Missed PEPE’s 1250% Rally? Analysts Say This Token Could Be the Next Top Crypto

The post Missed PEPE’s 1250% Rally? Analysts Say This Token Could Be the Next Top Crypto appeared first on Coinpedia Fintech News

If you missed the massive run in Pepecoin (PEPE), you’re hardly alone. In April 2023 the viral meme coin took off and climbed more than 1,000% in a few months. But now many analysts believe it may be too late to capture a similar breakout. A new contender has emerged: Mutuum Finance (MUTM), a fresh entrant poised to draw attention in the next DeFi cycle.

Pepecoin (PEPE)

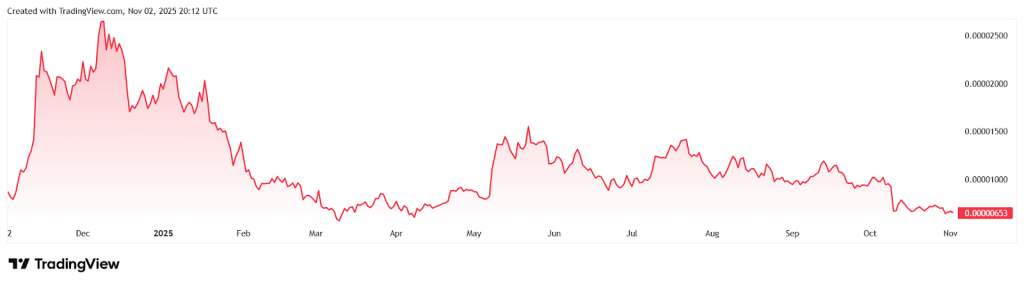

Pepecoin currently trades at around $0.000007, with a market cap of roughly $4 billion, based on a circulating supply of about 420 trillion tokens. While it still enjoys heavy social buzz and active trading, the technical picture suggests major resistance ahead.

The coin is struggling to break past the $0.000011 to $0.000013 range, which had halted earlier rallies. If it fails to hold support near $0.000005, a sharp retracement could follow.

More importantly, PEPE’s limitation is structural. With such a massive supply and meme-driven structure, the upside is inherently capped. Analysts now view its best near-term scenario as reaching perhaps $0.000015 by mid 2026, a modest advance compared with what early-stage projects can offer.

Mutuum Finance (MUTM)

In contrast, Mutuum Finance is not a meme coin. It’s a new DeFi crypto building a decentralized lending and borrowing protocol. Users will be able to supply assets, earn yield via interest, or borrow against collateral, all through non-custodial smart contracts.

The project is currently in its presale (“Phase 6”), with tokens priced at $0.035. Earlier phases started at around $0.01, meaning early supporters already saw a surge of 250%. Next up: price rises to $0.04 in the following phase, then a confirmed launch price of $0.06.

Out of a total supply of 4 billion tokens, 45.5 % (1.82 billion) are allocated to the presale. So far approximately 790 million tokens have been sold, with around $18.4 million raised and over 18,000 holders already onboard. This rapid sell-through is a signal of momentum building.

Three Reasons MUTM Could Outperform PEPE

First, PEPE is already huge. With a multi-billion dollar market cap and massive supply, its potential for explosive percentage gains is limited. MUTM, by contrast, is still early — lower supply, lower visibility with much more room to grow.

Second, PEPE is fundamentally a meme. Its value depends on social trends and hype. Mutuum Finance brings utility: its lending protocol links activity to token demand. Depositors will receive yield-bearing tokens (mtTokens) and the platform uses a buy-and-distribute model that allocates protocol fees to purchase MUTM tokens for stakers. That feedback loop means token value is tied to use case, not just hype.

Third, timing matters. Many early PEPE investors are now hunting for the next crypto. With Mutuum Finance’s V1 protocol set to launch in Q4 2025, awareness is rising. The presale phase stage 6 is almost sold out, audit complete, payment by credit card enabled — all signs the project is moving from concept to execution.

Key Milestones That Matter

Mutuum Finance has completed a CertiK audit, scoring 90/100 in Token Scan, which adds credibility to its smart contract structure. A $50,000 bug bounty program also enhances security and community confidence. A 24-hour leaderboard rewards the top daily contributor with $500 worth of MUTM tokens, keeping participants engaged throughout the presale.

As Phase 6 nears completion, large whale allocations are reported, adding fuel to the FOMO engine. The upcoming jump to $0.04 and then $0.06 at launch gives early investors a clear upside roadmap, one that many say could deliver far more than what a mature token like PEPE can offer.

Missed the PEPE Train? MUTM Might Be the Next Stop

Pepecoin grabbed headlines and delivered huge returns for early adopters. But with its size, supply, and reliance on hype, repeating that outcome seems unlikely without a major rediscovery — and that’s hard to count on.

Mutuum Finance offers a different profile. It’s a new cryptocurrency in the DeFi space, leveraging utility, token-linked demand dynamics, and a structured presale engineered for early investors. The entry price is still low, the roadmap is clear, and the product launch is tangible. If Mutuum delivers on its vision, it could capture the upside that eluded late-stage meme coins.

For those who watched PEPE’s rise and missed the window, MUTM presents a chance to participate at ground level. Keep an eye on its V1 launch, whale flows, and presale completion. The next major DeFi breakout might still be under $0.05.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

Fed Rate Cut and Tariff Effects: Powell’s Inflation Outlook