Meta Lands $27 Billion for Massive Louisiana AI Data Center

TLDR

- Meta partnered with Blue Owl Capital in a $27 billion joint venture to fund the Hyperion data center in Richland Parish, Louisiana.

- Blue Owl owns 80% of the venture while Meta retains 20% equity and will manage construction and property operations.

- Blue Owl contributed $7 billion in cash to the deal, with Meta receiving a $3 billion one-time payout.

- The Hyperion facility will deliver over 2 gigawatts of compute capacity and is expected to be completed by 2030.

- The data center is Meta’s largest globally and will consume roughly twice the electricity of New Orleans on peak days.

Meta announced a $27 billion financing agreement with Blue Owl Capital on Tuesday to fund its Hyperion data center project. The deal represents the company’s largest private capital transaction.

Under the joint venture terms, Blue Owl will own 80% of the project. Meta keeps a 20% equity stake.

Blue Owl contributed approximately $7 billion in cash to the partnership. Meta received a one-time payment of about $3 billion from the arrangement.

The Hyperion facility is being constructed in Richland Parish, Louisiana. The site spans an area equivalent to roughly 1,700 football fields.

Meta will handle construction management and property services for the data center. The company expects construction to finish by 2030.

Power and Capacity Requirements

The facility is projected to deliver more than 2 gigawatts of compute capacity. This power will support training of large language models.

Local utility Entergy reported that the data center could consume about twice as much electricity as New Orleans uses on a peak day. The power requirements reflect the massive scale of modern AI infrastructure.

Meta’s finance chief Susan Li described the deal as a step forward for the company’s AI plans. The financing structure provides speed and flexibility for the project.

Meta Platforms, Inc., META

The facility will create more than 500 jobs once operational. Meta has signed leases with a four-year initial term and an option to extend.

Industry Context

Tech companies are spending heavily on AI infrastructure this year. Morgan Stanley estimates that Alphabet, Amazon, Meta, Microsoft and CoreWeave will spend $400 billion on AI infrastructure in 2025.

OpenAI recently secured deals for about 26 gigawatts of computing capacity. Those agreements may cost over $1 trillion.

Google announced a $15 billion investment in a southern India data center last week. That facility will be Google’s largest AI hub outside the United States.

OpenAI, Oracle and Softbank formed the Stargate joint venture in January. The companies plan to invest $500 billion in data centers over the coming years.

The first Stargate location came online in September in Abilene, Texas. The site is located 180 miles west of Dallas.

Alvin Nguyen, senior analyst at Forrester, noted the deal helps Meta reduce risk while limiting its ownership stake. The company won’t need to provide as much capital upfront.

The structure also minimizes debt taken on for equipment and property. This could prove beneficial if AI investment slows in the future.

Blue Owl Co-CEOs Doug Ostrover and Marc Lipschultz called Hyperion a project that reflects the scale and speed required for next-generation AI infrastructure. Meta first announced Louisiana as the location for its largest data center in December.

The post Meta Lands $27 Billion for Massive Louisiana AI Data Center appeared first on Blockonomi.

You May Also Like

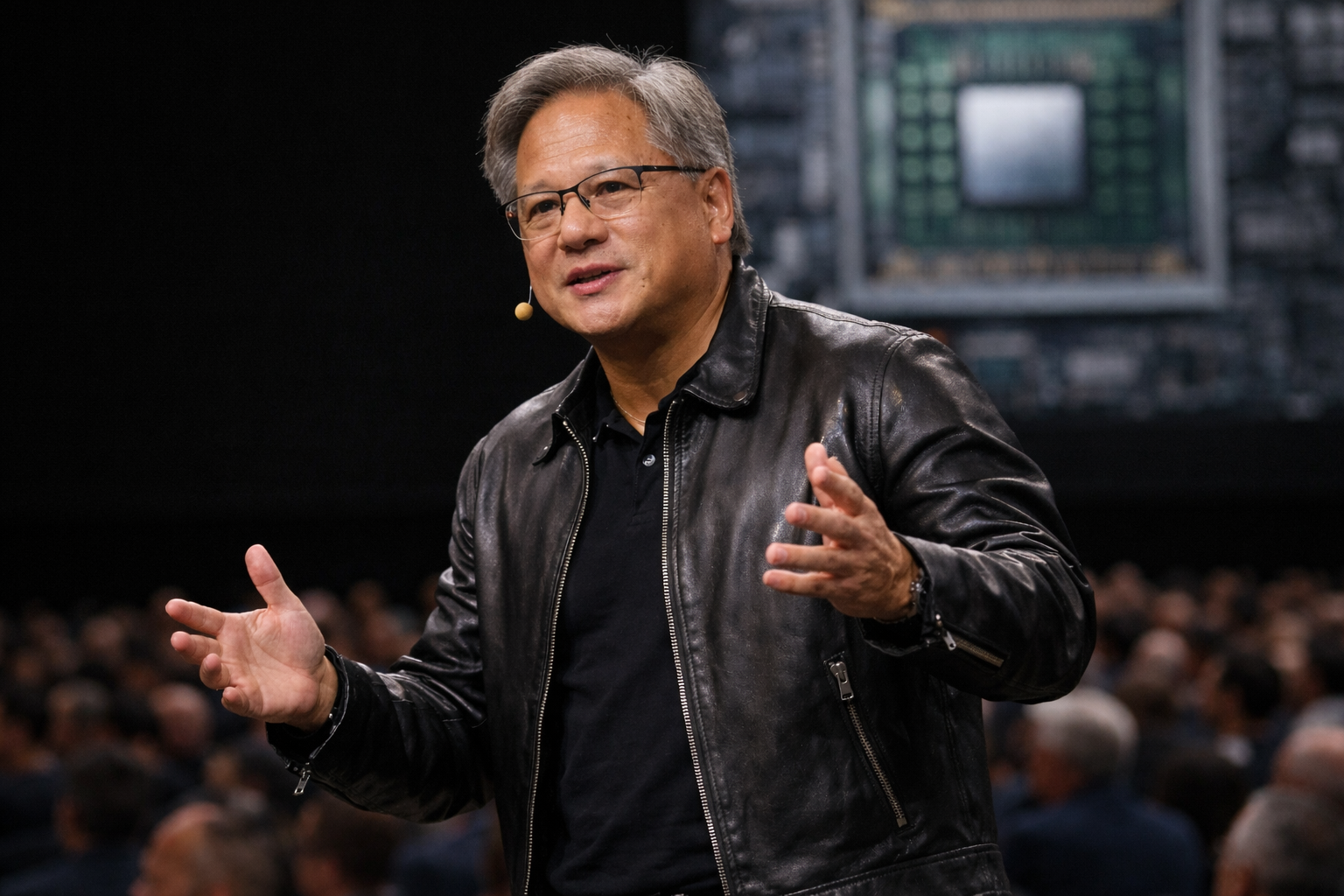

Nvidia’s Jensen Huang believes markets are wrong on software selloff

Intel’s foundry business keeps losing billions with no turnaround in sight