Cardano Price Soars 2% as Bulls Target $0.50 Amid Stable Derivatives Market

Highlights:

- The Cardano price has stabilized around $0.41, marking a 2.24% increase, as the trading volume spikes 9%.

- The derivatives market shows a positive sentiment, as the open interest and volume rise.

- The technical outlook signals a rebound to $0.50 if the $0.38 support holds.

The Cardano (ADA) price has stabilized at $0.41, marking a 2% increase in the past 24 hours. The daily trading volume has soared 9% to $728 million, reinforcing the bullish outlook. Meanwhile, the derivatives data is bullish with the open interest increasing and dominance growing, as well as positive funding rates. It is also more favourable on the technical side as ADA bulls aim at $0.50.

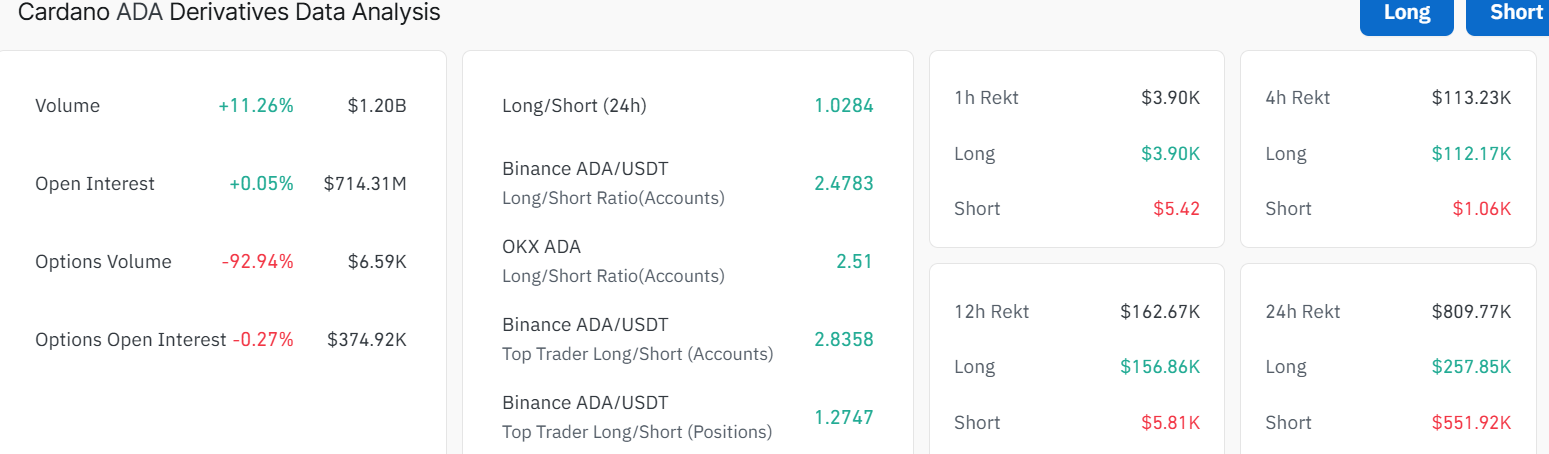

The Coinglass data shows that many traders are trading on future price changes, with the present open interest of $714 million, which has increased by 0.05% in the past 24 hours. Meanwhile, a noticeable increase in futures OI means that the notional value of all open contracts increases. This is because traders become more exposed to risk by buying new long positions or increasing leverage. With the recent market experience of a huge flow of overleveraged positions, new bulls or positions are more likely to emerge.

Cardano Derivatives Data: CoinGlass

Cardano Derivatives Data: CoinGlass

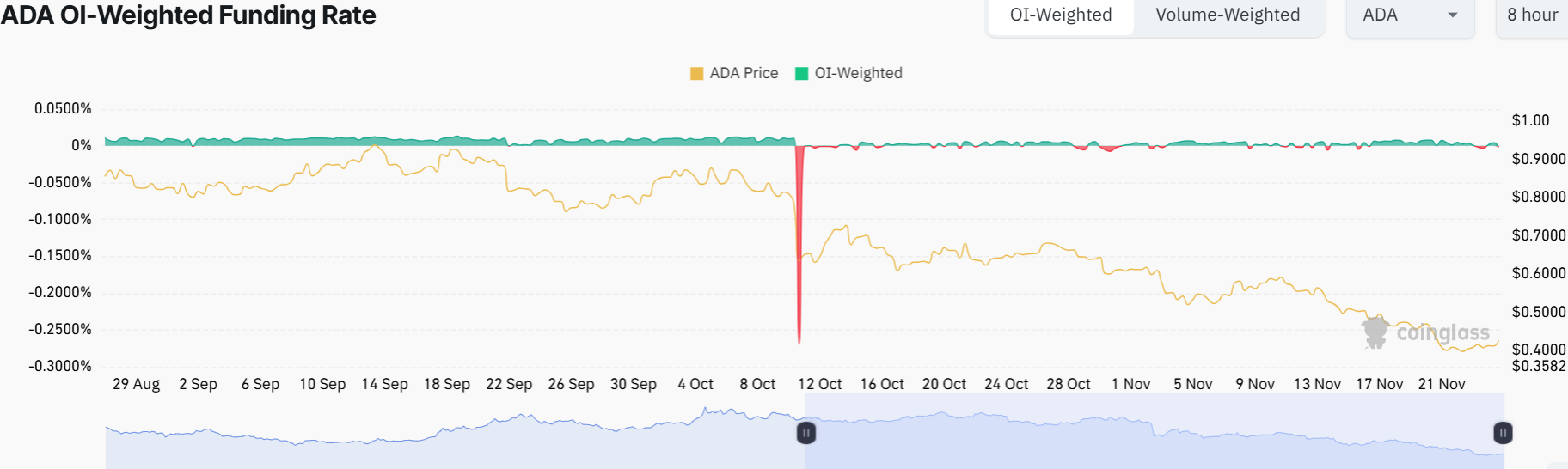

Adding to the bullish sentiment, the OI-weighted rate of funding has turned positive at 0.0014% on Tuesday. In the meantime, a positive funding rate indicates a bull-side dominance.

ADA OI-Weighted Funding Rate: CoinGlass

ADA OI-Weighted Funding Rate: CoinGlass

Cardano Price Aims for a Rebound to $0.50

The ADA/USD trading pair shows signs of a possible bullish reversal after holding strong above the $0.38 support level. The token is trading around $0.41, recovering from a recent downtrend that pushed it lower. This slight bounce suggests buyers are stepping back in and preparing for a push upward.

Traders are now watching for a potential recovery towards $0.50, which cushions the bulls against further upside. If the bulls can break above this level, Cardano price could make a run toward its next resistance near $0.59, coinciding with the 50-day SMA.

ADA/USD 1-day chart: TradingView

ADA/USD 1-day chart: TradingView

Technical indicators also support the potential for another move higher. The Relative Strength Index (RSI) is sitting around 29.90. This shows that the ADA token has entered the oversold region. In this case, the bulls may launch a buy-back campaign, leading to a recovery towards $0.50. On the other hand, the MACD indicator shows a looming buy signal, which will manifest when the MACD climbs above the orange signal line.

If bullish momentum strikes in the Cardano price, ADA could first retest the $0.50 level and then aim for $0.59. A breakout above $0.59 would signal that buyers are firmly in control and could open the door for further gains towards $0.72 in the mid-term.

On the downside, if the $0.38 support fails, Cardano’s price may face selling pressure that could send it back toward the $0.30 zone. In the meantime, the bulls have the potential to rebound, reinforced by the positive derivatives market. Moreover, the oversold conditions call for a buy-back campaign, which may see ADA recover to $0.50.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?