DeFi Gains Transparency as Market Turmoil Sparks Trust Revival

Cryptocurrency markets continue to grapple with high-profile security breaches and systemic risks, underscoring the importance of blockchain security and transparency. This week, major incidents include a significant DeFi exploit on Balancer, with over $116 million drained, and the collapse of Stream Finance, which triggered widespread stablecoin depegging and liquidity crises across DeFi platforms. Meanwhile, industry players are increasingly collaborating on risk assessment and regulatory advocacy, signaling a push toward greater openness and stability in the decentralized finance ecosystem.

- Balancer loses over $116 million in a major DeFi hack, targeting v2 contracts through a suspected smart contract vulnerability.

- DeFi risks extend with Stream Finance’s $93 million loss, causing stablecoin depegging and exposure across multiple lending protocols.

- RedStone launches Credora, a real-time DeFi risk ratings platform, to enhance transparency and assess default risks.

- Leading DeFi protocols form the Ethereum Protocol Advocacy Alliance (EPAA) to lobby policymakers and promote decentralized infrastructure.

- Web3 gaming and DeFi activity showed resilience despite market turbulence, with protocols like Raydium and Jupiter maintaining activity levels.

In the latest chapter of DeFi security challenges, Balancer experienced one of the largest decentralized finance exploits to date, with attackers siphoning over $116 million from its v2 liquidity pools. Investigations point to a potential smart contract vulnerability linked to faulty access controls, enabling the malicious actors to withdraw funds directly from liquidity pools, primarily affecting liquid staking assets such as Lido’s wstETH and StakeWise’s osETH.

The breach began with an estimated $70 million loss and subsequently increased. In response, Balancer offered a 20% white hat bounty to identify the attacker, while law enforcement and blockchain forensic teams work to track down the culprit. Despite extensive security audits—more than 10, according to industry insiders—the protocol remained vulnerable, highlighting the ongoing complexities of securing DeFi platforms today.

On Thursday, Balancer published a preliminary post-mortem, revealing that the attack exploited vulnerabilities in its v2 Stable Pools and Composable Stable v5 pools through a sophisticated code exploit. The incident exposes the persistent risks within DeFi, emphasizing the importance of continuous security auditing and improvements.

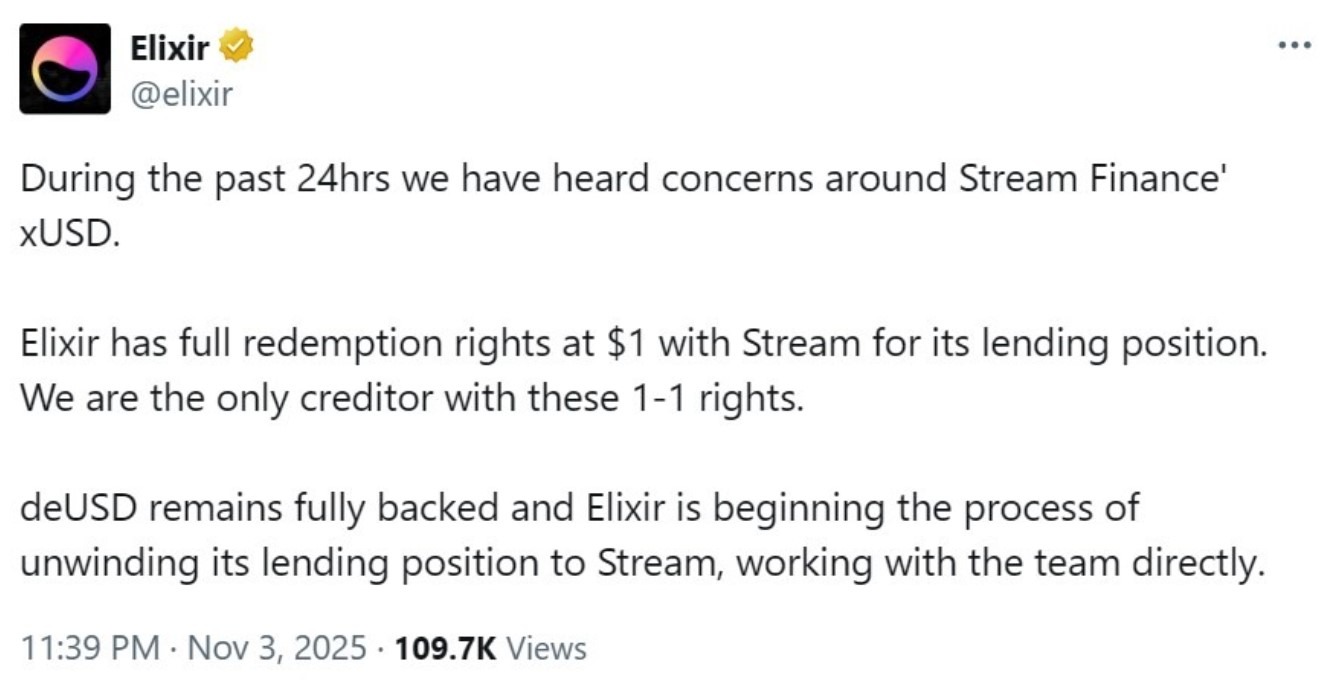

Simultaneously, the DeFi market faces systemic risks following the collapse of Stream Finance, which disclosed a $93 million loss tied to a failed external fund manager. The incident has ripple effects, leading to stablecoin depegging and liquidity freezes across interconnected platforms such as Euler, Solo, Morpho, and Gearbox. These interconnected vulnerabilities heighten the contagion risk within the DeFi lending and liquidity sectors.

Elixir, one of the most affected protocols, announced it had supported the redemption of 80% of its stablecoin deUSD, which led to the token losing its dollar peg—highlighting the fragility of these synthetic assets in such crises. The fallout underscores the need for robust risk management mechanisms in decentralized finance.

Source: Elixir

Source: Elixir

In efforts to promote responsible risk assessment, RedStone has launched Credora, a DeFi-native risk ratings platform. It provides real-time credit and collateral analytics to protocols like Morpho and Spark, aiming to improve transparency in a volatile market. The platform intends to support data-driven decision-making, which is crucial amid recent market shocks that saw $20 billion in liquidations in October.

Further, industry stakeholders are mobilizing to influence regulatory policy through the formation of the Ethereum Protocol Advocacy Alliance (EPAA). Backed by the Ethereum Foundation, the coalition of DeFi protocols—including Aave, Uniswap, Lido, Curve, Spark, Aragon, and The Graph—aims to advocate for a balanced regulatory environment that recognizes the importance of decentralized infrastructure and on-chain governance.

Ethereum protocols unveil new alliance. Source: EPAA

Ethereum protocols unveil new alliance. Source: EPAA

Despite turbulence, DeFi activity remains resilient, with sectors like Web3 gaming and DeFi platforms continuing to engage users actively. According to a recent report, protocols such as Raydium and Jupiter Exchange maintain significant usage, demonstrating ongoing innovation within the space even during periods of market stress.

Market data indicates that most of the top cryptocurrencies saw declines last week, with tokens like USDX and Paparazzi plummeting 69% and 54%, respectively, reflecting ongoing volatility across crypto markets. As risk factors persist, industry players emphasize the need for improved security, transparency, and regulatory clarity to foster sustainable growth in blockchain-based finance.

Thanks for staying updated on this week’s impactful developments in DeFi and the broader crypto space. Join us next week for more insights into the evolving world of blockchain technology and decentralized finance.

This article was originally published as DeFi Gains Transparency as Market Turmoil Sparks Trust Revival on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?