Crypto News: Bankman-Fried’s Biggest Mistake: Handing FTX to New CEO

Sam Bankman-Fried acknowledges that his most significant error was that he had given FTX to the new CEO prior to bankruptcy, and he had no final opportunity to.

The disgraced founder of FTX, Sam Bankman-Fried, says that his biggest mistake was the one that sent him the reins of the crypto exchange to the new CEO, John J. Ray III, before the company announced its bankruptcy in November 2022.

Bankman-Fried became aware of a possible external investment that could have rescued FTX just a few minutes after signing over the exchange and said he could not take his decision back.

It was revealed in a recent exclusive interview with Mother Jones and shed new light on the dramatic final days of the $32 billion exchange that on November 11, 2022, filed Chapter 11 bankruptcy.

Under the leadership of Ray, FTX went bankrupt quickly, and he hired the law firm Sullivan and Cromwell to provide legal advice. The new CEO has a reputation for handling corporate meltdowns such as Enron.

The fall of FTX was described as an unprecedented corporate control failure where financial records were chaotic and management practices were poor, which was revealed throughout the bankruptcy process.

The bankruptcy of FTX showed that the company had misused millions of customer funds. Customer funds of the company were misused by the sister company, Alameda Research, and the company suffered billions of dollars of trading losses, the notorious Alameda gap.

Later on, Bankman-Fried was arrested in the Bahamas and extradited to the U.S., where he was sentenced to 25 years in prison over his part in the collapse and the fraud.

FTX Creditors Approach $1.6 Billion Repayment Milestone

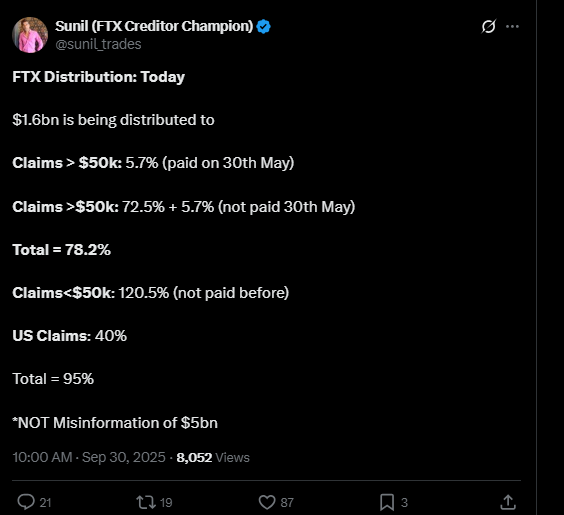

Recently, the FTX bankruptcy estate provided information that it will release 1.6 billion dollars to creditors in the continued repayment process.

Source – X

This will be the third large tranche after previous repayments in February and May 2025.

The repayments will be modeled to have high recovery rates for the smaller claimant of more than 120 percent, larger claims of more than 50,000 U.S. claimants will have approximately 60 percent recovery rate, and an overall total repayment rate is near 78.2 percent.

Such repayments are an indication of a gradual yet progressive bid to pay back creditors following the industry destabilizing meltdown.

Bankman-Fried and his legal team are challenging his conviction, saying the newly appointed CEO mishandled the billion-dollar bankruptcy.

The law company that made a lot of money out of the costly court cases. This scandal is another twist to the dramatic story of the spectacular collapse of FTX.

The post Crypto News: Bankman-Fried’s Biggest Mistake: Handing FTX to New CEO appeared first on Live Bitcoin News.

You May Also Like

Trump ally raises eyebrows with startling admission on Fox News: 'Cover-up isn't new'

South Korean Prosecutors Sell 320 Bitcoin for $21.5M After Hacker Returns Stolen Funds