows the trend in the Open Interest for Bitcoin over the past week:

As displayed in the above graph, the Bitcoin Open Interest has followed an overall downward trajectory in this period, a sign that a net amount of positions have disappeared.

Interestingly, this trend has developed alongside a recovery surge in the BTC price to the $117,000 level. Generally, rallies attract speculative activity so the indicator tends to rise with them, but it would appear that it hasn’t been the case this time around.

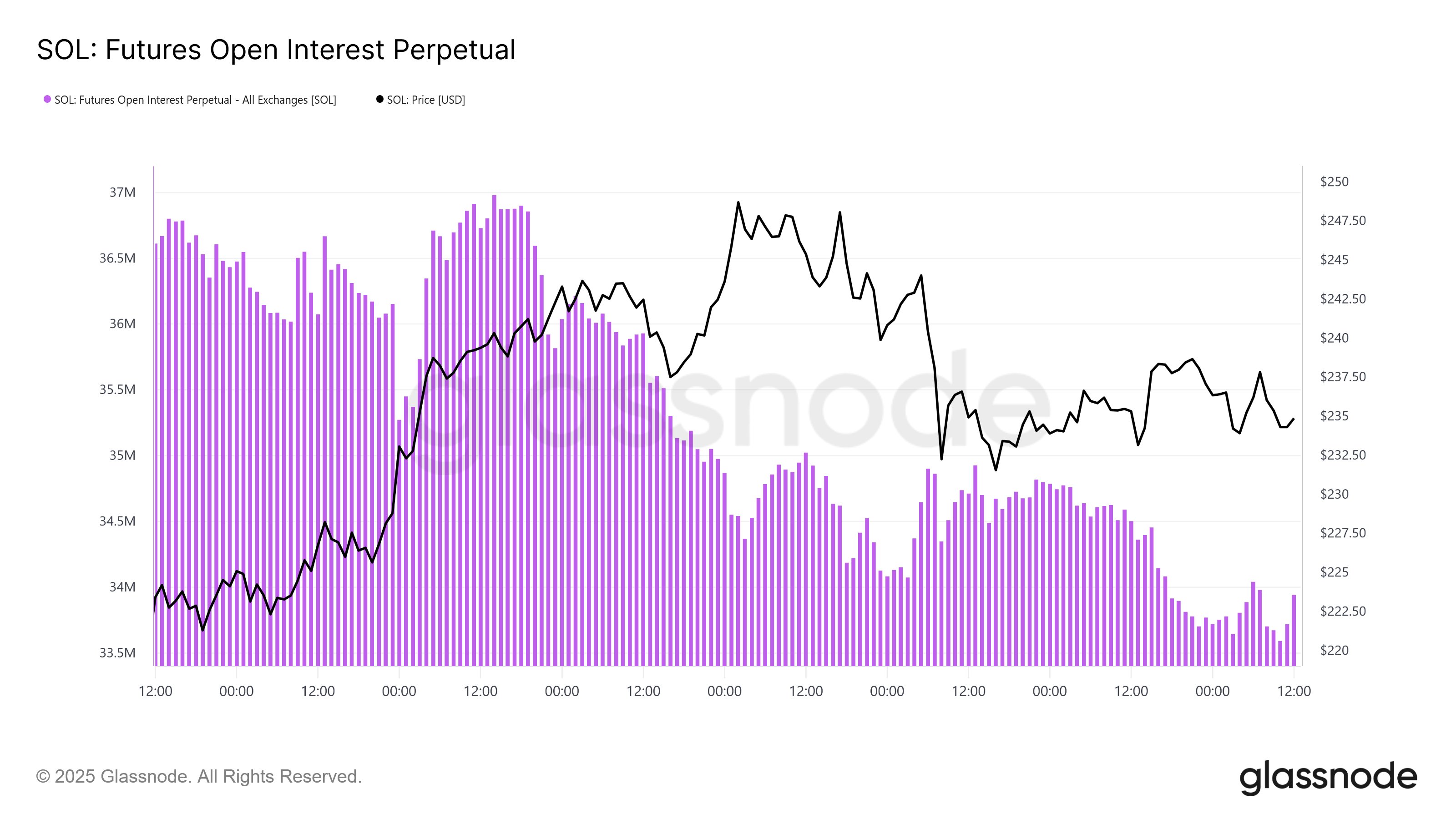

Solana, the cryptocurrency sixth largest by market cap, has seen a similar trajectory in its Open interest during the past week, as the below chart shows.

Thus, it seems both BTC and SOL have seen a cooldown in speculative activity even though their prices have witnessed a net increase over the past week. The same trend, however, hasn’t been seen with some of the other top digital assets.

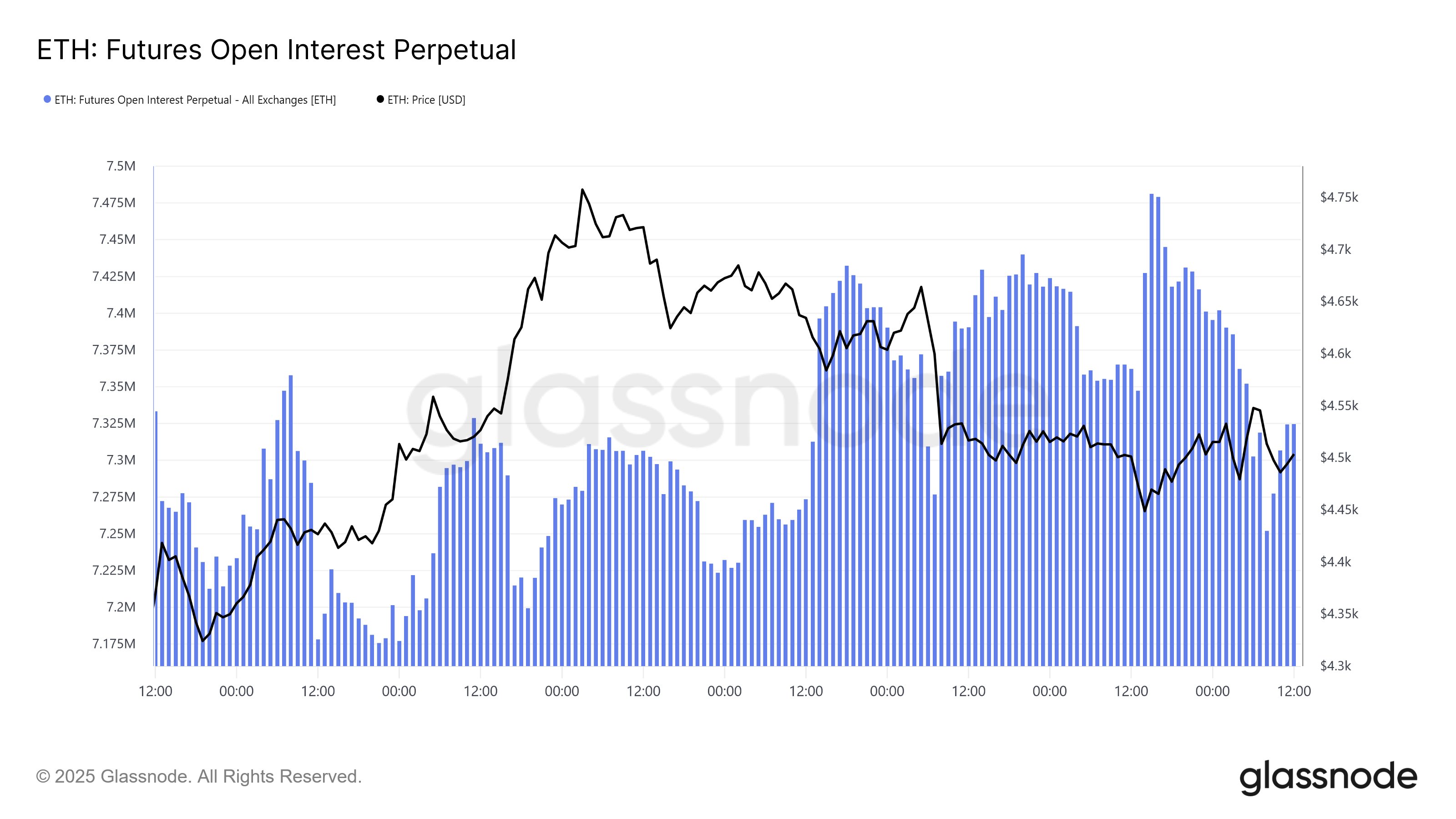

The cryptocurrency number two only to Bitcoin, Ethereum, has witnessed a surge in the Open Interest, implying an increase in demand among the investors for leveraged positioning.

The analytics firm has pointed out that XRP and BNB have also observed a similar trend. Given this divergence that has formed between the assets, it’s possible that ETH and company may be in for higher volatility than BTC and SOL.

BTC Price

Bitcoin recovered to $117,900 on Wednesday, but it seems the coin has seen a minor pullback since then as it’s now back at $117,000.

You May Also Like

Trump’s Tactics Reignite Crypto’s SEC Dialogue

‘Huge’ investor demand for apartment buildings