4 Altcoins Under $1 That Could Explode in Q4 2025

The post 4 Altcoins Under $1 That Could Explode in Q4 2025 appeared first on Coinpedia Fintech News

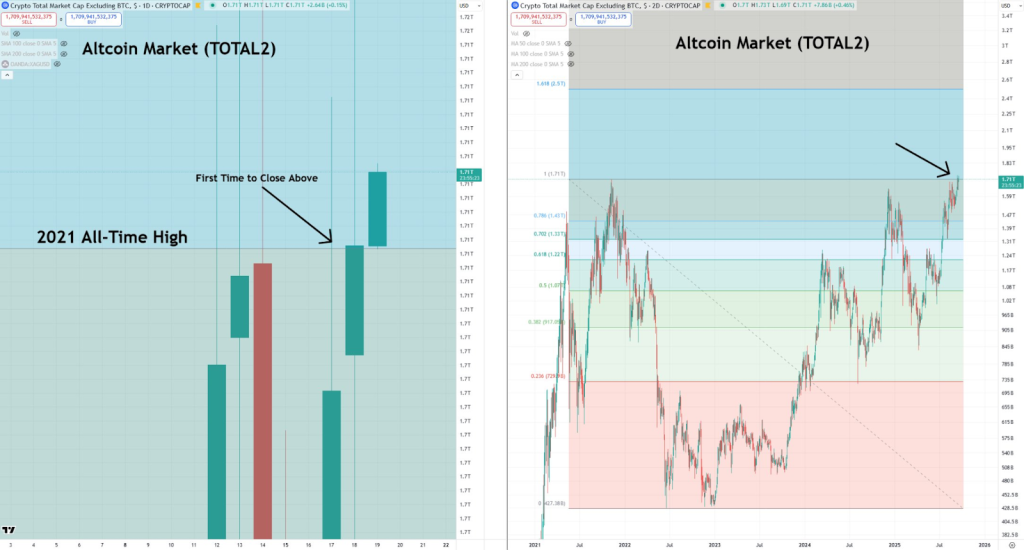

The Altcoin Market (TOTAL2) has closed above its 2021 all-time high, coinciding with the Russell 2000. This dual breakout signals a new phase of capital rotation. The Altcoin Season Index (ASI) currently sits at 76, after touching 77 yesterday, firmly placing the market in the “alt season” zone for two consecutive days.

According to Coinglass data, 75 marks the prelude to official Altcoin Season. With sentiment strengthening and capital flowing into alternative assets, many analysts believe Altseason 2025 has already begun.

With this, altcoins under $1 remain a hot target for retail investors. While the low price alone doesn’t guarantee growth, combining strong fundamentals with adoption trends can make these tokens prime candidates for explosive upside.

The Top 4 Altcoins Below $1 for Massive Gains in 2025

Stellar (XLM)

Stellar (XLM), launched in 2014, remains one of the most established players in cross-border payments. With 22 successful protocol upgrades already deployed, its upcoming Protocol 23 (WHISK) aims to:

- Improve developer experience

- Enhance network efficiency with lower latency

Beyond tech, Stellar is expanding its real-world asset (RWA) ecosystem, partnering with Paxos and Onando to target $3 billion in tokenized assets by late 2025.

Institutional interest continues to rise, with major partnerships involving IBM, MoneyGram, and Franklin Templeton. XLM currently trades at $0.38, up 300% year-over-year, with a market cap of $12.2B. Analysts believe a breakout above $1, its 7-year-old ATH of $0.87, is within reach.

Cronos (CRO)

Crypto.com’s native token CRO saw explosive gains this year after Trump Media Group revealed a $6.4B treasury allocation in the asset, instantly becoming the largest CRO holder with 6.3B tokens.

The move pushed CRO from $0.16 to $0.38 in two days, although it has since retraced to the $0.23–$0.24 range. Traders are now watching the $0.26 resistance closely, with projections as high as $1.54 if broken.

CRO is the third-largest centralized exchange token by market cap, reinforcing its long-term role in the CEX ecosystem.

Sui (SUI)

Sui has emerged as one of 2025’s best-performing Layer-1s. Its TVL surpassed $2B, fueled by strong DeFi adoption and rapid stablecoin growth. Beyond finance, Sui’s ecosystem is diversifying with:

- Walrus for decentralized data storage

- Seal & Nautilus for security and privacy

- Sweet Player X1, a blockchain-integrated gaming console

Sui also supports a growing memecoin market, expanding its user base further. With adoption accelerating, SUI is positioning itself as a multi-sector blockchain leader.

Sei Network (SEI)

SEI Network is quickly evolving into a financial powerhouse. Its TVL surged from $5M in early 2024 to $567M in 2025. Two major developments are fueling its growth:

- MetaMask integration, opening SEI to 100M+ potential users

- The upcoming Giga upgrade, designed to handle 200,000 TPS, will enable Web2-level transaction speed

SEI already boasts 66M total wallets and over 200 projects live on mainnet. At $0.31 with a $1.9B market cap, SEI remains an attractive entry point with strong upside potential.

Ethena (ENA)

Athena Labs, issuer of the synthetic stablecoin USDE, has rapidly grown into the third-largest stablecoin project, trailing only Tether (USDT) and Circle (USDC).

The ENA fee switch allows holders to earn yields above 5%. Recent expansions include bringing staked USDE (SUSDE) to Avalanche, broadening DeFi opportunities across chains.

At $0.70 with a $4.8B market cap, ENA is trading below its ATH of $1.52. With increasing cross-chain integration, analysts believe a breakout past previous highs is realistic during the next bull cycle.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, altcoin season is underway. The Altcoin Season Index is above 75, signaling capital is rotating from Bitcoin into alternative cryptocurrencies, fueling broad growth.

Established projects like Stellar (XLM) and Cronos (CRO) show strong potential due to real-world partnerships, growing adoption, and solid technological foundations in payments and exchange ecosystems.

While no coin guarantees a 1000x return, lower-cap gems with innovative use cases—like Sei (SEI) for high-speed finance or Sui (SUI) for DeFi and gaming—carry higher growth potential, though they also involve greater risk.

Coins with strong fundamentals, like Stellar (XLM) for cross-border payments or Ethena (ENA) for synthetic stablecoins, are well-positioned due to institutional backing and real-world utility beyond pure speculation.

You May Also Like

Zcash (ZEC) Price Prediction: ZEC Defends $300 Support as Bullish Structures and Privacy Narrative Return to Focus

The 5000x Potential: BlockDAG Enters Its Final Hours at $0.0005 Before the Presale Ends