Eric Trump Urges Crypto Investors to “Buy the Dips” During Market Decline

TLDR

- Eric Trump posted “Buy the dips!” on X as Bitcoin and Ethereum face selling pressure this week

- The Trump family has major crypto investments, including a $1.5 billion stake in American Bitcoin mining company

- Bitcoin is down over 6% to around $109,500 while Ethereum dropped 8% to $4,020 in the past week

- Market reactions were mixed, with some traders viewing it as a buy signal while analysts warn of potential volatility

- Eric Trump has advisory roles in crypto companies like Metaplanet, raising questions about conflicts of interest

Eric Trump returned to social media this week with a direct message for cryptocurrency investors facing market pressure. His post on X simply stated “Buy the dips!” as major cryptocurrencies experienced downward movement.

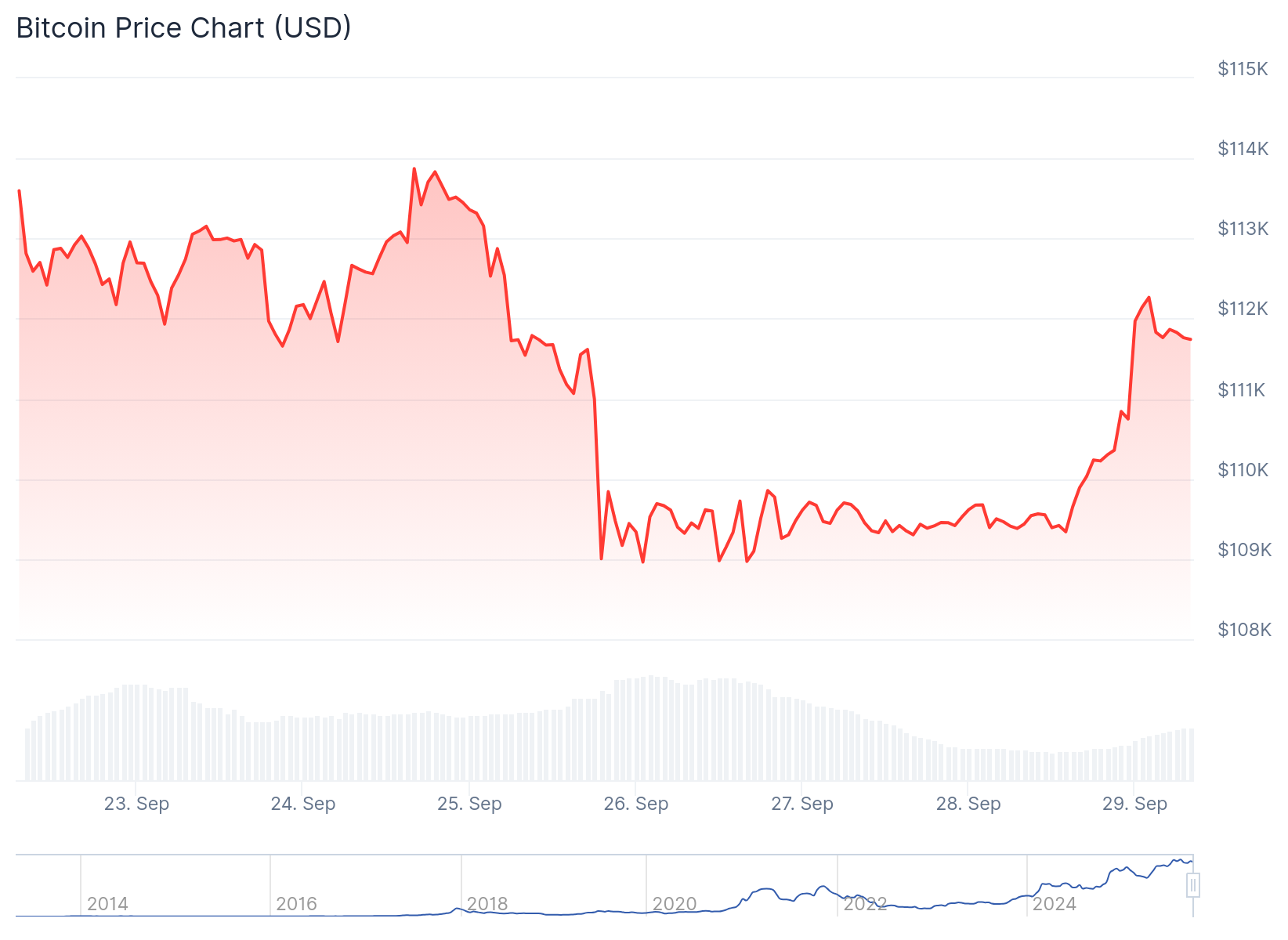

The timing of Trump’s message coincided with Bitcoin trading near $109,500, representing a decline of more than 6% over seven days. Ethereum faced even steeper losses, hovering around $4,020 after dropping approximately 8% during the same period.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The Trump family’s involvement in cryptocurrency extends beyond social media commentary. Eric and his brother Donald Jr. backed American Bitcoin, a mining and accumulation firm that recently debuted on Nasdaq.

Their stake in American Bitcoin grew to approximately $1.5 billion following the company’s market performance after going public. The firm operates mining operations and maintains strategic Bitcoin reserves, making Eric’s public statements carry more weight than casual market commentary.

Business Ties Raise Questions

Eric Trump also holds advisory influence at Metaplanet, a Japanese Bitcoin treasury company planning capital raises tied to further Bitcoin accumulation. Reports indicate he attended the company’s shareholders meeting in Tokyo in August.

These business connections have drawn scrutiny from lawmakers and watchdogs concerned about potential conflicts of interest. Critics point out that his position as the president’s son could influence market sentiment when making public investment recommendations.

Democratic Senator Elizabeth Warren has been among those questioning the influence of the president’s family members and associates on market activities. The scrutiny extends to whether public figures with crypto investments should make such direct market calls.

Market participants showed mixed reactions to Trump’s latest post. Some retail traders viewed the message as a buy signal and echoed the sentiment across social media platforms.

Historical Context and Caution

However, analysts expressed caution about following public figure endorsements in volatile crypto markets. They noted that such calls often coincide with increased short-term price swings rather than sustained recoveries.

Previous instances provide context for this skepticism. After Trump urged increased Ethereum exposure during a February dip, ETH fell approximately 35% in the following months before eventually staging a recovery.

Market veterans emphasized that fundamental factors typically drive long-term trends more than social media posts. Macro economic forces, institutional positioning, and liquidity flows generally have greater impact on sustained price movements.

Short-term traders often react to sentiment-driven messages, while long-term holders focus on underlying fundamentals. Both groups felt the impact of Trump’s latest market call.

The crypto market continues to test key support levels as investors navigate current selling pressure. Bitcoin and Ethereum remain below recent highs as traders assess whether current prices represent buying opportunities.

The post Eric Trump Urges Crypto Investors to “Buy the Dips” During Market Decline appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip