Bitcoin Price Analysis: Will BTC Drop Below $110K This Week?

Bitcoin has recently faced heightened volatility, with the price rejected near the $118K supply zone. The market now sits at a pivotal area where order flow and liquidity pockets will determine the next directional move.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, Bitcoin was rejected from the supply zone at $118K, which aligns with the descending channel structure.

After multiple failed attempts to sustain momentum above $120K, the price retraced sharply and is now hovering above the $111K–$110K demand zone.

This pullback also tested the 100-day moving average at $111K, a level that has consistently provided structural support, underscoring its significance. As long as Bitcoin holds above this demand cluster, the broader uptrend remains intact. However, a decisive breakdown here would likely expose deeper liquidity near $107K–$105K, where stronger demand is expected.

Source: TradingView

Source: TradingView

The 4-Hour Chart

On the 4-hour chart, Bitcoin shows the clear aftermath of a liquidity sweep above $117K–$118K. That breakout attempt quickly reversed, sparking a sharp sell-off into the $111.5K–$111K demand zone. For now, bids have stepped in to stabilize the price at this level.

If buyers successfully defend this zone, Bitcoin could mount a retracement toward the broken ascending trendline or even retest the $115K resistance. Conversely, failure to hold $111K decisively would confirm further weakness, opening the door to a slide toward the $108K–$107K demand block, where significant liquidity aligns with long-term support.

Source: TradingView

Source: TradingView

Sentiment Analysis

By Shayan

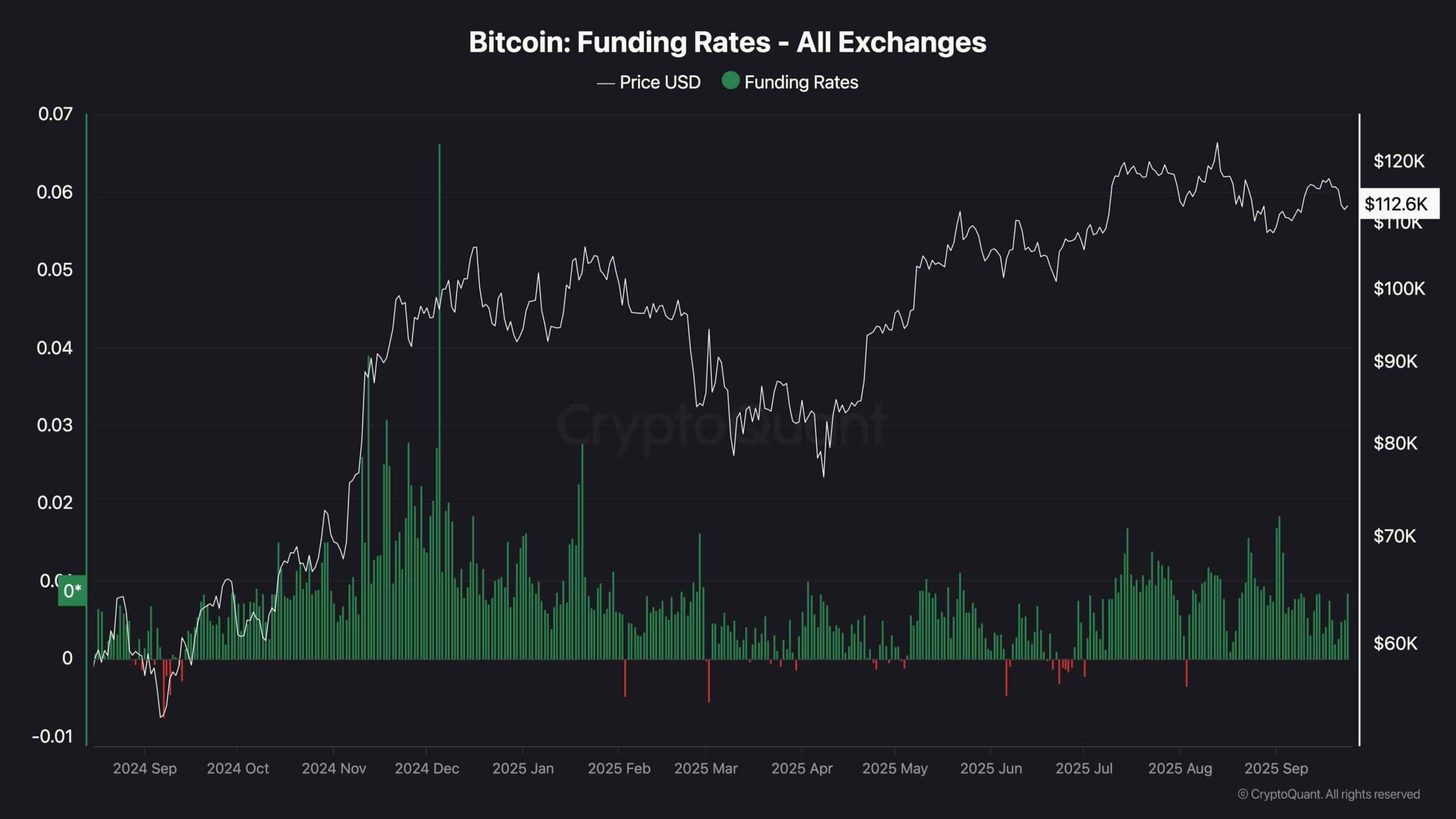

When looking at the funding rate behavior around Bitcoin’s two most recent peaks, a clear difference in market dynamics emerges. In December 2024, when Bitcoin pushed toward the $120K level, funding rates spiked to extreme positive values, reflecting an overheated market dominated by aggressive long positions. This unsustainable level of leverage created a setup where even a small shift in sentiment could trigger a cascade of liquidations, and the subsequent sharp correction confirmed this vulnerability.

By contrast, the rally in August 2025, which brought Bitcoin back to the same region near its all-time high, was accompanied by far more moderate funding rates. This restraint indicated that traders were less reckless with leverage compared to the December 2024 run. The price action still reached similar highs, but the absence of extreme funding pressure made the correction that followed less severe and more controlled, highlighting a healthier market structure.

In the current environment, funding rates have begun to rise again after a relatively quiet period, signaling that buyers are gradually stepping back into the market. This increase does not yet resemble the overheated levels of December 2024, but it does point to renewed confidence and the potential influx of fresh long positioning. If managed within sustainable bounds, this uptick in demand could help Bitcoin consolidate above the $110K area and provide momentum for another attempt at reclaiming the upper resistance levels.

Source: CryptoQuant

Source: CryptoQuant

The post Bitcoin Price Analysis: Will BTC Drop Below $110K This Week? appeared first on CryptoPotato.

You May Also Like

VIRTUAL Weekly Analysis Jan 21

Dogecoin, Shiba Inu & XYZVerse: Three Meme Coin Paths — Stability, Gradual Growth & Explosive Upside?