Is This Good or Bad? Find Out the Surprising Truth!

Certainly! Here’s the rewritten article with a concise introduction, key takeaways, and optimized language for SEO, maintaining the original HTML structure:

The evolution of Bitcoin and the broader cryptocurrency market continues to challenge traditional notions of market cycles and bubbles. Recent analyses suggest that Bitcoin’s price behavior is no longer following the classic patterns of exponential growth followed by sharp declines. Instead, the landscape appears to be shifting toward increased stability, with implications for investors and regulators alike. This article explores these emerging trends and the changing dynamics of crypto market cycles.

- Bitcoin’s historic price cycles show diminishing peaks of exponential growth, indicating potential changes in market dynamics.

- Volatility of Bitcoin has decreased significantly from over 140% in early years to around 50%, suggesting increased stability.

- Recent data implies that the traditional four-year cycle involving crypto winters may no longer apply in the same way.

- Bitcoin’s risk-return profile has shifted, with returns declining but still noteworthy, supported by institutional adoption such as Bitcoin ETFs.

- Future growth may be slower, with lower volatility, making ultra-optimistic forecasts like $13 million per Bitcoin less probable.

The concept of financial bubbles remains a hotly debated topic within the cryptocurrency community, with academic research dating back to Professor Didier Sornette’s 2014 study. A bubble is typically described as a period of unsustainable, faster-than-exponential price growth that inevitably results in a market correction or crash. In the crypto world, Bitcoin has historically experienced several such cycles—sharp rises followed by steep declines, or “crypto winters.” These declines have ranged from 75% to over 90%, reflecting the sector’s high volatility and unpredictable nature.

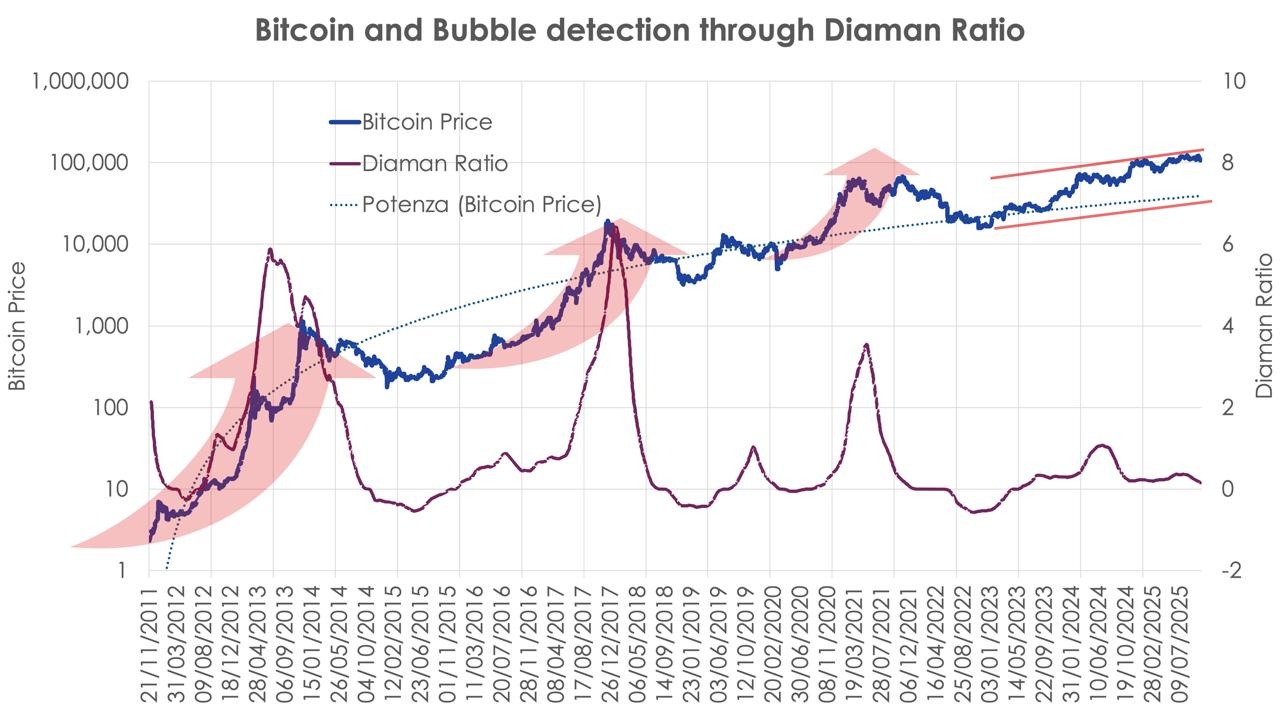

Bitcoin’s price trajectory over the years has been heavily influenced by its halving events approximately every four years, which reduce the supply of new Bitcoins entering circulation. This predictable rhythm has often led to phases of market decline, recovery, and subsequent exponential growth. The price chart, when viewed logarithmically, reveals these cyclical patterns quite clearly.

Bitcoin price, logarithmic scale. Source: Diaman PartnersBack in 2011, Diaman Partners and Professor Ruggero Bertelli introduced the Diaman Ratio, a statistical indicator based on linear regression between Bitcoin prices and time on a logarithmic scale. When the Diaman Ratio exceeds 1, it signals more-than-exponential growth—a hallmark of market bubbles. Historical data shows that previous Bitcoin cycles experienced such elevated ratios, often correlating with rapid price surges.

Interestingly, recent cycles reveal that the Diaman Ratio has rarely surpassed 1 by much, suggesting that the Bitcoin market is no longer experiencing the same degree of bubble-like expansion. During the latest cycle, Bitcoin’s price soared past previous highs—thanks in part to institutional acceptance, such as the US approval of Bitcoin ETFs—yet the bubble indicators have remained subdued. This hints at a possible structural change in Bitcoin’s market dynamics.

Bitcoin price + bubble detection. Source: Diaman Partners

Bitcoin price + bubble detection. Source: Diaman Partners

Another noteworthy trend is the marked decline in Bitcoin’s annual volatility—from over 140% in its early years to roughly 50% today. Lower volatility indicates greater market stability, which could suggest that future price swings will be less extreme. Despite this, the risk-return profile has shifted; while annual returns have decreased, Bitcoin’s price still appreciated from $15,000 in December 2022 to over $126,000 during recent peaks.

The analysis of four-year rolling returns shows a flattening trend, breaking away from past patterns of spectacular years followed by devastating downturns. The total wealth accumulated through Bitcoin investments has also grown substantially, underscoring its status as a premier store of value over the past 15 years. Institutional involvement, notably the rise of cryptocurrency ETFs, appears to have played a role in stabilizing and extending the market cycle.

Overall, the emerging evidence suggests that Bitcoin’s market behavior is evolving: reduced bubble intensity, lower volatility, and changing growth expectations all point toward a new era for cryptocurrency investments. While the pace may slow, Bitcoin remains a significant asset class, promising more measured growth with fewer dramatic crashes.

This article is for general informational purposes only and does not constitute financial or legal advice. The views expressed are solely those of the author and do not reflect the opinions of any affiliated entities.

This article was originally published as Is This Good or Bad? Find Out the Surprising Truth! on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Solana (SOL) Price: Is a Breakout Coming After Four Weeks Stuck in the Same Range?

South Africa Tax Collector Deploys New Tech to Track Crypto and Offshore Assets