Bitcoin Hyper Raises $1M in a Week – Could It Be the Next 1000x Crypto?

Bitcoin ($BTC) remains the undisputed king of crypto, but it’s a monarch trapped in slow motion. While it holds a $2.4T+ market cap and dominates global adoption, the network still processes one block every 10 minutes, struggles with high fees, and can’t natively support DeFi, dApps, or real-time payments.

In a world now used to $SOL-level speed and $ETH-level programmability, Bitcoin feels like dial-up in a fiber-optic era. That’s where Bitcoin Hyper ($HYPER) steps in – a new Layer-2 built to supercharge Bitcoin’s capabilities and become the next 1000x crypto.

With $21.7M+ raised – including $1M in whale buys last week alone – $HYPER is positioning itself as the upgrade Bitcoin has been waiting for.

With $21.7M+ raised – including $1M in whale buys last week alone – $HYPER is positioning itself as the upgrade Bitcoin has been waiting for.

And if $HYPER delivers on its promise, Bitcoin could finally rival $SOL and $ETH – without ever leaving its own chain.

Bitcoin’s Greatness Comes at a Cost

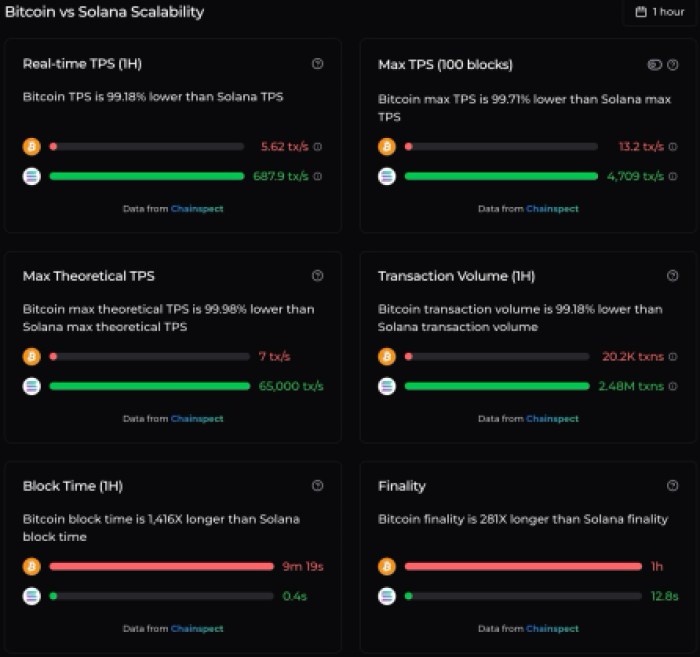

Bitcoin’s reliability is legendary – but it comes with baggage. The network’s Proof-of-Work design, while unmatched in security, limits throughput to around seven transactions per second (TPS). In real time, according to Chainspect, it’s at around 5.6 TPS with an average block time of nine minutes.

To put that into context, Solana processes 688 TPS in real-time and can push a max theoretical value of 65K TPS, with a block time of 0.4s. This puts Bitcoin at 99%+ lower than Solana in terms of TPS, and its block time is over 1.4K times longer.

That’s the difference between sending money instantly versus waiting nearly 10 minutes for confirmation.Bitcoin has tried to evolve. The Taproot upgrade improved privacy and efficiency, and the Lightning Network promised faster payments, but adoption lagged. And during busy bull markets, on-chain transfer fees can skyrocket, pricing out everyday users.

The paradox: Bitcoin is the King of Crypto, yet you can’t build dApps, trade DeFi, or launch meme coins tokens directly on it. It’s a digital giant confined by its own architecture. Scalability isn’t a luxury anymore – it’s the single obstacle preventing Bitcoin from becoming the financial backbone of Web3.From Store of Value to Full-Fledged Ecosystem

Bitcoin Hyper ($HYPER) plans to rewrite what Bitcoin can be. Built as a Layer-2 solution for Bitcoin, it will integrate the Solana Virtual Machine (SVM) – the same high-performance framework that enables Solana to process millions of transactions per hour. Instead of competing with Bitcoin, Hyper is designed to improve it.

Here’s how it will work, step-by-step:

- Bridge in: Send your $BTC to a Hyper smart contract address. The system verifies your deposit by reading Bitcoin blocks.

- Mint on the Layer-2: Once verified, the same amount of $BTC is automatically minted on Bitcoin Hyper as wrapped $BTC. No middlemen, just pure trustless bridging.

- Transact, stake, or build: On Hyper, you can trade, stake for rewards, or deploy dApps instantly with sub-second finality and near-zero fees, thanks to the SVM.

- Secure settlement: Transactions are bundled and validated through zero-knowledge proofs, then anchored back to Bitcoin’s mainnet for security and transparency.

- Bridge out anytime: When you’re ready, withdraw your $BTC back to the Layer-1. The process is clean, verifiable, and fully synced with Bitcoin’s original chain.

Unlike wrapped tokens or sidechains that rely on third-party custody, Bitcoin Hyper will connect directly to Bitcoin using zero-knowledge verification, combining Bitcoin’s integrity with Solana’s speed.

This will mean instant Bitcoin payments, $BTC-native DeFi, and Solana-compatible dApps, all powered by the world’s oldest blockchain. In simple terms – if $ETH owns DeFi and $SOL owns speed, $BTC will have both.It’s like giving a vintage Ferrari a modern engine… Same body, but 1000x the performance. More transactions mean more users, more fees and, ultimately, more demand.

$HYPER aims to turn Bitcoin from a static store of value into a living, breathing digital economy with speed and programmability that institutions and retail crave.

Find out more about this exciting new project in our comprehensive Bitcoin Hyper guide.

Whales Are Feeding On The $HYPER Frenzy

Momentum around the Bitcoin Hyper ($HYPER) presale is building fast. The project has already raised $21.7M+, with more than $1M in whale purchases the past week alone, including buys of $196.6K, $145K, and $56.9K.

These aren’t small-time investors; they’re high-conviction players betting big that Bitcoin Hyper will be the next crypto to explode to 1000x.

These aren’t small-time investors; they’re high-conviction players betting big that Bitcoin Hyper will be the next crypto to explode to 1000x.

Each $HYPER token is currently priced at $0.013065, while staking yields sit at 53% APY, rewarding long-term believers who help secure the network early. We predict $HYPER’s price to potentially reach the $1.50 mark by 2030. That means buying $HYPER at today’s price could see it pump by around 11,380%.

Holding $HYPER will also give you access to a full ecosystem: use yours for gas, staking, governance, and launchpad access. Discover how to buy Bitcoin Hyper in our step-by-step guide.

Early buyers get the first-in advantage in what is set to become Bitcoin’s execution layer. Bitcoin Hyper will give $BTC the speed of $SOL and the utility of $ETH, meaning it could rewrite Bitcoin’s role in the market entirely.

If early $ETH backers saw 15,000X returns by recognizing potential before the crowd, Bitcoin Hyper might offer Bitcoin’s version of that same opportunity. The whales have noticed, and they’re buying before the next price jump.

If early $ETH backers saw 15,000X returns by recognizing potential before the crowd, Bitcoin Hyper might offer Bitcoin’s version of that same opportunity. The whales have noticed, and they’re buying before the next price jump.

Remember, though, presale prices go up in stages, while the APY drops as more holders stake their tokens. And the next price increase is due tomorrow.

The clock is ticking. Join the Bitcoin Hyper presale before the next price increase.

Disclaimer: As always, this article is not financial advice. Always do your own research and never invest more than you can afford to lose.

Disclaimer: As always, this article is not financial advice. Always do your own research and never invest more than you can afford to lose.

Authored by Aidan Weeks, Bitcoinist – https://bitcoinist.com/bitcoin-hyper-next-1000x-crypto-1m-raise-week

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Will XRP Price Increase In September 2025?