DDC Secures $124M at 16% Premium to Supercharge 10,000 Bitcoin Treasury — Can It Crack the Top 10?

DDC Enterprise has announced a $124 million equity financing round, marking another major step in its aggressive push to build one of the world’s largest corporate Bitcoin treasuries.

The new funding round, priced at $10.00 per Class A share, represents a 16% premium to DDC’s October 7 closing price and comes close to the company’s 15-day average trading price.

DDC Investment is Led by PAG Pegasus and Mulana

The funding was led by PAG Pegasus Fund and Mulana Investment Management, with participation from OKG Financial Services Limited, a subsidiary of OKG Technology Holdings; the financing strengthens DDC’s war chest for its Bitcoin accumulation strategy.

Founder, Chairwoman, and CEO Norma Chu also personally invested $3 million in the round, underscoring her long-term commitment to the company’s vision.

All investors, including Chu, have agreed to a 180-day lock-up period from the closing date, reflecting a shared belief in the company’s trajectory and its focus on institutional Bitcoin exposure.

The proceeds will primarily fund DDC’s Bitcoin treasury program, which aims to build a 10,000 BTC reserve and position the company among the world’s top public holders of the digital asset.

Chu described the investment as “a strong endorsement of our vision and the growing importance of public Bitcoin treasuries,” adding that the partnership with established institutional investors provides both capital and “substantial strategic value.”

The announcement follows a series of Bitcoin purchases that have steadily expanded DDC’s holdings over the past year. The company first unveiled its Bitcoin accumulation strategy in May, pledging to acquire 100 BTC immediately and 5,000 BTC within 36 months.

By June 2025, it had increased its holdings to 138 BTC at an average purchase price of $78,582 per coin, representing an estimated $10.8 million in total value at the time.

In the same month, DDC entered a strategic partnership with Web3 investment firm Animoca Brands to oversee and generate yield from Animoca’s Bitcoin reserves.

Under the agreement, Animoca allocated up to $100 million worth of BTC for DDC to manage, further cementing DDC’s reputation as a specialized corporate Bitcoin treasury operator.

Norma Chu has described Bitcoin as both a store of value and a hedge against macroeconomic volatility, calling the company’s accumulation plan “a cornerstone of our long-term value creation strategy.”

She said the dedicated Bitcoin treasury team and crypto-native advisory board would ensure a “disciplined and risk-aware” approach to BTC acquisitions.

Bitcoin Treasuries Hit Record 3.9M BTC as DDC Pushes for Top 10 Spot

The company’s financial momentum supports that confidence. DDC reported $37.4 million in revenue for 2024, a 33% year-over-year increase, with gross margins rising from 25% to 28.4%. The performance was driven largely by U.S. strategic acquisitions and cost discipline.

DDC’s expansion into Bitcoin mirrors earlier corporate moves by companies like Strategy and Metaplanet, which have turned crypto accumulation into long-term treasury strategies.

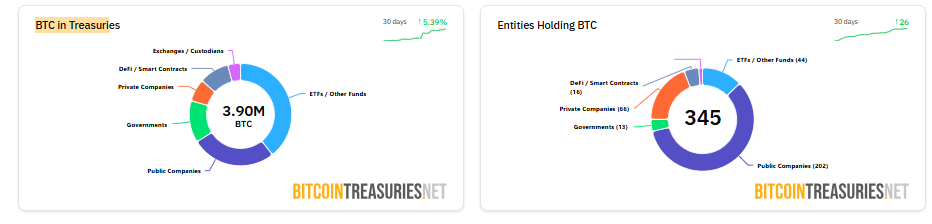

Data from Bitcoin.net shows that 345 public companies collectively hold 3.9 million BTC in reserves, with the top 10 led by MicroStrategy’s 640,000 BTC and Marathon Holdings’ 52,850 BTC.

Source: Bitcoin.net

Source: Bitcoin.net

If DDC achieves its 10,000 BTC goal, it would likely join that top 10 list, placing it alongside major Bitcoin treasury players like Coinbase, CleanSpark, and Trump Media.

Corporate interest in Bitcoin as a treasury asset continues to grow, with several global firms unveiling major accumulation strategies over recent months.

Dutch crypto firm Amdax announced on October 7 that it had raised €30 million ($35 million) to launch Amsterdam Bitcoin Treasury Strategy (AMBTS), a dedicated entity aiming to acquire up to 1% of Bitcoin’s total supply. Co-founder Lucas Wensing called the initiative a “milestone” in advancing institutional Bitcoin adoption.

Earlier, on September 15, U.S.-based Hyperscale Data launched a $100 million Bitcoin treasury program as part of its shift toward artificial intelligence and digital assets.

The company plans to fund the effort through data center asset sales and equity offerings while expanding its Michigan operations for AI and cloud computing.

In Asia, Chinese entertainment company CPOP disclosed the purchase of 300 BTC worth $33 million on September 11, boosting its share price before a brief market correction. A day earlier, QMMM announced plans for a $100 million crypto treasury spanning Bitcoin, Ethereum, and Solana.

Institutional holdings have surged globally. According to River’s 2025 report, public companies now control 1.3 million BTC, more than double the total held in early 2024.

Leading holders include Marathon Holdings, Twenty One Company, and Japan’s Metaplanet, while Strategy remains the largest with roughly $80 billion in Bitcoin reserves.

You May Also Like

Where is the Bottom for Bitcoin?

China Launches Cross-Border QR Code Payment Trial