Crypto on-chain activity surges as active users hit 70M, a16zcrypto reveals

A16zcrypto says active crypto users are now around 70 million, up 10 million from last year, showing more people are actually using crypto. And adoption is picking up everywhere, with wallets booming in emerging markets more than anywhere else.

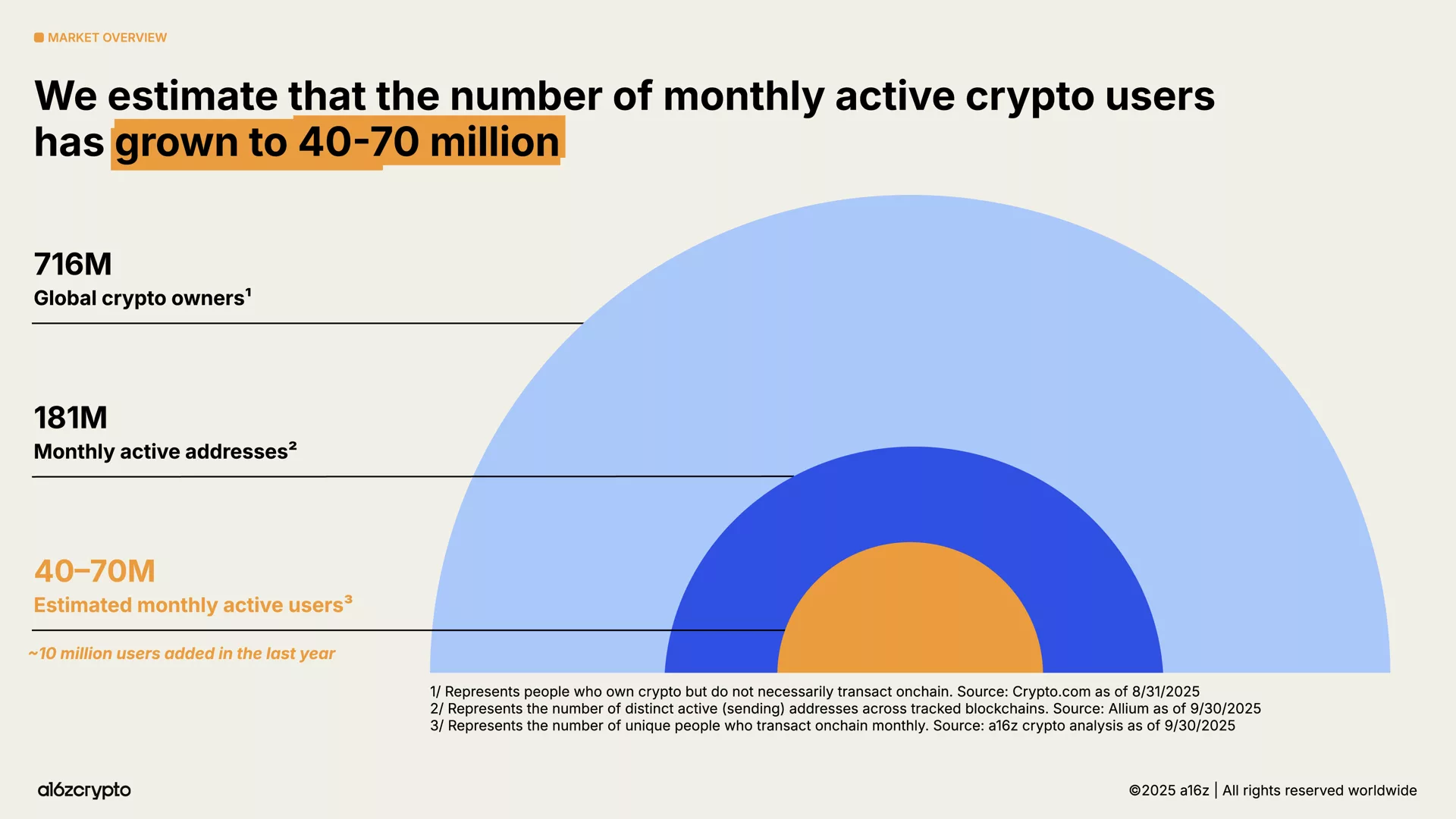

- Andreessen Horowitz’s crypto arm estimates that active crypto users have grown to 40-70 million, up 10 million from last year, signaling a shift from passive ownership to regular on-chain activity.

- Adoption is rising globally, with mobile wallets booming in emerging markets and trading activity leading in developed nations, while Bitcoin, Ethereum, and Solana see renewed engagement from users and developers.

- Institutional adoption and stablecoins are transforming finance, with billions flowing through exchange-traded products and over $150 billion in U.S. Treasuries held on-chain, highlighting crypto’s expanding role in global money flows.

Andreessen Horowitz‘s crypto-focused investment arm, a16zcrypto, says the crypto market is quietly carving out more room at the global finance table than many outside the industry might expect.

In a recent “State of Crypto 2025” report, the firm estimated there’re roughly 40-70 million active crypto users, representing an increase of about 10 million over the past year, based on an updated methodology.

While this remains a small fraction of the 716 million people who own crypto, the crypto-focused arm suggested it signals the market is moving beyond passive ownership into more regular, on-the-ground activity.

Meanwhile, token-related web traffic points to a different type of user in developed nations. Australia and South Korea show heavy engagement with trading and speculation rather than pure transactional activity, the data reveals.

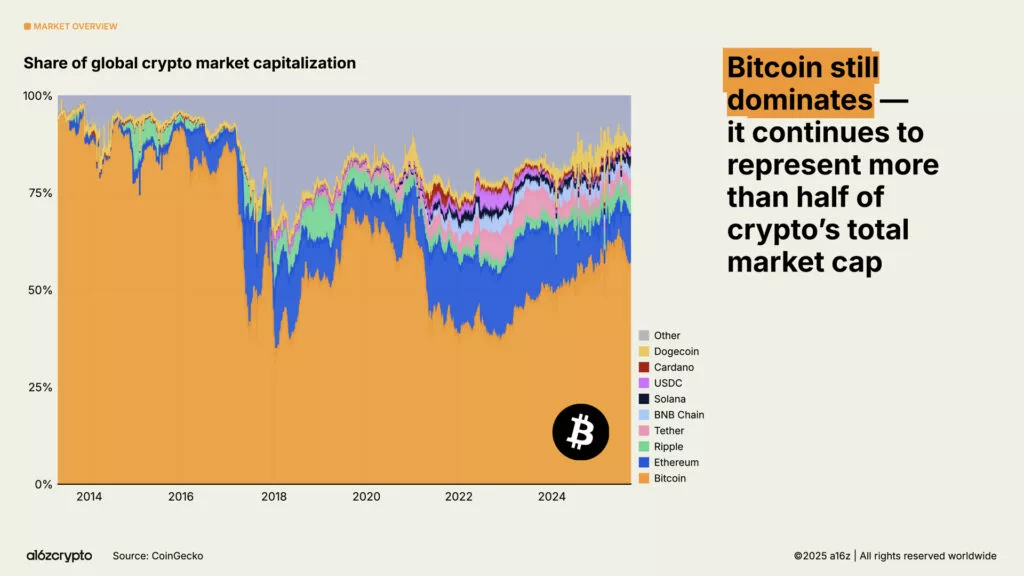

This growing user activity is mirrored in the market itself. Bitcoin (BTC) remains dominant, crossing $126,000 and capturing more than half of crypto’s market cap. Ethereum (ETH) and Solana (SOL) are clawing back from their post-2022 slumps.

Developers and institutions

On the developer side, a16zcrypto said Ethereum and its Layer-2 networks remain the top destination for new builders, while Solana has seen builder interest rise 78% over the past two years.

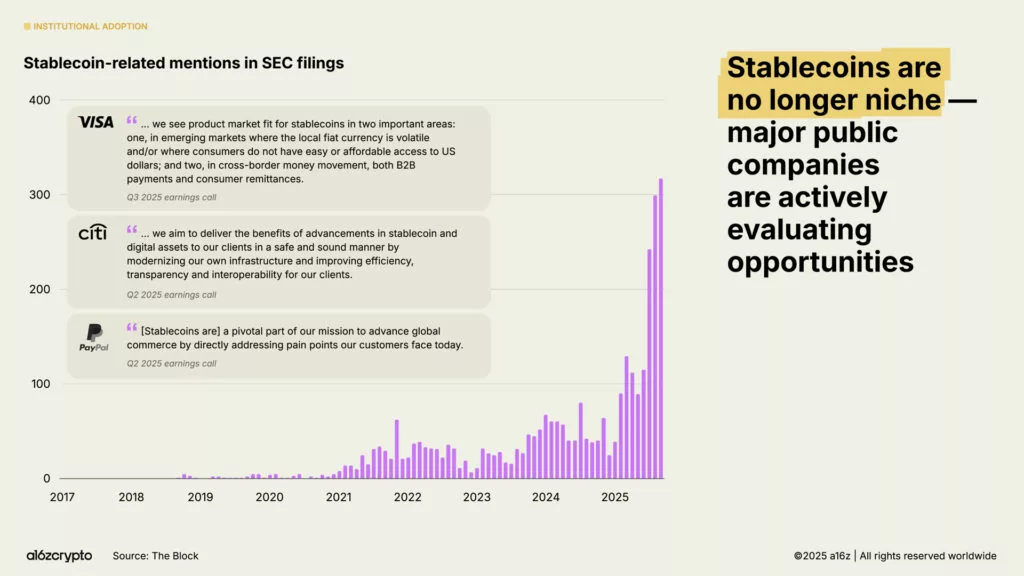

Institutional adoption, the firm added, is no longer a matter of speculation as major banks and fintechs are rolling out crypto products, from Circle’s billion-dollar IPO to JPMorgan and Visa integrating digital assets alongside equities and ETFs.

Exchange-traded products are unlocking billions of institutional dollars, while publicly traded “digital asset treasury” companies now collectively hold around 10% of both Bitcoin’s and Ethereum’s token supplies.

Stablecoins are now here

Stablecoins, a16zcrypto said, have become the backbone of the on-chain economy. The report indicated that stablecoins have done $46 trillion in total transaction volume in the last year, up 106% from the previous year.

Adjusted for organic activity, that amounts to $9 trillion, more than five times PayPal’s throughput and over half of Visa’s. Monthly adjusted stablecoin transaction volume reached $1.25 trillion in September alone, a figure largely uncorrelated with trading volume, underscoring real-world use beyond speculation.

The rise of stablecoins is reshaping dollar dynamics. They now hold more than $150 billion in U.S. Treasuries, more than many sovereign nations. Per the data, over 99% of stablecoins are denominated in U.S. dollars, and they are projected to grow 10x to more than $3 trillion by 2030, offering a new, on-chain source of demand for U.S. debt even as foreign central bank holdings falter.

So, in other words, crypto’s footprint is expanding. From the wallets in Argentina to Wall Street boardrooms, it’s starting to matter where it counts: in the flow of money itself.

You May Also Like

Pi Network Completes Mandatory v20.2 Protocol Upgrade: Preparing for Pi Day and a New Era of Utility

The Manchester City Donnarumma Doubters Have Missed Something Huge