Best Altcoins to Buy as Bitcoin Stands to Benefit from Europe’s Currency Risks

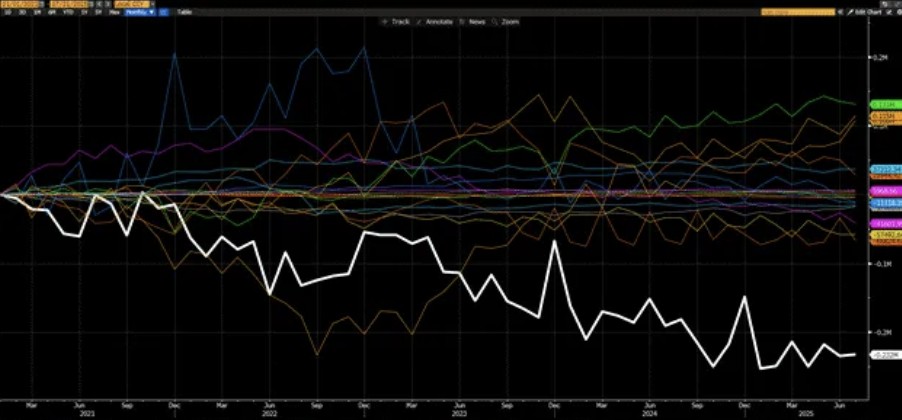

France now has the largest TARGET deficit among all Eurozone countries, which is also at the center of Hayes’s argument.

TARGET2 is the internal payment ledger of the European Central Bank (ECB) that tracks the inflow and outflow of money between the National Central Banks (NCBs) of Eurozone countries.

A positive TARGET balance indicates that more funds have flowed into a country’s national banks, while a negative balance means more funds have flowed out.

Now, France, aka the Eurozone’s second-largest economy and certainly ‘too big to fail,’ has a deeply negative TARGET balance.

This simply means that French institutions and savers have been moving their money out of the country to safer destinations such as Germany and Luxembourg – two countries that have consistently maintained positive TARGET balances.

Read on as we explore in detail the implosion of France’s financial position and how it could be supremely positive for Bitcoin and crypto.

You can also find out about altcoins like Bitcoin Hyper.

Foreign Funds Fleeing France

Another key number to pay attention to is the Net Portfolio Balance (NPB), which measures the difference between foreign assets owned by a country’s citizens abroad and domestic assets owned by foreigners.

Simply put, a positive NPB means that citizens of a given country own more assets outside their country than foreigners own inside it.

France has the second-largest negative NPB balance, currently at 38% of its GDP, which means that a large portion of French assets – mainly government bonds, equity, and debt – are owned by foreigners. Most of these ‘foreigners’ are German and Japanese investors.

Now, both Germany and Japan are seeing increased pushes for domestic production and consumption as a result of Trump’s ‘America First’ policy.

This means there’s mounting pressure for the repatriation of funds into domestic investment vehicles, which could trigger aggressive selling of French bonds and debt.

Bitcoin Is the Ultimate Winner

To put it in a nutshell, France is at huge risk of losing international funding and support amid the changing geopolitical scenario.

So, how would France deal with this? According to Hayes, Macron will likely try to ‘keep everyone happy’ by increasing spending instead of cutting it down.

The first consequence would be a default on foreign funds, followed by internal capital restrictions to trap domestic money within the country.

Another possible scenario is France leaving the Eurozone and bringing back its own currency, the Franc. This would devalue the currency, boost tourism, and strengthen exports.

However, ultimately, the EU would have to print more euros to keep the Eurozone from falling apart. Hayes estimates that the EU would need at least €5T just to keep its economy afloat.

Amidst all this chaos and uncertainty, there’s one clear winner: Bitcoin. As the French government imposes internal fund-flow restrictions, trust in the banking system collapses, and investors look for a safe haven they can truly own and move freely.

That’s exactly what Bitcoin offers. As the EU prints more money, huge liquidity will flood the markets, and much of it will ultimately be absorbed by Bitcoin.

Bitcoin will become a ‘digital lifeboat’ for anyone looking to escape the sinking French economy. This could be a once-in-a-lifetime opportunity for those who missed the earlier Bitcoin rally.

A weakening euro, trillions in new money printing, and a collapsing French economy could be the perfect fuel to ignite the next Bitcoin fire.

However, investing only in Bitcoin won’t be enough. Here are some other low-cap altcoins that could deliver big time due to this unfolding Euro crisis.

1. Bitcoin Hyper ($HYPER) – New Bitcoin Layer 2 Improving the Blockchain’s Real-World Utility

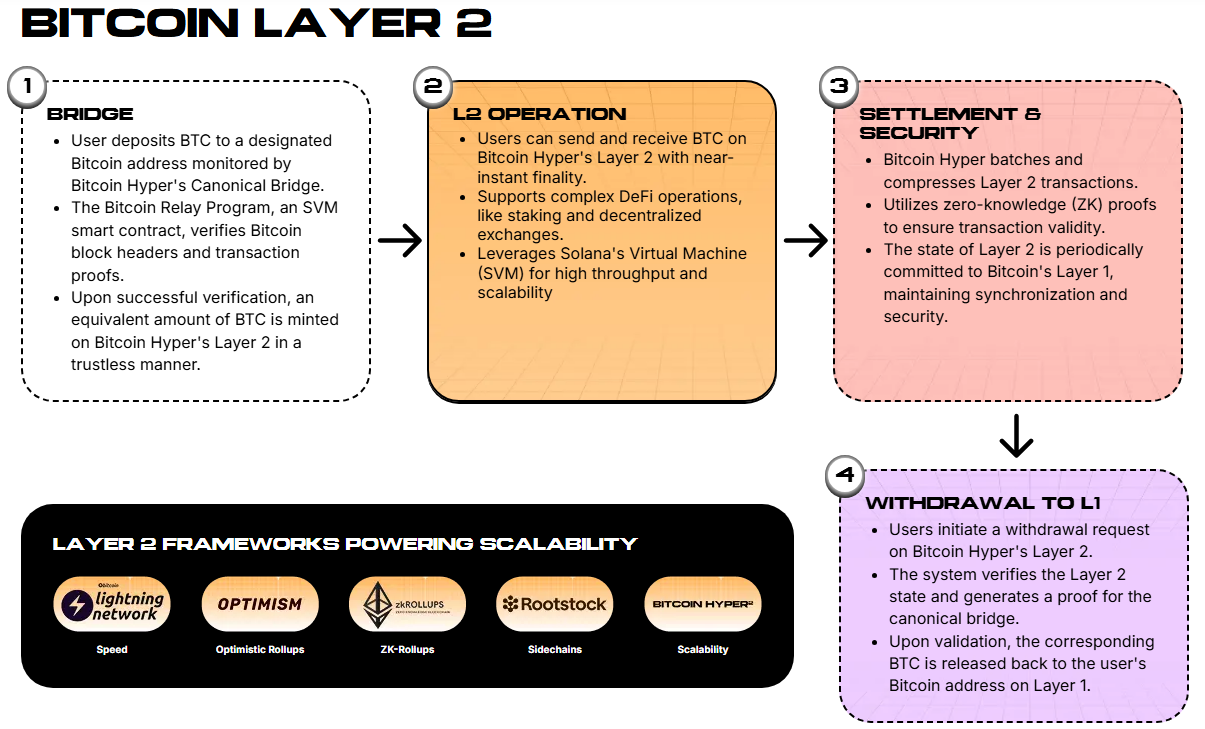

Bitcoin Hyper ($HYPER) is the latest and arguably the greatest Layer 2 solution on the Bitcoin blockchain, adding a fast lane of scalability and Web3 compatibility to the otherwise vanilla Bitcoin.

No doubt, Bitcoin is the largest cryptocurrency in the world, but it has largely been reduced to an investment vehicle, while other blockchains like Ethereum and Solana have dominated the DeFi and Web3 space.

$HYPER addresses this very issue. It brings the power of Solana Virtual Machine (SVM) integration to Bitcoin, allowing developers to build dApps and execute smart contracts directly on Bitcoin without compromising on security or needing to migrate to other blockchains.

The SVM also brings the advantages of fast transactions and low costs to Bitcoin. Currently, Bitcoin can only process 7 transactions per second, compared to Solana’s 65K TPS.

However, with SVM’s fast execution, Bitcoin can now close the gap between itself and other blockchains considerably.

Another important component of Bitcoin Hyper is its non-custodial canonical bridge, which locks your Layer-1 Bitcoin tokens to mint an equivalent amount of Web3-compatible Layer-2 tokens.

You can then use these L2 tokens to engage with DeFi and Web3 applications such as staking, borrowing, lending, and more. Once you’re done, you can simply swap back your L2 tokens to unlock your original Bitcoins.

The $HYPER presale has been setting the market ablaze, having already raised $21.3M. Each token is currently available for just $0.013055.

And it’s not just retail investors driving the frenzy: two whales recently scooped up $373K and $177K worth of $HYPER, respectively.

Grab your $HYPER tokens before the next price increase.

2. Maxi Doge ($MAXI) – Dogecoin-Themed Degen Meme Coin Has Its Eyes Set on 1000x Gains

Maxi Doge ($MAXI) is the best crypto to watch if you love hype-driven, degen meme coins with 1000x potential.

Of course, Dogecoin is the king of meme coins, now boasting a market cap of $38B. Sure, it grabbed all the attention, but that caused its far-distant cousin, Maxi, to be quietly ignored at family gatherings and social circles.

Frustrated by this humiliation, $MAXI chugged down protein shakes and did rep after rep to return as a ripped version of $DOGE, and it doesn’t plan to stop until it hits that 1000x mark.

How will it do it? A massive 40% of the total 150B token supply has been reserved for aggressive marketing campaigns, including social media ads, paid partnerships, and influencer promotions.

The goal is to build a loyal community of $MAXI investors who believe in the token’s degen-fueled power.

And while most projects are happy with just CEX and DEX listings, $MAXI aims for the moon; it plans to list on futures trading platforms too, allowing investors to leverage their positions and potentially take home life-changing gains.

The $MAXI presale is live and has already raised $2.7M, with each token currently priced at $0.0002605.

Join Maxi Doge on its exciting mission – visit its official website to learn more.

3. SPX6900 ($SPX) – Blending Humor and Finance in a Never-Before-Seen Fashion

SPX6900 ($SPX) might ring a bell for all Wall Street investors. The token blends the seriousness of big-money Wall Street investments with the chaotic energy and unfiltered madness of the meme coin community.

Inspired by the S&P 500 index, SPX6900 is a satirical take on the seriousness of white-collared investors who analyze every fundamental and technical aspect to make money.

SPX6900, on the other hand, is fueled purely by community support, hype, and meme-fueled mania. It has gained more than 45% in the last seven days and is currently trading around $1.44.

Having bounced sharply from its long-term support at $0.90, it’s now fast approaching key resistance at $1.15. If it manages to break out from here, it could quickly surge another 50% to break its previous all-time high of $2.28.

Interested? Buy $SPX on CoinFutures or any of the other crypto exchanges.

Recap: With Bitcoin set to benefit from Europe’s brewing financial chaos, now’s the perfect time to load up on low-cap, high-upside tokens like Bitcoin Hyper ($HYPER), Maxi Doge ($MAXI), and SPX6900 ($SPX).

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Altcoins to Buy as Bitcoin Stands to Benefit from Europe’s Currency Risks appeared first on Coindoo.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

EIGEN rockets by 33% in one day after AI agents hype