Dormant Bitcoin Whale Returns as The Smarter Web Company Buys Dip

After nearly a year of inactivity, a dormant Bitcoin whale who previously sold BTC BTC $104 151 24h volatility: 3.5% Market cap: $2.07 T Vol. 24h: $84.70 B in November 2024 has resurfaced, this time buying back 800 BTC worth $84.87 million at an average price of $106,060.

The trader, known for three highly profitable swing trades between 2022 and 2024 that netted over $120 million, is betting once again on Bitcoin as volatility pushes prices down.

Whale Accumulation amid Market Weakness

The move comes as Bitcoin dropped to $103,000, down 3.5% in 24 hours, with trading volume surging 78.54% to $80.49 billion, CoinMarketCap data shows. Despite the correction, Bitcoin continues to hold above the $2 trillion market cap.

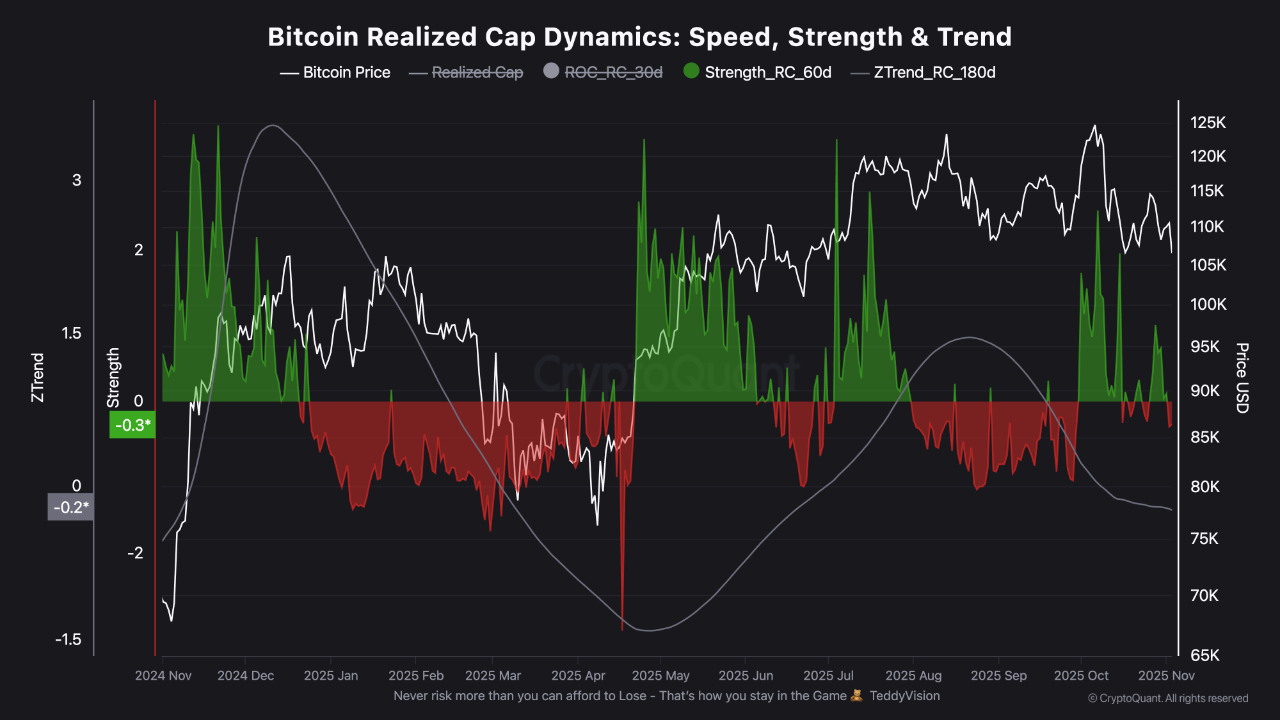

According to CryptoQuant, Bitcoin’s Realized Cap Dynamics indicate that structural momentum is fading, showing little new capital inflow into the network. Metrics such as Strength_RC_60d and ZTrend_RC_180d remain near or below zero, indicating a massive drop in investor conviction.

Bitcoin realized cap dynamics: speed, strength, and trend | Source: CryptoQuant

Analysts warn that if realized capitalization doesn’t pick up soon, the next major valuation wave could tilt lower, resulting in a potential distribution phase.

The Smarter Web Company Expands Bitcoin Treasury

While Bitcoin dropped to $103K, The Smarter Web Company, the UK’s largest publicly traded firm holding Bitcoin, announced the purchase of 4 additional BTC at an average price of $108,510, worth approximately $432K. This brings the company’s total holdings to 2,664 BTC, valued at over £220 million ($272 million).

Operating under its long-term “10 Year Plan,” The Smarter Web Company is gradually buying BTC, integrating the leading digital asset into its treasury and business strategy. It also accepts BTC payments and sees the asset as a cornerstone of the future financial system.

Analysts Split on Market Outlook

According to Swissblock, Bitcoin has now held above the $100,000 structural floor for 180 days, forming what analysts describe as a critical confluence zone. “Hold $100K, and the bulls reset for another leg higher. Lose it, and there’s nothing below, just open air and fear,” the firm said.

Glassnode’s latest report stated that as prices drop, short-term momentum is improving with mild accumulation. However, institutional outflows and negative ETF flows, totaling $617.2 million, paint a worrisome picture.

Moreover, the MVRV ratio dropped to 2.05 which basically confirms that capital is rotating but new demand is yet to be seen. If Bitcoin holds above $100K–$103K, it could stabilize for a potential rebound toward $110K.

nextThe post Dormant Bitcoin Whale Returns as The Smarter Web Company Buys Dip appeared first on Coinspeaker.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)