BlackRock Files for Ethereum Staking ETF, Could ETH Price Recover?

World’s largest asset manager, BlackRock, has reportedly filed for a staked Ethereum ETF with the U.S. Securities and Exchange Commission (SEC).

This new fund will sit along with the existing iShares Ether Fund (ETHA), which has already amassed more than $13 billion since its inception.

Ethereum’s ETH $3 011 24h volatility: 2.6% Market cap: $363.43 B Vol. 24h: $37.34 B price dipped to around $2,850 but has recovered above $3,000 at the time of writing.

BlackRock Pushes for Staked Ethereum ETF

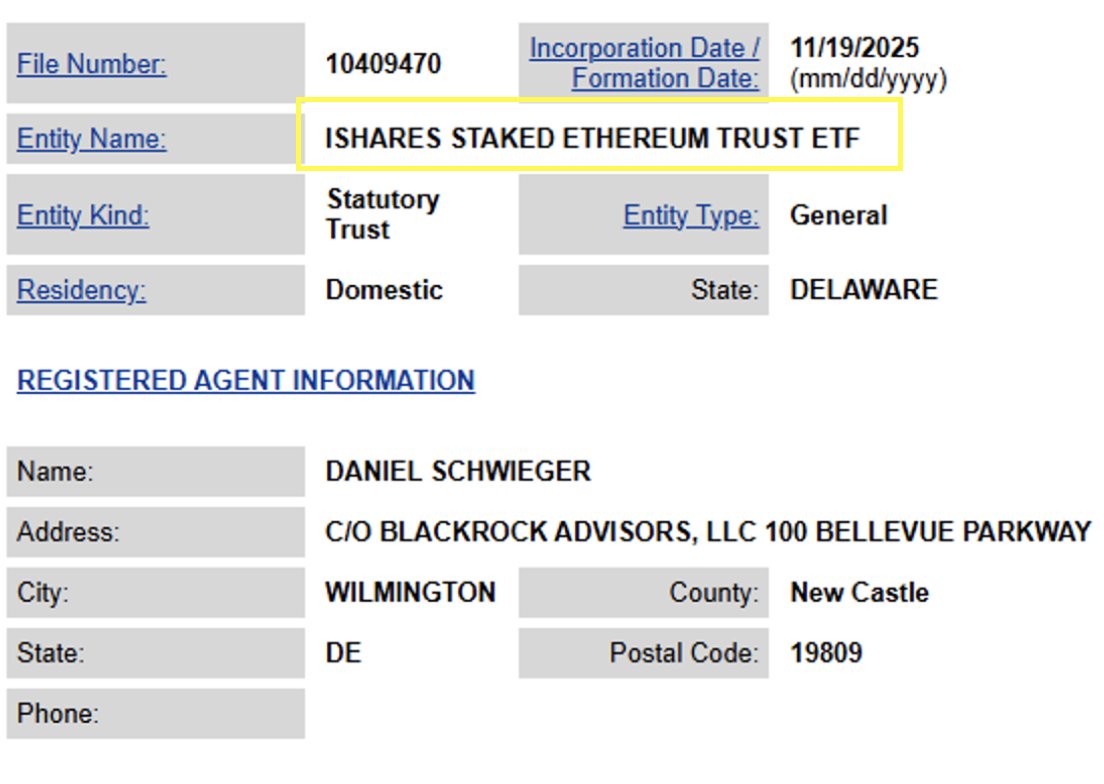

BlackRock has expanded its push into Ethereum’s staking sector by registering the iShares Staked Ethereum Trust ETF as a new statutory trust in Delaware.

Records from the Delaware Division of Corporations confirm that the trust was formally established on Nov. 19, as reported by Bloomberg executive Eric Balchunas.

BlackRock files for staked Ethereum ETF. | Source: US SEC

The filing doesn’t include product-specific documentation. The registration was handled by Daniel Schweiger, a Wilmington-based BlackRock managing director who also oversaw the creation of the iShares Ethereum Trust in late 2023.

BlackRock also needs to submit a Form S-1 to the U.S. Securities and Exchange Commission before the fund can move forward.

The trust was registered under the Securities Act of 1933, which required BlackRock to provide comprehensive disclosures before offering any investment product to the public.

Following yesterday’s filing, BlackRock joins asset managers like 21Shares, Fidelity, Franklin Templeton, and Grayscale in pursuing the addition of staking features to their Ethereum ETF offerings.

On the other hand, spot Ethereum ETFs have witnessed outflows for the past seven consecutive trading sessions. This comes amid the broader crypto market downturn seen over the past few weeks.

Will ETH Price Stage a Recovery Ahead?

The BlackRock filing to bring staking to its Ethereum ETF (ETHA) is certainly a positive development for the ecosystem.

Amid this development, the ETH price quickly bounced back from the intraday lows of $2,870.

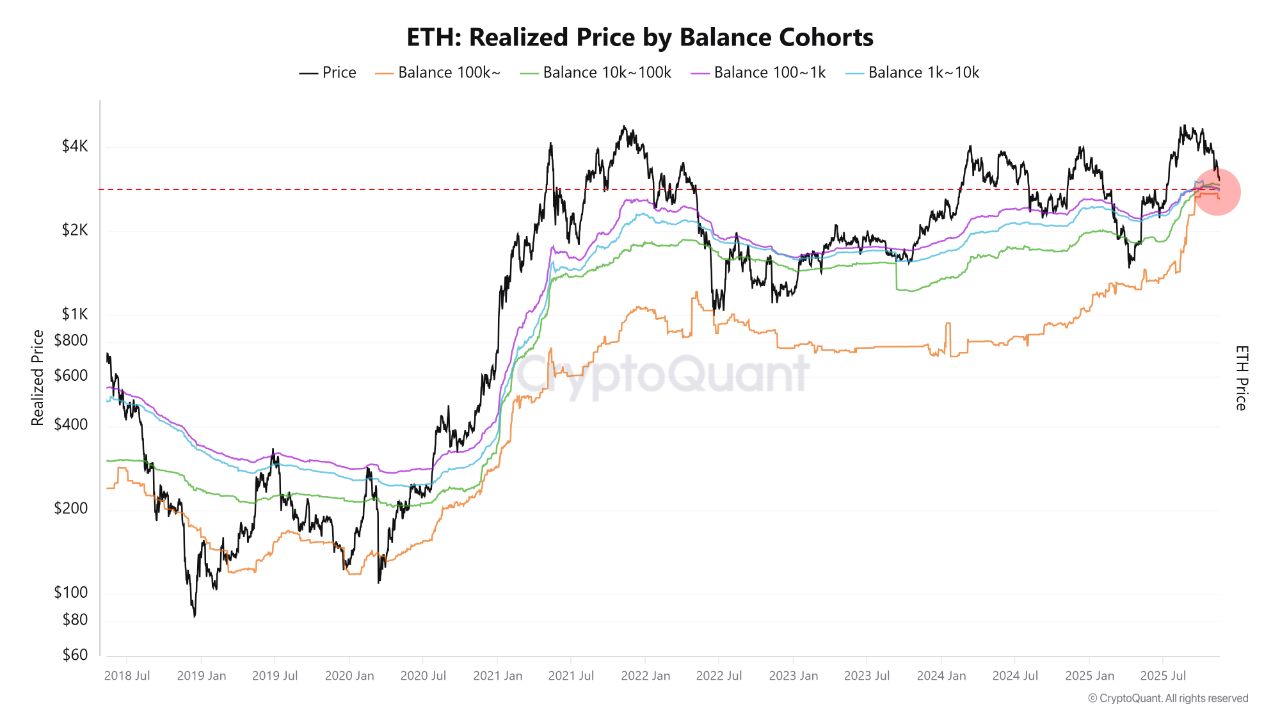

Crypto analyst CryptosRus said Ethereum is currently testing one of its most significant on-chain support levels.

The $2,800 level aligns with the realized price of both retail investors and large holders, which historically mark Ethereum cycle bottoms. ETH tapped this zone “perfectly,” the analyst noted.

On-chain trends show retail wallets are reducing exposure, while wallets holding 10,000+ ETH have been accumulating. This is usually a bottom zone behavior, said the analyst.

ETH Price and value rotation. | Source: CryptoQuant

Liquidation data also supports this setup. Long liquidations have been muted despite lower price levels, suggesting forced selling has largely subsided.

The analyst added that today’s ETH price dip was not a routine one, but a test of a major support area marked by whale accumulation.

nextThe post BlackRock Files for Ethereum Staking ETF, Could ETH Price Recover? appeared first on Coinspeaker.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun