Newbie Bitcoin Whales Now Control 44% Of Realized Cap, Highest Ever

On-chain data shows the short-term holder Bitcoin whales have recently increased their Realized Cap share to the highest level ever.

Bitcoin Is Currently Being Dominated By New Capital

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the share of the Bitcoin whale Realized Cap held by the short-term holders.

The Realized Cap here is an on-chain indicator that measures, in short, the total amount of capital that the BTC investors as a whole have put into the cryptocurrency. Changes in this metric reflect the incoming or outgoing of capital.

In the context of the current topic, the Realized Cap of only a portion of holders is of interest: the whales. These are the entities carrying more than 1,000 BTC (about $111.4 million) in their balance.

Whales can be further broken down into cohorts on the basis of holding time. Whale-sized holders who bought their coins within the past 155 days are known as the short-term holder (STH) or new whales. Similarly, those who have a holding time higher than this cutoff are called the long-term holder (LTH) or old whales.

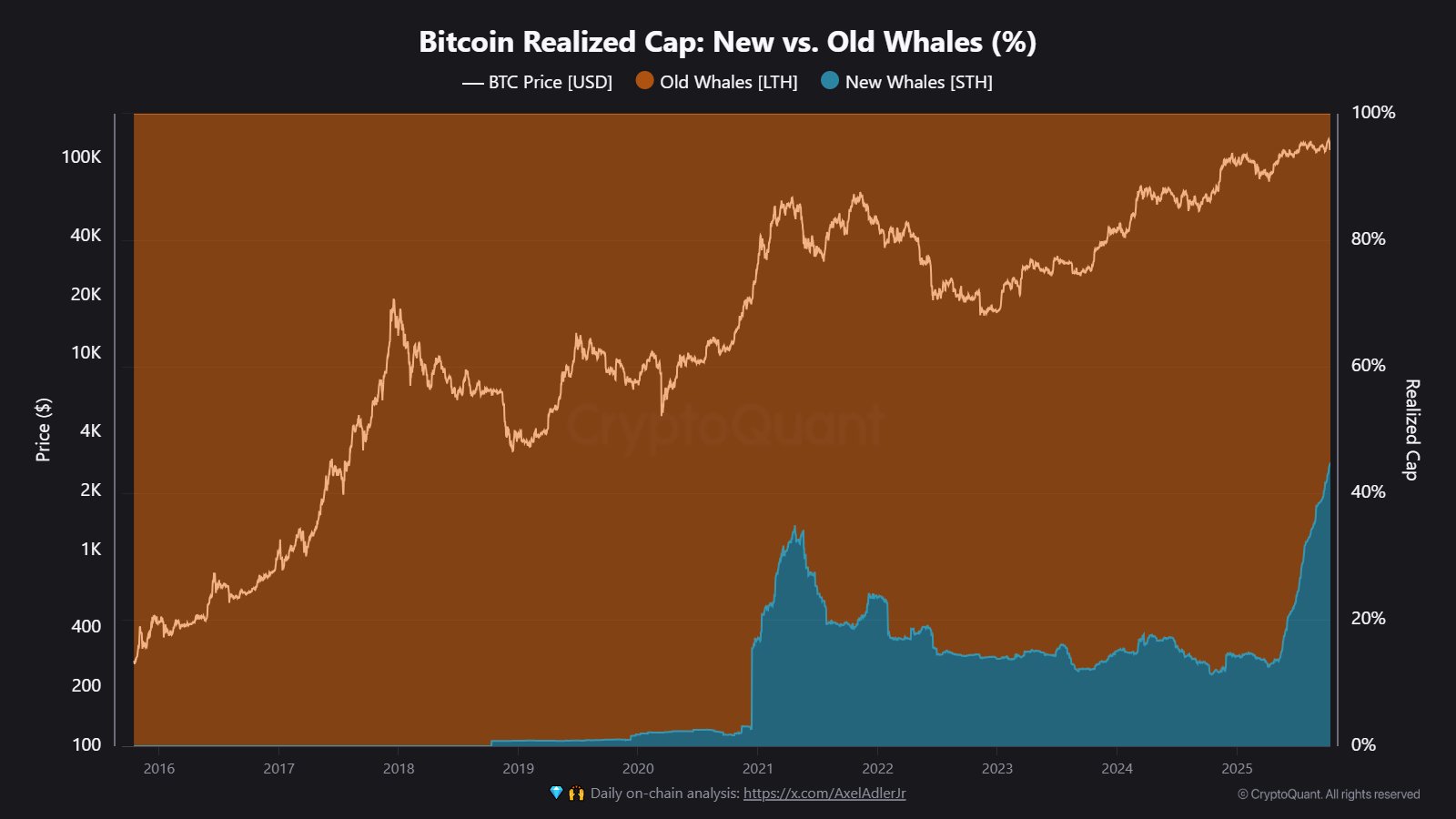

Now, here is the chart shared by Maartunn that shows how the Bitcoin Realized Cap dominance of these two groups has changed over the past decade:

As displayed in the above graph, new whales have rapidly gained ground in the Bitcoin Realized Cap recently and hit a dominance of 44%. The STH whales represent the big-money capital that has come into the coin over the last 155 days. Thus, it would appear that 44% of the capital stored on the BTC network is currently “fresh.”

This is the largest share of the whale Realized Cap that the STHs alone have occupied in the cryptocurrency’s history. To put things into perspective, the 2021 bull run topped out at a value of 31%.

The STH whales gain Realized Cap dominance through two means: a transfer of coins between members of the cohort at a higher price and selling from the LTH whales.

LTH whales are the resolute hands of the market who hold out through volatile periods in wait for profitable exit opportunities. These smart-money investors usually ramp up their selling during bull runs and transfer their coins to new money coming into Bitcoin. As long as demand is high enough to absorb this distribution, the rally continues, but once capital inflows drop off, the asset hits a top.

So far, the growth in the STH whale Realized Cap share has maintained, but it only remains to be seen how much room is still left.

BTC Price

Bitcoin has been struggling to recover since Friday’s crash as its price is still trading around $111,400.

You May Also Like

This is Trump's tell that all isn't well

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam