New Crypto to Watch as Treasuries Become the Berkshire Hathaway of Blockchain

In traditional finance, Berkshire Hathaway is famous for using its balance sheet to invest, acquire, and support businesses.

In crypto, a similar pattern is forming: digital asset treasuries (DATs) holding native tokens are evolving beyond mere wallets.

As these crypto treasuries scale, they could rival the influence of legacy investment firms. Here you can find out about new crypto projects that already show signs of embracing that future.

From Hoarders to Builders

Crypto treasuries, also called digital asset treasuries, are no longer just vaults full of Bitcoin and Ethereum.

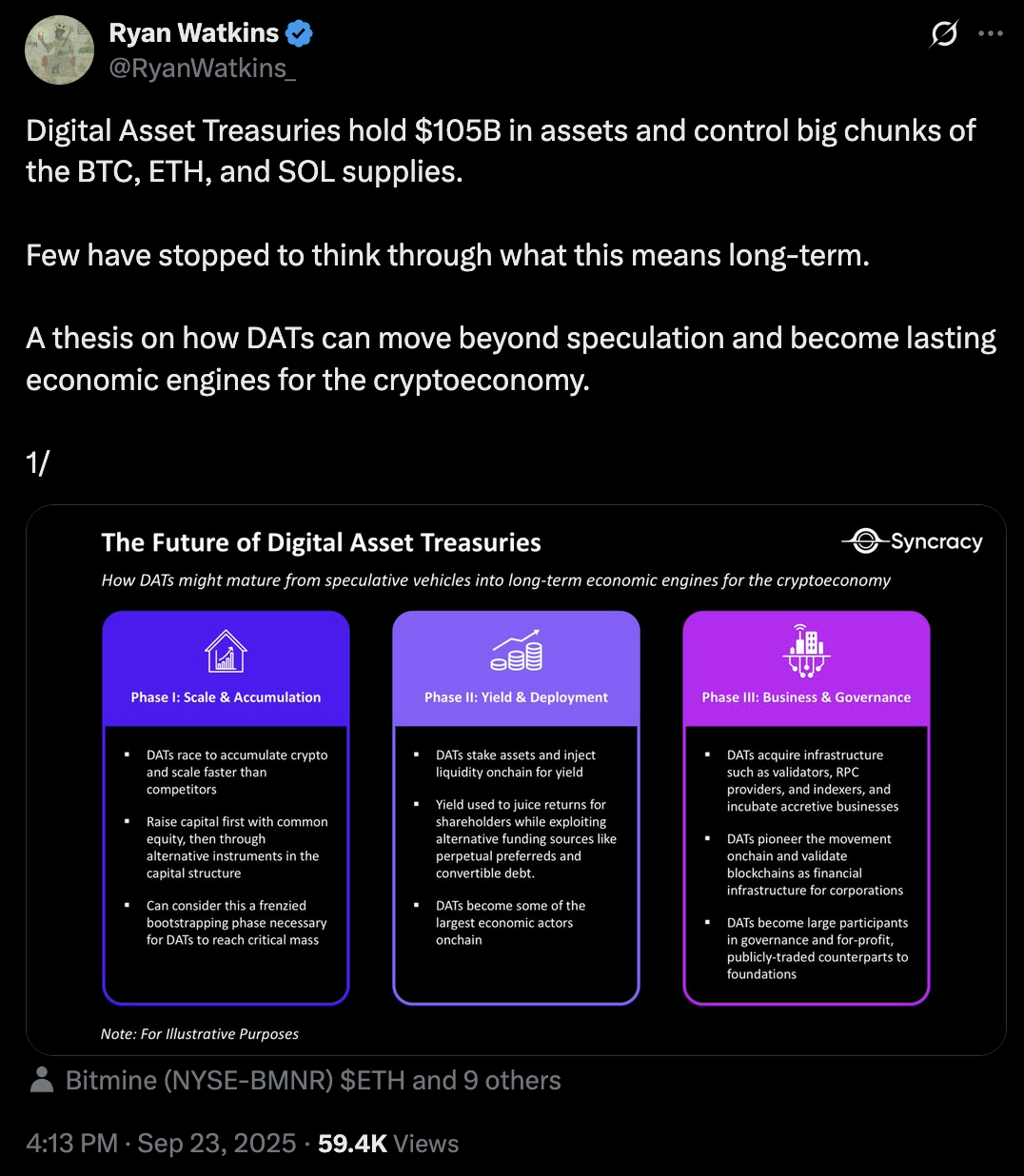

Syncracy Capital co-founder Ryan Watkins noted that these firms collectively hold around $105B in tokens, and how they use those assets is changing the game.

Instead of sitting back and waiting for prices to rise, they’re putting tokens to work – staking them for yield, lending them out, funding developers, and even shaping governance decisions inside major blockchains.

That shift matters because it moves DATs closer to the role Berkshire Hathaway plays in traditional finance: an investor with a balance sheet strong enough to influence the companies it owns.

In crypto, treasuries with deep reserves of ETH, SOL, or newer programmable tokens can drive product development and policy. They’re becoming active operators, not just speculators – and that’s a big narrative shift.

1. Bitcoin Hyper ($HYPER) – Bitcoin’s Execution Layer

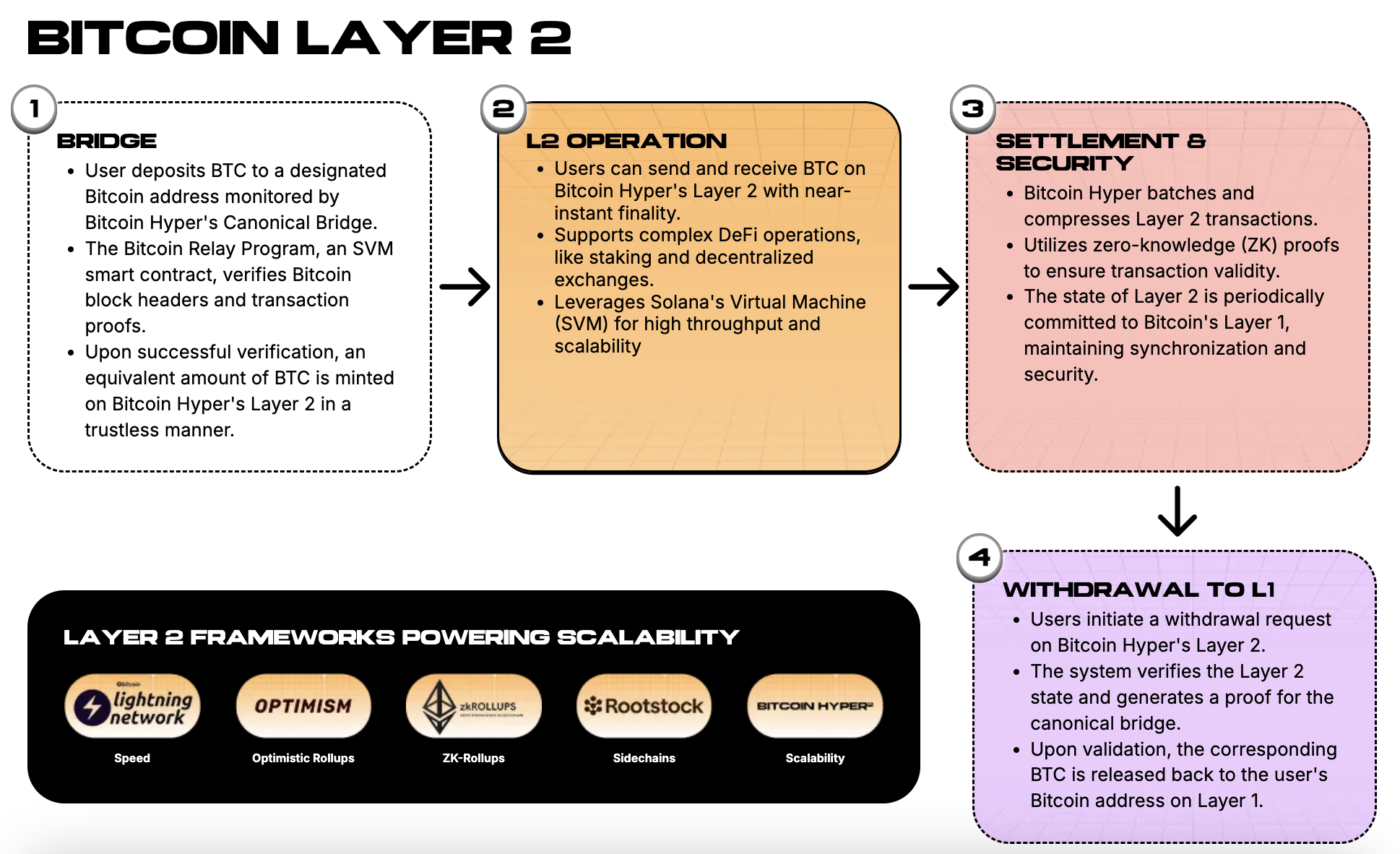

Bitcoin has long been called the ultimate store of value. But Bitcoin Hyper ($HYPER) is rewriting the script.

Built as the fastest Bitcoin Layer 2, it isn’t a sidechain or a half-measure. It’s a full blockchain designed to finally scale Bitcoin and unlock what the network was always meant to be: fast, cheap, and usable everywhere.

At the heart of Bitcoin Hyper is the Solana Virtual Machine (SVM). This means sub-second transactions, near-zero gas fees, and instant compatibility with Solana’s thriving ecosystem of dApps and DeFi tools.

In practice, Bitcoin Hyper turns $BTC into more than digital gold. It becomes the foundation for meme coins, decentralized apps, and cross-chain interoperability with Ethereum, Solana, and beyond.

The token that fuels it all is $HYPER. Currently priced at $0.012985, the presale has already raised $18.6M, with whales dropping six-figure buys.

That ties directly into the growing “crypto Berkshire” narrative: balance sheets using programmable assets to shape networks, not just sit on them.

Early buyers get first-in advantage with staking, governance, and airdrops.

The $HYPER presale is live, and it’s the moment to decide if you want a stake in Bitcoin’s future.

2. Best Wallet Token ($BEST) – The Utility Engine Behind a Growing Ecosystem

While the Best Wallet app is grabbing headlines as a next-gen challenger to MetaMask, the real driver of value is its native asset, Best Wallet Token ($BEST).

Currently priced at $0.025705, with more than $16.1M already raised in presale, $BEST is positioned as the backbone of a rapidly growing crypto platform.

What sets $BEST apart is how deeply it’s tied to real utility. Holding the token unlocks reduced fees, early access to new projects, higher staking rewards, and a say in governance decisions.

It also powers Upcoming Tokens, a presale feature built directly into the app. This gives $BEST holders a safer route into early-stage projects by bypassing scam sites and letting them participate directly from within the wallet.

For treasuries, this model echoes the Berkshire-style narrative people see emerging in crypto. By owning $BEST, they tap into multiple revenue streams – swaps, staking, presales, and user fees.

The $BEST presale offers investors a front-row seat to the ecosystem’s future – and the earlier you get in, the greater your leverage.

3. BlockchainFX ($BFX) – The Multi-Asset Super App Token

BlockchainFX is positioning itself as a ‘super app’ for finance, bridging crypto, DeFi, stocks, forex, and commodities under one roof.

At the center of this ecosystem is BlockchainFX ($BFX), currently in presale at $0.025, with over $8.3M raised and more than 10K early participants onboard.

The token is designed to capture value from multiple revenue streams. Holders receive a portion of trading fees distributed in $USDT, can stake to boost returns, and gain exposure to a platform already supporting 500+ assets.

Future plans include issuing Visa cards linked to user portfolios, which ties the token’s utility directly into everyday financial activity.

For treasuries, $BFX is a compelling play.

Treasuries can leverage these holdings to influence platform direction, back spinouts, and secure reliable yield from fee sharing. $BFX offers early buyers a way to secure exposure to one of the broadest ecosystems in crypto, and the window is open now.

The Next Generation of Treasury-Backed Crypto

Crypto treasuries are evolving.

New crypto projects like Bitcoin Hyper, Best Wallet Token, and BlockchainFX show how token, use case, governance, and yield can align.

These tokens are aiming to grow from treasury holdings into ecosystem anchors.

Remember that this article is for informational purposes only and doesn’t constitute financial advice. Always do your own research (DYOR) before investing in crypto.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post New Crypto to Watch as Treasuries Become the Berkshire Hathaway of Blockchain appeared first on Coindoo.

You May Also Like

The Channel Factories We’ve Been Waiting For

‘KPop Demon Hunters’ Gets ‘Golden’ Ticket With 2 Nominations