Europe’s Largest Asset Manager Amundi to Launch Crypto ETFs

Amundi, with €2.3 trillion in assets under management, is preparing to enter the crypto ETF market, according to French analyst and TheBigWhale co-founder Gregory Raymond. In an exclusive report on Monday, Raymond confirmed that Amundi’s leadership has greenlit preparations to roll out Bitcoin BTC $115 603 24h volatility: 0.4% Market cap: $2.30 T Vol. 24h: $79.49 B Exchange-Traded Notes (ETNs).

The Paris-based fund manager referenced inflation resilience and portfolio diversification as the primary drivers behind its move into crypto-linked investment products. Amundi’s planned Bitcoin ETNs, Europe’s equivalent to the US ETFs, are expected to launch in early 2026, signaling a strategic push to capture rising institutional demand for compliant exposure to crypto.

The timing aligns with crypto regulations’ openness in Europe, with the Polish parliament adopting the Markets in Crypto-Assets Regulation (MiCA) framework in late September, offering fund managers clearer legal frameworks to introduce blockchain-based financial products.

Amundi Set to Rival BlackRock as US Regulations Set Global Standards

According to Gregory Raymond’s post, Amundi’s imminent Bitcoin ETNs will debut two years behind US spot Ethereum ETH $4 263 24h volatility: 2.8% Market cap: $513.50 B Vol. 24h: $50.45 B and Bitcoin ETFs which began trading in January 2024. The analyst predicts that Amundi’s move could propel the global crypto secondary market to new heights by enhancing Bitcoin’s legitimacy among institutional investors in Europe.

With over €2 trillion in assets, Amundi could rival Wall Street’s dominance in the crypto ETF race. BlackRock’s iShares Bitcoin Trust (IBIT) currently holds more than 4% of Bitcoin’s circulating supply, acquiring over 800,000 BTC, currently valued at nearly $100 billion within just 20 months of trading.

Best Wallet Presale Hits $16.5M as Amundi Sparks Renewed Institutional Crypto Interest

As Amundi, Europe’s largest asset manager, prepares to launch Bitcoin ETNs in 2026, the positive tailwinds hit early-stage projects like Best Wallet (BEST). Best Wallet offers multi-chain asset management and high staking rewards.

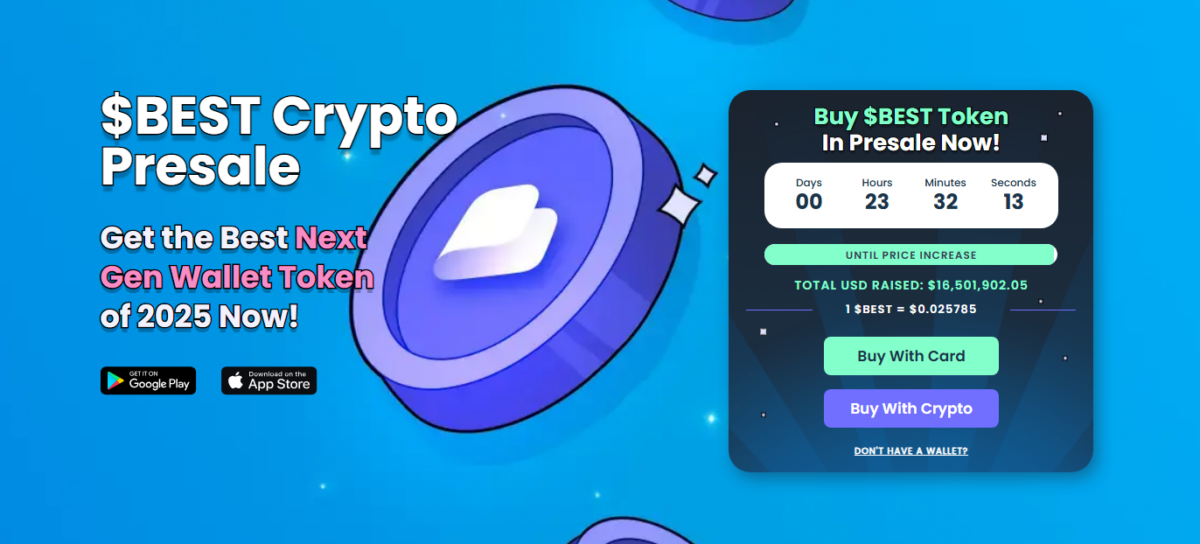

Best Wallet Presale

At press time, the Best Wallet presale has surpassed $16.5 million, with tokens trading at $0.026. With less than 24 hours before the next price tier unlocks, prospective investors can still join via the official Best Wallet website to secure early-access staking rewards ahead of the project’s public rollout.

nextThe post Europe’s Largest Asset Manager Amundi to Launch Crypto ETFs appeared first on Coinspeaker.

You May Also Like

Solar and Internet from Space: The Future of Global Connectivity and Energy Supply

Shiba Inu Price Prediction Is Edging Out in the Meme Race, But Pepeto Might Carry the 100x Trophy With $7.8M Raised