PPL Corp (PPL) Stock: Why This Utility’s Turnaround Story Has Investors Watching

TLDR

- PPL Corporation has transformed into a pure-play U.S. utility after selling its UK business in 2021, now serving 3.6 million customers

- The company expects 6-8% annual earnings growth through 2028, driven by $20 billion infrastructure investments and rising data center demand

- PPL’s dividend has resumed growth after a previous cut, with the payout ratio improving to a healthier 60%

- Shares currently trade at a forward P/E of 20, above the analyst’s fair value range of 16-18 times earnings

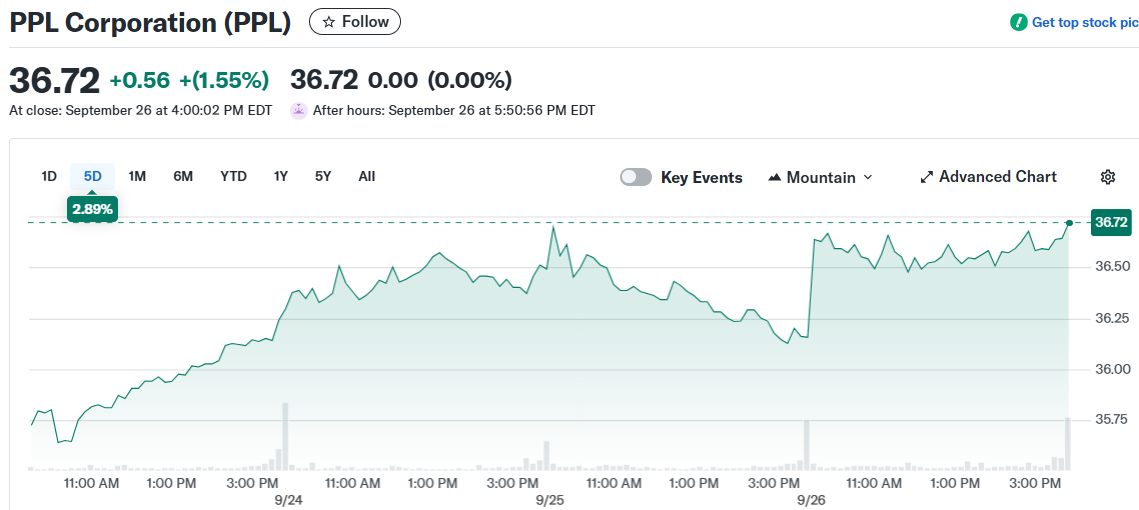

- Stock outperformed the market on Friday with a 1.55% gain, closing at $36.72

PPL Corporation closed Friday’s trading session at $36.72, posting a 1.55% gain that outpaced the broader market. The S&P 500 gained 0.59% while the Dow Jones added 0.65%.

PPL Corporation (PPL)

PPL Corporation (PPL)

The utility stock has struggled over the past month, declining 1.09% while the Utilities sector gained 0.26%. Despite the recent underperformance, PPL has shown renewed momentum following its business transformation.

The company completed its shift to a pure-play U.S. utility in 2021 after selling its UK operations to National Grid. PPL now serves approximately 3.6 million electricity and natural gas customers across Pennsylvania, Kentucky, and Rhode Island.

Financial Performance Shows Recovery

PPL’s recent quarterly results presented a mixed picture. Revenue grew 7.7% to $2.03 billion in the latest quarter, exceeding expectations by $39 million. However, adjusted earnings per share fell to $0.32 from $0.38 in the prior year, missing estimates by $0.07.

This marked the third consecutive quarter of high single-digit revenue growth for the company. The Pennsylvania segment saw earnings from ongoing operations decline 9.5%, while Kentucky remained flat. Rhode Island operations generated $0.01 per share, down from $0.04 previously.

Looking at longer-term trends, PPL’s performance improved dramatically after divesting its UK business. From 2021 to 2024, earnings per share jumped from $1.05 to $1.69, representing a compound annual growth rate exceeding 17%. Revenue surged from $5.8 billion to $8.5 billion during the same period.

Growth Drivers and Future Outlook

Management projects 6-8% annual earnings growth through 2028. For 2025, the company expects earnings per share between $1.75 and $1.87, representing 7.1% growth from the prior year.

The growth strategy centers on $20 billion in infrastructure investments through 2028, including $4.3 billion planned for 2025. These investments support rate case filings in Pennsylvania and Kentucky that should result in higher base rates.

Data center demand provides another growth catalyst. Pennsylvania alone expects over $90 billion in announced data center investments. PPL anticipates base rates company-wide will grow 9.8% annually through 2028 as power demand increases.

The upcoming earnings report is expected to show continued progress. Analysts forecast earnings per share of $0.48, up 14.29% from the prior-year quarter. Revenue estimates call for $2.19 billion, representing 6.11% growth.

Dividend Recovery and Valuation Concerns

PPL cut its dividend following the UK asset sale but has resumed growth since then. The dividend increased 12.5% in 2022, 7.3% in 2024, and 5.8% earlier this year. Management projects 6-8% annual dividend increases through 2028.

The payout ratio has improved to a healthier 60% for 2025, compared to the high 60s range before the previous cut. This provides more room for future dividend growth while reducing risk of another reduction.

However, valuation metrics suggest the stock may be overpriced. PPL trades at just over 20 times expected 2025 earnings, above its five-year average of 18.6 times and ten-year average of 16.2 times.

The company currently sports a Zacks Rank of #4 (Sell) and trades at a forward P/E ratio of 19.94. This represents a premium to the industry average forward P/E of 17.97.

With a current yield of 3% and projected 7% earnings growth, total return potential appears limited to around 6% annually. Multiple contraction could act as a 3.6% annual headwind if the stock reverts to more typical valuation levels.

For the full year, analysts expect earnings of $1.81 per share and revenue of $8.67 billion, representing increases of 7.1% and 2.5% respectively from the previous year.

The post PPL Corp (PPL) Stock: Why This Utility’s Turnaround Story Has Investors Watching appeared first on CoinCentral.

You May Also Like

a16z Targets $2 Billion Crypto Fund as Venture Capital Eyes Blockchain Recovery

Will XRP Price Increase In September 2025?