BTC Drops to $109K Amid ETF Slowdown; Bitcoin Hyper Whales Invest $117K in Two Days

After soaring past $117K earlier this month, $BTC has slipped into a cooling phase at $109K. The reasons? HODLers are turning cautious and cashing out, not helped by a recent slowdown in ETF purchases.

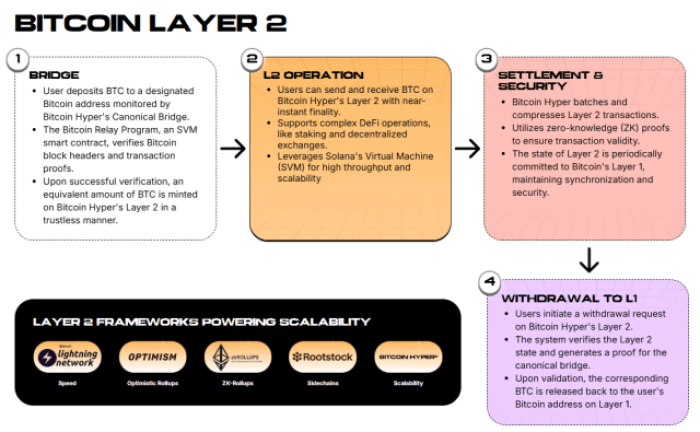

But it’s not all bad news. According to Glassnode data, the current cooldown appears more like a healthy pause than the end of the cycle. If support holds and ETF demand picks up, $BTC might even come back stronger.Suppose that happens, Bitcoin Hyper’s utility will become all the more necessary. The reason is that its upcoming Layer-2 (L2) network will make the Bitcoin network faster and cheaper for $BTC transactions during heightened demand.

It’s no wonder that there’s already growing confidence in that vision. Over the past days, large whales have invested $17.3K, $87.1K, and $12.7K into the project, pushing the $HYPER presale past $18.3M+ to support the L2’s development.

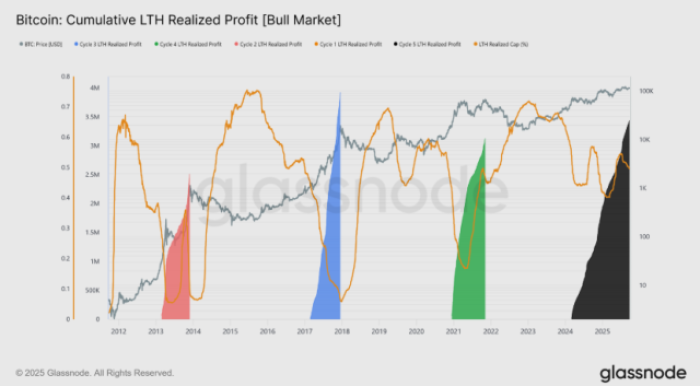

Long-Term Investors Cash Out 3.4M $BTC

Glassnode found that long-term holders have realized 3.4M $BTC in profits, more than any past cycle. While it doesn’t signal the end, new demand is necessary for Bitcoin to maintain a competitive edge.

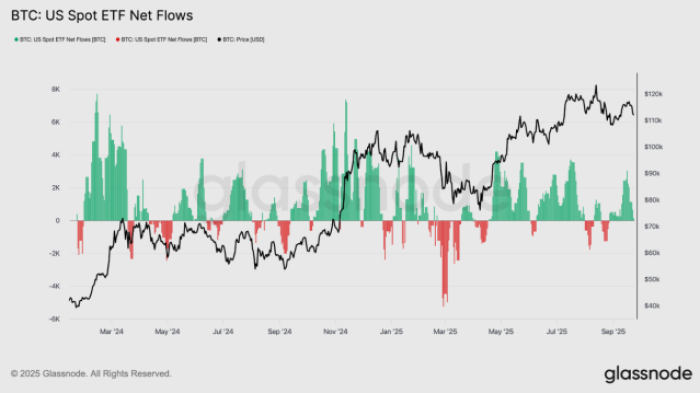

HODLers and institutional buyers are shaping the cycle by scooping up $BTC through US Spot ETFs and digital asset trusts. In turn, they help drive demand that keeps the crypto leader rallying. ETF inflows are what have kept HOLDERs from selling up historically, but the balance is fragile.

During the time of a Federal Open Market Committee (FOMC) meeting discussing interest rates, long-term holders began selling around 112,000 $BTC per month. Around the same time frame, ETF buying nosedived from around 2.6K $BTC a day to almost nothing.

But here’s where $BTC’s future trajectory starts to look more promising. Despite these pullbacks, the drawdown for $BTC’s $124K ATH is just 12%.

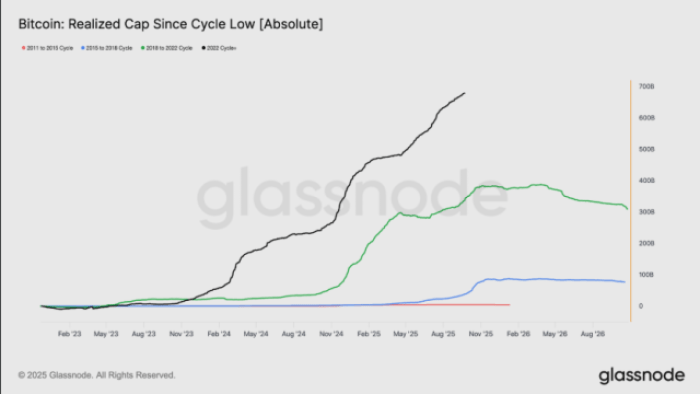

It’s also worth noting that capital inflows have been substantial. Over $678B has flowed into Bitcoin since November 2022, almost 1.8x more than in the previous cycle.

Suppose ETF buying also picks up, $BTC might be positioned not only to recover but also to reach greater highs.

If a new bull run starts to form, the launch of Bitcoin Hyper this quarter will be even more highly anticipated.

To support the next wave of $BTC adoption, the L2 is designed to provide the scalability, speed, and low fees essential for meeting rising demand.

Bitcoin Hyper Addresses Bitcoin’s Biggest Barriers

Bitcoin Hyper is on a mission to address the Bitcoin network’s most well-known pain points. Take its transaction speed, for instance. Currently, Bitcoin can process only 5.96 transactions per second (tps), which is 67.56% lower than Ethereum’s 18.39 tps.

Interestingly, Bitcoin’s current average gas fees of $0.845 are slightly lower than Ethereum’s $1.08. Nevertheless, both networks lag far behind speedier networks like Solana, where fees rarely exceed $0.05.

Bitcoin Hyper is built to introduce Solana-level throughput to Bitcoin. By leveraging the Solana Virtual Machine (SVM), it’ll be able to support thousands of tps without hefty costs.To top it off, the L2 will feature a Canonical Bridge, allowing you to quickly and easily move $BTC into the Hyper ecosystem.

The bridge will also enable you to access a range of new opportunities, spanning DeFi and dApps to launchpads and NFT marketplaces.

The outcome? Bitcoin will be more useful than ever.

$HYPER Supports L2 Developments & 64% Staking Rewards

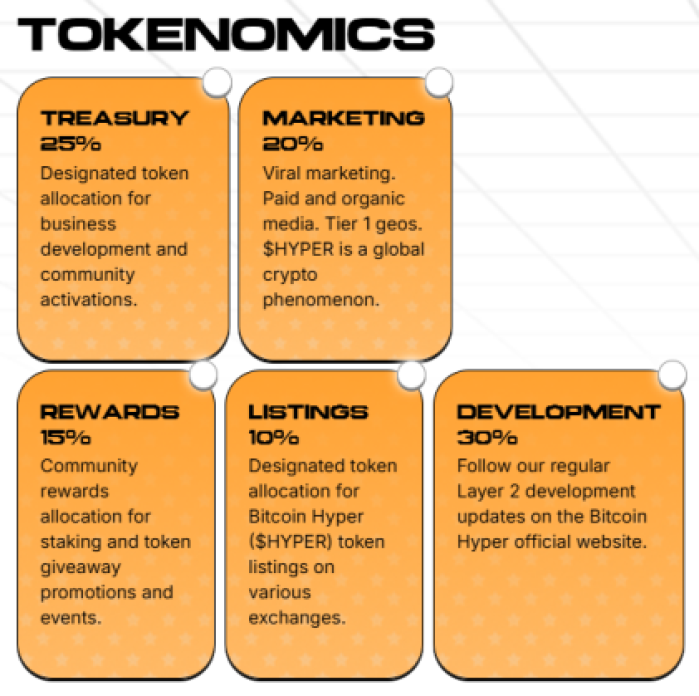

$HYPER is the backbone of the entire Hyper ecosystem. Its presale success hinges on the L2’s success – 30% of its total token supply funds its developments, after all.

But beyond helping propel the network to rosier pursuits, $HYPER comes with other holder benefits, including governance rights, lower gas fees, and the opportunity to earn a 64% staking APY. (Note: this rate will decrease as more investors clock on.)

You can get involved by purchasing $HYPER on presale for just $0.012975. Our Bitcoin Hyper price prediction anticipates the coin to reach $0.32 this year, following the L2’s official launch.

Now might be an opportune time to join for possible gains of 2,367% if that target is hit.

Visit the Bitcoin Hyper presale.

This isn’t investment advice. Always do your own research and never invest more than you’d be sad to lose.

Authored by Leah Waters, Bitcoinist – https://bitcoinist.com/bitcoin-hyper-whales-rally-as-bitcoin-falls

You May Also Like

The USDC Treasury burned $50 million worth of USDC on the Ethereum blockchain.

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?