Japan Emerges As APAC’s Fastest-Growing Crypto Market In 2025 – Report

As crypto adoption continues to grow, Japan has emerged as the Asia-Pacific (APAC) region’s fastest-growing crypto market in 2025, eclipsing the likes of India, South Korea, and Vietnam. Several important advances in the crypto industry can be credited for Japan’s growth in the emerging sector.

Japanese Crypto Ecosystem Witnesses Strong Growth

According to a recent report by Chainalysis, titled “APAC Crypto Adoption Accelerates with Distinct National Pathways,“ the APAC region was the fastest-growing region in the world in terms of on-chain value received.

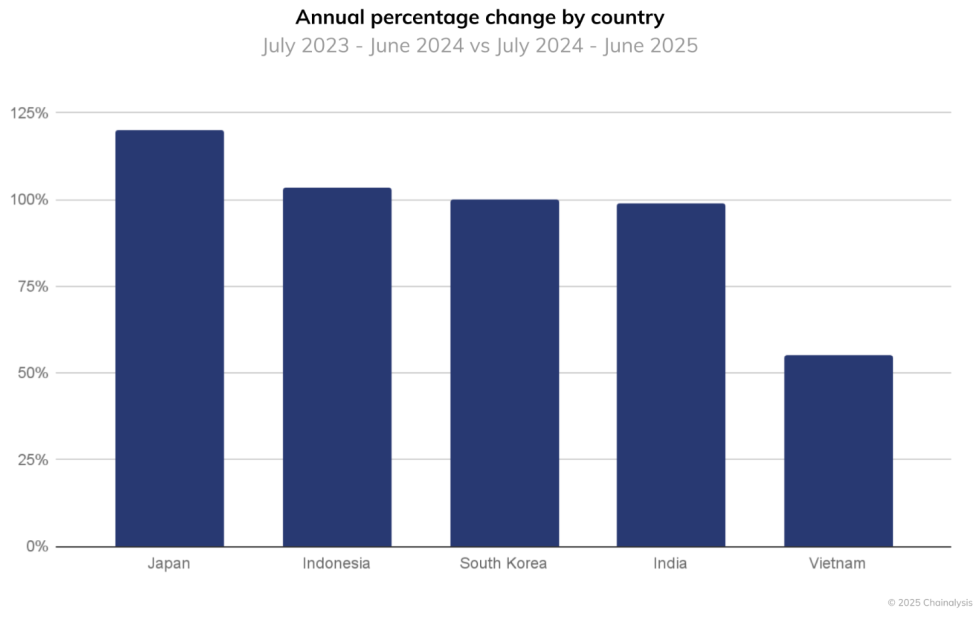

While typical digital assets leaders such as India, South Korea, and other countries continued to make strides in terms of adoption, Japan emerged as the unanticipated leader in 2025, growing its on-chain value received by 120% in the 12 months to June 2025.

In comparison, Indonesia saw an increase by 103%, while South Korea witnessed a 100% growth in on-chain value received. Similarly, India’s on-chain value surged by 99%, while Vietnam’s increased by 55%.

It should be noted that in the previous years, Japan’s crypto market had been relatively subdued compared to its Asian neighbors. The report attributes the growth in the Japanese digital assets ecosystem to the numerous favorable policy developments it has initiated in recent years.

For example, earlier this year, leading stablecoin issuer Circle announced that it would deepen its business operations in Japan and ensure easy access for the Japanese to its flagship USDC stablecoin. This comes after years of regulatory bottlenecks that restricted the listing of stablecoins on Japanese crypto exchanges.

Another potential factor is the Japanese traders’ growing interest in digital assets trading, especially altcoins. Over the 12 months to June 2025, XRP accounted for $21.7 billion in fiat trading activity. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) saw $9.6 billion and $4 billion in fiat trading activity, respectively.

The high-volume trading in XRP is important, as it shows that Japanese investors may be becoming more comfortable taking bets on the real-world utility of the XRP token, following Ripple’s strategic partnership with SBI Holdings.

India and South Korea Score High In Adoption

Besides Japan, India and South Korea emerged as the two other major crypto countries in the APAC region. However, the growth factors that spurred their digital assets ecosystem differ.

For instance, India’s digital assets growth is a result of grassroots adoption and institutional strength. In addition, India’s broader digital economy provides further growth to the budding digital assets industry in the country. However, high taxation remains a concern for digital assets businesses.

Similarly, South Korea’s crypto industry benefited due to rapid growth in stablecoin usage in the country. Notably, the Korean won (KRW) purchases of stablecoins reached $59 billion in the 12 months to June 2025.

That said, higher crypto adoption is bringing a new set of challenges for regulators. Recently, a South Korean lawmaker called for measures to address the high number of suspicious digital assets transactions. At press time, BTC trades at $113,752, up 0.8% in the past 24 hours.

You May Also Like

U.Today Crypto Review: Ethereum (ETH) Loses 30-Day Progress, Shiba Inu’s (SHIB) End of Bears; Bitcoin’s (BTC) Last Recovery Chance

Headwind Helps Best Wallet Token