A practical guide to surviving a bear market: How to avoid the yield trap?

Author: Santisa , Crypto KOL

Compiled by: Felix, PANews

Before starting the content of this article, let’s take a look at the following story (or reality).

A “never-ending” list of tariffs was announced. Then the market crashed and altcoins collapsed.

Your original low-risk "mine" yield has dropped from 30% to near the level of a Treasury bill (note: T-bill, a short-term debt security issued by the government).

This is unacceptable to you. You originally planned to retire with $300,000, and the annual "mining" income is $90,000. Therefore, the rate of return must be high.

So you start moving down the risk curve, chasing imaginary levels of return that the market would favor you.

You traded your blue chip for an unknown new project; you increased your yield by deploying your assets into a riskier new fixed-term protocol or AMM. You started to feel secretly proud.

After a few weeks, you start to question why you were so risk-averse in the first place. This was apparently a “safe and sure” way to make money.

Then, the surprise came.

The custodial, leveraged, L2 wrapped, ultra-liquid foundational trading project you entrusted your life savings to collapsed, and now you have lost 70% of your PT-shitUSD-27AUG2025. You got some vested governance tokens, and a few months later the project was abandoned.

Although this story is exaggerated, it reflects the reality that has been played out many times during bear market when yields are compressed. Based on this, this article will try to provide a manual on how to survive a yield bear market.

As people try to adjust to the new reality, in the face of a market crash, they increase risk to make up for the difference in returns, while ignoring the potential costs of these decisions.

Market neutral investors are also speculators whose advantage is to find unadjusted interest rates. Unlike their directional trading partners, these speculators face only two outcomes: either making a little money every day or losing a lot of money all at once.

I personally believe that the neutral rate in the crypto market will be seriously misaligned on the way up, providing an alpha that is higher than its true risk, but the opposite is true on the way down, providing returns below the risk-free rate (RFR) while taking on a lot of risk.

Obviously, there is a time to take risks and a time to avoid them. Those who fail to see this will become someone else's "Thanksgiving dinner".

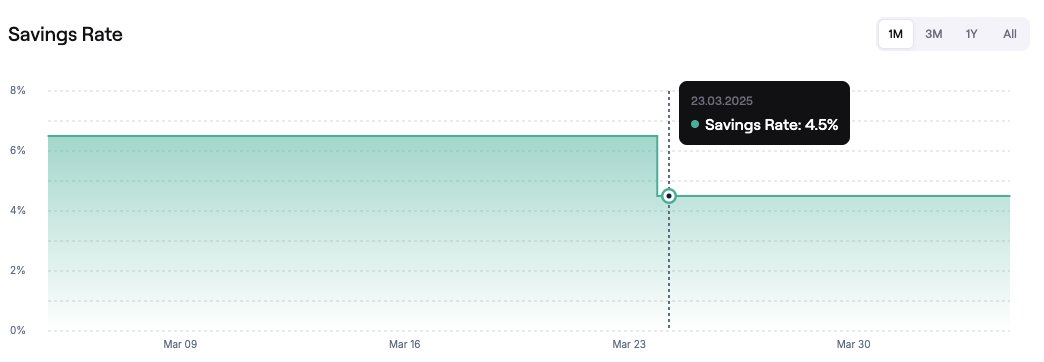

For example, at the time of writing, AAVE’s USDC yield is 2.7% and sUSDS yields 4.5%.

- AAVE USDC bears 60% of the RFR and also assumes smart contract, oracle, custody and financial risks.

source

- Maker incurs fees 25 basis points above the RFR while taking on the risks of smart contracts, custody, and actively investing in higher-risk projects.

source

When analyzing the interest rates of DeFi market-neutral investments, you need to consider:

- Custody Risk

- Financial risks

- Smart Contract Risks

- Risk-free rate

You can assign an annual risk percentage to each risk, add the RFR, and arrive at the required "risk-adjusted return" for each investment opportunity. Anything above that rate is alpha, and anything below that rate is not alpha.

Maker’s required risk-adjusted return was calculated a while ago and came up with a fair compensation of 9.56%.

Maker’s interest rate is currently around 4.5%.

Both AAVE and Maker hold secondary capital (~1% of total deposits), but even with significant insurance, yields below the RFR should not be acceptable to depositors.

In the age of Blackroll T-bills and regulated on-chain issuers, this is the result of laziness, lost keys, and stupid money.

So what to do? It depends on your size.

If you have a smaller portfolio (less than $5 million), there are still attractive options. Check out the safer protocols for all-chain deployments; they often offer incentives on lesser-known chains with lower TVL, or do some base trading on high-yield, low-liquidity perpetual contracts.

If you have a large sum of money (over $20 million):

Buy short-term Treasuries and wait and see. Favorable market conditions will eventually return. You can also search for OTC exchanges; quite a few projects are still looking around for TVL and are willing to significantly dilute their holders.

If you have LPs, let them know this and even ask them to exit. On-chain treasuries are still lower than real trading. Don't get carried away by the unadjusted risk-return. Good opportunities are obvious. Keep it simple and avoid greed. You should be here for the long term and manage your risk-return properly; if not, the market will figure it out for you.

Related reading: Comprehensive data analysis of the capital flows behind the trillion-dollar growth of stablecoins. If altcoins did not rise, where did the money go?

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

Michael Saylor: The February STRC dividend yield has been raised by 25 basis points to 11.25%.