Opendoor (OPEN) Stock: Rallies as CEO Confirms Bitcoin Payment Integration Plans

TLDR

- Opendoor CEO Kaz Nejatian confirmed the company will accept Bitcoin for home purchases, stating “We will. Just need to prioritize it”

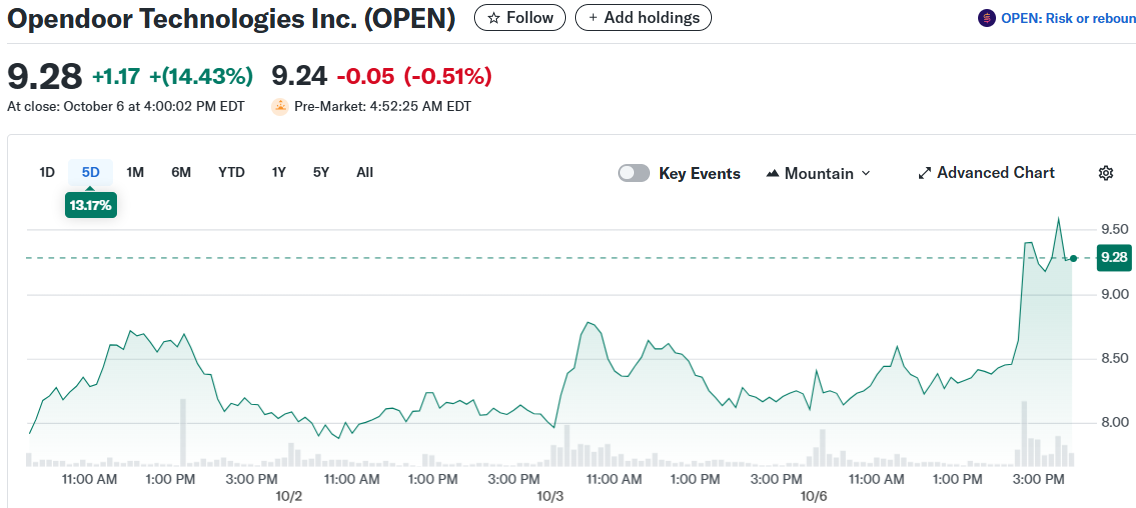

- OPEN stock jumped 14% to $9.28 on October 6 following the announcement, with shares up 480% year-to-date

- New CEO Kaz Nejatian joined from Shopify while co-founders Keith Rabois and Eric Wu returned to leadership roles

- Bitcoin reached new record highs over the weekend, driving increased business interest in cryptocurrency payments

- Opendoor operates as an iBuyer, buying and renovating homes before reselling them directly to consumers

Opendoor CEO Kaz Nejatian confirmed over the weekend that the company plans to accept Bitcoin for home purchases. The announcement came in response to a user question on X about enabling cryptocurrency payments.

Shares rose 14.4% to $9.28 on October 6 following the announcement. The market reaction suggests growing confidence that integrating cryptocurrency could attract new buyers to the platform.

Opendoor Technologies Inc. (OPEN)

Opendoor Technologies Inc. (OPEN)

The company has not provided additional details about implementation timelines. Investors are waiting to learn when Bitcoin payments might actually become available.

The announcement comes as Bitcoin hit another record high on Sunday. The cryptocurrency’s price surge has sparked renewed interest from businesses exploring digital payment options.

Stock Performance and Leadership Changes

OPEN stock has surged over 1,300% since early July. Shares peaked at $10.52 on September 11 before pulling back.

Year-to-date returns stand at 480% as of October 6. The rally has made Opendoor a favorite among meme stock traders.

The stock’s movement follows a major leadership overhaul. Opendoor appointed Nejatian, formerly Shopify’s chief operating officer, as CEO in September.

Co-founders Keith Rabois and Eric Wu returned as board chair and director respectively. Both leaders have been active on social media discussing company plans.

The new leadership team brings a focus on operational efficiency and disciplined growth. Analysts say the team’s experience could help Opendoor navigate challenging market conditions.

Business Model and Recent Performance

Opendoor operates as an iBuyer, buying homes, renovating them, and reselling at higher prices. The model allows the company to manage transactions internally, making it possible to convert Bitcoin into US dollars without requiring individual sellers to handle crypto.

This capital-intensive model struggles during high interest rate periods. Most competitors have exited the iBuyer space, leaving Opendoor as one of the few companies still pursuing this strategy.

The company has cut costs to improve profitability. Net loss dropped to $29 million in the second quarter from $92 million the previous year.

In the second quarter of 2025, Opendoor reported $1.6 billion in revenue. The company marked its first positive EBITDA in three years.

Management launched a new agent partnership program. Agents use Opendoor’s platform to find customers, with the company taking a cut of sales.

Market Conditions

Early results show promise with the new program. Twice as many customers reach final cash offers, and they receive them faster.

The program is expanding to all Opendoor markets. Management sees the partnership model as a way to grow without taking on additional risk.

Existing home sales rose 1.8% year-over-year in August according to the National Association of Realtors. Median home prices increased 2% over the same period.

The Federal Reserve has begun cutting interest rates, potentially improving real estate market conditions. The housing market has been slow to respond to rate changes.

Data from Propy, a blockchain-based transaction platform, shows over $4 billion in real estate deals completed on-chain since 2017. These transactions include properties in California, Florida, and Dubai.

According to a 2025 report by Deloitte, tokenized real estate assets could surpass $4 trillion by 2035. The World Economic Forum estimates that 10% of global GDP could be stored on blockchain by 2030.

Opendoor would join companies like MicroStrategy in embracing cryptocurrency. MicroStrategy shifted to holding Bitcoin as a treasury asset in 2020, inspiring other companies to follow.

Nejatian’s Bitcoin comments represent the latest catalyst for OPEN stock. The company’s cryptocurrency plans align with broader trends in crypto-backed property transactions.

The post Opendoor (OPEN) Stock: Rallies as CEO Confirms Bitcoin Payment Integration Plans appeared first on CoinCentral.

You May Also Like

the “ambient gambling” shift coming to brokerage accounts

UK crypto holders brace for FCA’s expanded regulatory reach