Ray Dalio Warns Fed Bubble Could Send Gold, Bitcoin Soaring — Then Implode

Ray Dalio has issued a stark warning that the Federal Reserve’s decision to halt quantitative tightening marks the beginning of a dangerous cycle of “stimulating into a bubble” rather than responding to economic weakness.

The billionaire investor and Bridgewater Associates founder argues that the Fed’s shift from balance sheet reduction to expansion represents a classic late-stage debt cycle dynamic that could drive gold and Bitcoin dramatically higher before an inevitable collapse.

The Fed announced that it would end quantitative tightening, effective December 1, 2025, transitioning to balance sheet maintenance at $6.5 trillion, while redirecting agency security income into Treasury bills rather than mortgage-backed securities.

Dalio views this as more than a “technical maneuver,” as officials describe it, particularly as the shift occurs alongside large fiscal deficits and strong private credit creation.

Meanwhile, the S&P 500 earnings yield of 4.4% barely exceeds the 10-year Treasury yield of 4%, leaving equity risk premiums at a razor-thin 0.4%.

Historic Reversal: From Depression Stimulus to Bubble Fuel

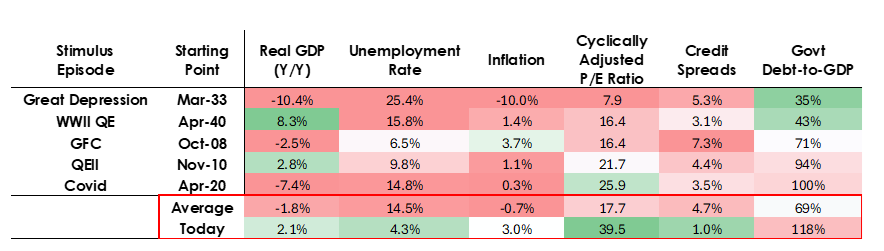

Dalio emphasizes that previous quantitative easing deployments occurred under fundamentally different conditions, characterized by economic contractions, falling asset valuations, low inflation, and wide credit spreads.

Meanwhile, the current environment features the opposite. Stocks are hitting new highs, the economy is growing at a rate of 2% annually, unemployment is at just 4.3%, and inflation is running above the Fed’s 2% target, at over 3%.

Source: X/@RayDalio

Source: X/@RayDalio

“This time the easing will be into a bubble rather than into a bust,” Dalio warned, noting that AI stocks already register as bubble territory according to his proprietary indicators.

The combination of massive fiscal deficits, shortened Treasury maturities to compensate for weak long-term bond demand, and central bank balance sheet expansion represents what he describes as “classic Big Debt Cycle late cycle dynamics.“

Market analysts have shared these concerns.

Cristian Chifoi noted that while narratives surrounding QE and QT dominate discussions, actual liquidity began flooding markets between October and December 2022, when the tightening effectively ended, with the Reverse Repo Program serving as the gateway.

Ted Pillows also warned that crypto markets, historically sensitive to liquidity conditions, may not bottom until actual quantitative easing begins rather than merely stopping tightening.

He cited the 40% decline in altcoins that followed the Fed’s 2019 QT pause before fresh stimulus arrived.

Gold Surges as Liquidity Mechanics Shift

Gold has responded dramatically to the policy shift, recovering above $4,000 per ounce after initial volatility following the Fed announcement.

The World Gold Council reported that global demand in Q3 2025 increased 3% year-over-year to 1,313 tons, with investment demand reaching the highest quarterly total on record as prices achieved 13 new all-time highs during the quarter.

Dalio explained the mechanics driving gold’s appeal: with zero yield and gold trading at approximately $4,025 while 10-year Treasuries offer 4%, investors must expect gold price appreciation exceeding 4% annually to prefer the metal over bonds.

“The higher the inflation rate, the more gold will go up because most of inflation is due to the value and buying power of other currencies going down due to their increased supply, while there isn’t much increased supply of gold,” he wrote.

Central bank purchasing has accelerated 10% year-over-year, with Poland announcing expanded programs and Brazil resuming purchases for the first time since July 2021.

However, in times of financial uncertainty and crisis, Bitcoin has outperformed Gold and all other risk assets.

The Melt-Up Before the Crash

Dalio’s most ominous warning centers on predicting that increased Fed balance sheet expansion, combined with interest rate cuts amid large fiscal deficits, would constitute “classic monetary and fiscal interaction of the Fed and the Treasury to monetize government debt.“

This dynamic should push real interest rates down, compress risk premiums, expand price-to-earnings multiples, and especially boost long-duration assets, such as technology and AI stocks, alongside inflation hedges, including gold and inflation-indexed bonds.

“It would be reasonable to expect that, similar to late 1999 or 2010-2011, there would be a strong liquidity melt-up that will eventually become too risky and will have to be restrained,” Dalio wrote.

“During that melt-up and just before the tightening that is enough to rein in inflation that will pop the bubble is classically the ideal time to sell,” he concluded.

You May Also Like

VivoPower To Load Up On XRP At 65% Discount: Here’s How

Today’s Wordle #1671 Hints And Answer For Thursday, January 15