Hashdex’s Crypto Index ETF Comprising BTC, ETH, XRP, SOL Gets SEC Greenlight

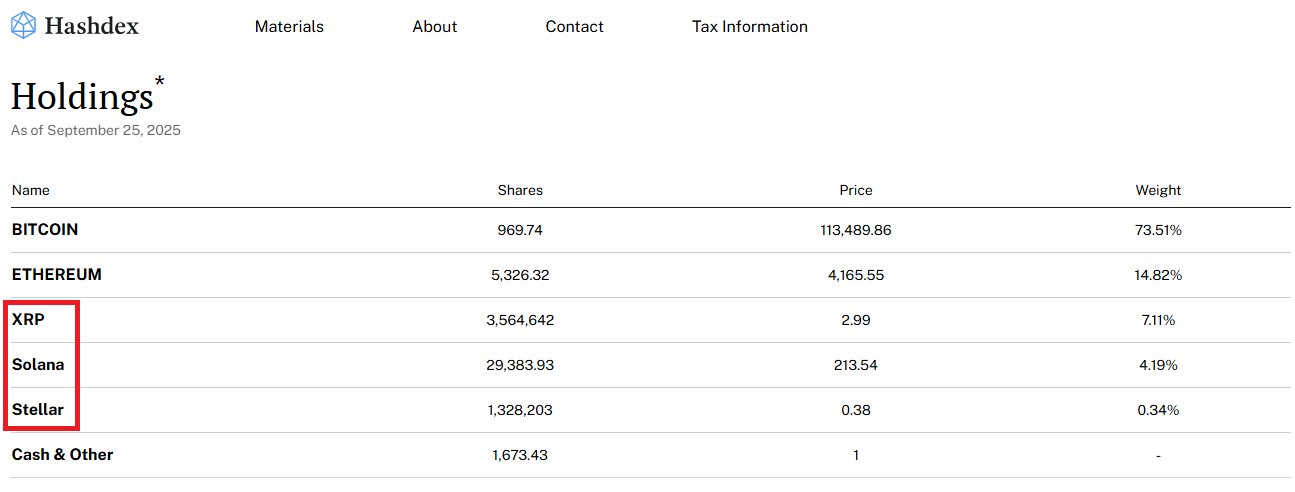

In a breakthrough development, the US Securities and Exchange Commission (SEC) approved the expansion of the Hashdex Nasdaq Crypto Index ETF under the new generic listing standards. This ETF comprises the top digital assets such as Bitcoin BTC $111 777 24h volatility: 0.9% Market cap: $2.23 T Vol. 24h: $51.20 B , Ethereum ETH $4 029 24h volatility: 3.5% Market cap: $486.61 B Vol. 24h: $40.88 B , XRP XRP $2.83 24h volatility: 1.5% Market cap: $169.22 B Vol. 24h: $6.73 B , Solana SOL $203.3 24h volatility: 3.5% Market cap: $110.35 B Vol. 24h: $8.13 B , and Stellar XLM $0.36 24h volatility: 2.3% Market cap: $11.49 B Vol. 24h: $225.28 M .

Hashdex Crypto Index ETF Will Trade on Nasdaq

The crypto ETF will trade on Nasdaq under the ticker NCIQ. This is the second crypto ETF fund launched in a week’s time after Grayscale’s GDLC.

The Hashdex Crypto Index ETF is structured in Delaware and classified as an “emerging growth company.” The amended trust agreement was filed as an exhibit, confirming the product’s compliance with Nasdaq’s updated listing requirements.

Hashdex Crypto Index ETF | Source: SEC website

According to the official data, XRP will represent roughly 6.9% of the index, while Solana (SOL) will account for 4.3%. Bitcoin and Ethereum continue to dominate the portfolio with weightings of 72.5% and 14.8%, respectively, while Cardano (ADA) makes up 1.2%.

The addition of XRP and Solana is expected to draw greater institutional interest in both tokens. Besides, it will also open the gates for the approval of spot ETFs for both these digital assets.

October to See a Flood of Crypto ETF Approvals?

Earlier in September 2025, the US SEC announced its decision to apply the generic listing standards for crypto ETFs. Since then, asset managers have been making quick moves to take advantage of the change. Steven McClurg, founder of Canary Capital Group, said:

The new rules allow qualified crypto ETFs to bypass the lengthy case-by-case review process that previously delayed approvals for months. Under the old framework, approvals could take up to 270 days, whereas the revised system can clear products in as little as 75 days.

nextThe post Hashdex’s Crypto Index ETF Comprising BTC, ETH, XRP, SOL Gets SEC Greenlight appeared first on Coinspeaker.

You May Also Like

U.Today Crypto Review: Ethereum (ETH) Loses 30-Day Progress, Shiba Inu’s (SHIB) End of Bears; Bitcoin’s (BTC) Last Recovery Chance

Headwind Helps Best Wallet Token