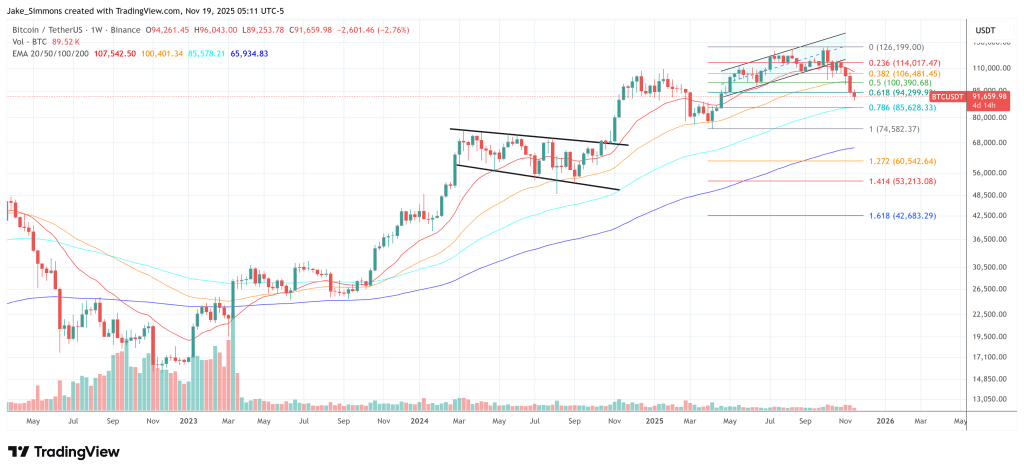

Will Bitcoin Bottom At $56,000? CryptoQuant CEO Presents The Data

CryptoQuant CEO Ki Young Ju has put a clear reference level on the current Bitcoin correction – but is adamant it should not be mistaken for a prediction.

“Many people seem to be misunderstanding this, so let me clarify,” he wrote. “I am not saying $56K is the bottom. I am saying the realized price is 56K. If you follow the cycle theory, that level would be the bottom. But I think the cycle theory is broken, and the price could flip at any time depending on macro conditions and market sentiment.”

Bitcoin Realized Price Sits at $56,000

His latest data briefing breaks the market into three layers: futures, spot, and on-chain.

In the futures market, Ju says the average order size shows that futures whales have left and retail now dominates. Internal flow profile (IFP) data indicates BTC inflows from spot to futures exchanges have collapsed, ending the phase when large players were posting BTC as collateral to go long.

At the same time, the Estimated Leverage Ratio remains high, and Binance deposit cost basis sits around $57,000, which “means traders already captured large gains from ETF and institutional flows.” Open interest is still above last year’s levels, while the aggregated funding rate is neutral, not fearful, suggesting leverage remains elevated but without a classic capitulation reset.

Spot data points to fading institutional aggression. Ju notes the Coinbase Premium is at a nine-month low, which he attributes to ETF-driven institutional selling. Spot Bitcoin ETFs have seen net negative weekly flows for three straight weeks, and Strategy mNAV at 1.23 implies that “near-term capital raising seems difficult,” as many structured strategies are already sitting on substantial gains.

On-chain metrics provide the context for the much-discussed $56,000 level. Ju observes that realized cap growth has stalled for three days, while market cap is growing more slowly than realized cap, a configuration he interprets as strong selling pressure as profitable coins move.

CryptoQuant’s PnL Index flipped short on November 8, which Ju summarizes as whales taking profit. “If the cycle theory holds, the cycle bottom would be around $56K (realized price),” he says – and immediately distances himself from treating that as a hard rule in a structurally changing market.

CryptoQuant CEO Rejects Classic Cycle Bottom Theory

In a separate prediction segment, Ju turns to macro conditions. “Short-term conditions are weak: dollar liquidity is slow, funding markets are tight, and Bitcoin inflows have cooled,” he writes. However, he adds, “I do not expect Bitcoin inflows to stop or turn into sustained outflows over the next six months.”

In his view, a shift in the policy narrative could rapidly invert sentiment: “If rate cuts or any easy-money narrative appears, sentiment could flip and liquidity would rush back into ETFs.”

Ju also sketches a longer-term structural thesis. He argues that stablecoin adoption and a wave of reverse ICOs by public companies could push traditional assets onto DEXs, enabling on-chain long and short trading in names like Tesla. In that world, on-chain analysis could evolve into labeling wallets like “Elon Musk’s ETH address to track Tesla coin onchain inflows and outflows.”

He believes Bitcoin would benefit the most, while altcoins with weak narratives or no real performance would likely lose liquidity as capital concentrates in assets with clear utility or narrative strength.

“I gave up predicting Bitcoin price,” Ju reminds followers, “but I haven’t given up analyzing data.” His $56,000 reference is best understood in that spirit: a data-driven anchor derived from realized price and cycle theory, not a promise that this drawdown will end neatly at that line.

At press time, BTC traded at $91,659.

You May Also Like

Let insiders trade – Blockworks

ZKP Might Be The Next 100x Crypto You Should Watch While ETH Demand Builds, & XRP Stalls in January