Spot Bitcoin-ETFs Recorded the Second-largest Capital Outflow by Almost $870M per Day

- Investors withdrew $869.86 million from spot bitcoin ETFs.

- For exchange-traded funds based on the first cryptocurrency, this is the second largest daily amount of capital lost.

- The spot Ethereum-ETF sector also recorded outflows of $259.72 million, while Solana-ETF continues to receive investments.

On November 13, 2025, the spot bitcoin ETF sector lost $869.86 million, according to SoSoValue. This is the sixth negative figure in a month. In addition, the amount of capital withdrawn was the second-largest in the history of these funds.

Dynamics of capital inflows into US spot bitcoin ETFs. Data: SoSoValue.

Dynamics of capital inflows into US spot bitcoin ETFs. Data: SoSoValue.

According to the platform, outflows occurred from almost all funds, and three funds lost over $110 million, in particular:

- BTC — $318.2 million;

- IBIT — $149.92 million;

- FBTC — $119.93 million.

Capital inflows/outflows in the US spot bitcoin ETF sector. Source: SoSoValue.

Capital inflows/outflows in the US spot bitcoin ETF sector. Source: SoSoValue.

Two exchange-traded funds did not receive funds under management.

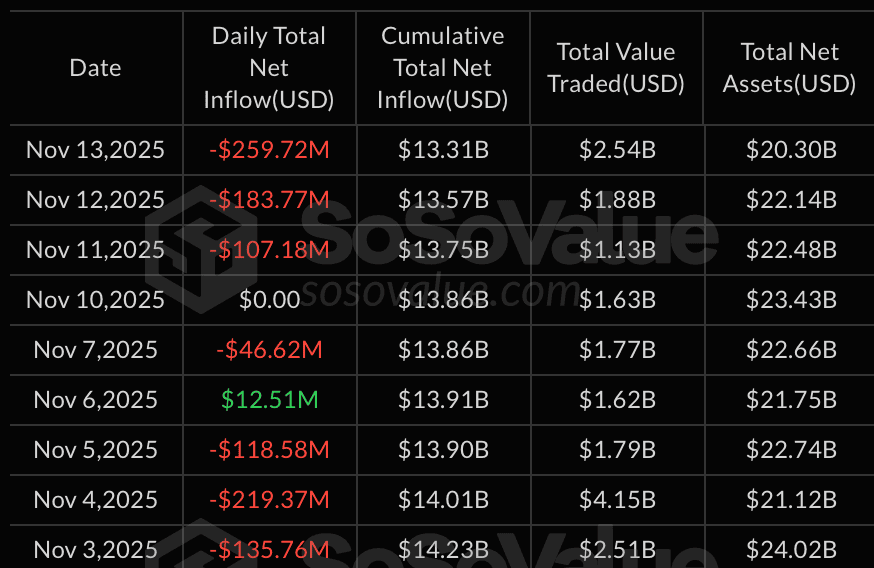

Investment losses from the spot Ethereum-ETF sector amounted to $259.72 million.

Dynamics of capital inflows into US spot Ethereum-ETFs. Data: SoSoValue.

Dynamics of capital inflows into US spot Ethereum-ETFs. Data: SoSoValue.

According to the platform, the distribution of withdrawn funds is as follows:

- ETHA — $137.31 million;

- ETHE — $67.91 million;

- ETH — $35.82 million;

- FETH — $14.25 million;

- QETH — $4.42 million.

Capital inflow/outflow in the US spot Ethereum-ETF sector. Source: SoSoValue.

Capital inflow/outflow in the US spot Ethereum-ETF sector. Source: SoSoValue.

The other four funds did not record any cash flows.

At the same time, Solana-based spot funds continue to attract capital for the 13th trading day in a row since their launch.

Capital inflows/outflows in the US spot Solana-ETF sector. Source: SoSoValue.

Capital inflows/outflows in the US spot Solana-ETF sector. Source: SoSoValue.

Last week, spot bitcoin and Ethereum ETFs lost more than $1.72 billion in capital.

You May Also Like

OurCryptoMiner Introduces USDC Dual Mining Model

Wormhole token soars following tokenomics overhaul, W reserve launch

Wormhole’s native token has had a tough time since launch, debuting at $1.66 before dropping significantly despite the general crypto market’s bull cycle. Wormhole, an interoperability protocol facilitating asset transfers between blockchains, announced updated tokenomics to its native Wormhole (W) token, including a token reserve and more yield for stakers. The changes could affect the protocol’s governance, as staked Wormhole tokens allocate voting power to delegates.According to a Wednesday announcement, three main changes are coming to the Wormhole token: a W reserve funded with protocol fees and revenue, a 4% base yield for staking with higher rewards for active ecosystem participants, and a change from bulk unlocks to biweekly unlocks.“The goal of Wormhole Contributors is to significantly expand the asset transfer and messaging volume that Wormhole facilitates over the next 1-2 years,” the protocol said. According to Wormhole, more tokens will be locked as adoption takes place and revenue filters back to the company.Read more