What do TradFi See in Dogecoin ETFs? DOGE Price Prediction and Latest DOGE News

Crypto asset manager Bitwise launched its Dogecoin exchange-traded fund on Wednesday, listing the product on the New York Stock Exchange under branding that features the familiar cartoon dog.

In a statement on the launch, Hunter Horsley, Bitwise’s chief executive, said Dogecoin holds an unusual place in the market. “DOGE started as a joke and then became a symbol of the crypto movement,” Horsley said.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

How Does the Bitwise Dogecoin ETF (BWOW) Compare With Grayscale and REX-Osprey?

Dogecoin makes no grand promises. It does not pretend to rebuild the world of finance. And it does not sell itself as a project with deep economics or complex technology.

DOGE is a 12-year-old coin built on a cartoon dog, online jokes, people doing good, and the simple idea that users should be free to spend their money how they like.

Despite that, Dogecoin has grown into one of the largest names in crypto. It now ranks as the ninth-biggest digital asset by market value, sitting at around $23Bn. Interest surged after Tesla chief Elon Musk repeatedly posted about Dogecoin on social media.

Those posts helped push the coin far beyond its meme roots and into mainstream conversation.

In 2025, Dogecoin received another boost after Musk and entrepreneur Vivek Ramaswamy were chosen to lead a U.S. government unit called the Department of Government Efficiency, shortened to DOGE.

Since then, the price has retreated to roughly $0.15. Earlier this week, Reuters reported that the department had been wound down earlier than planned.

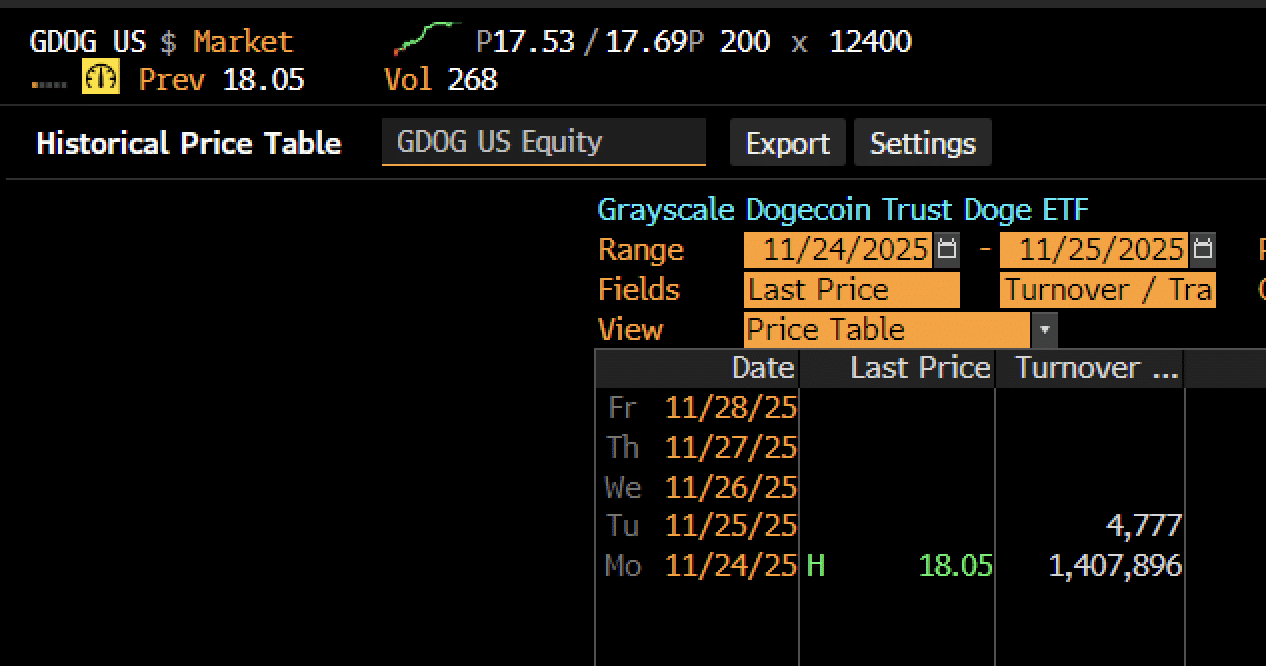

The Bitwise Dogecoin ETF, trading as BWOW, is entering a market that’s already crowded. The Grayscale Dogecoin ETF launched earlier in the week. The REX-Osprey DOGE ETF has been trading since September. That fund uses a different setup because the Investment Company Act of 1940 sets the rules for pooled investment products in the United States. Grayscale’s fund, listed as GDOG, logged about $1.4M in trading volume on its first day.

Eric Balchunas of Bloomberg called the start “solid for an average launch but low for a ‘first-ever spot’ product,” and said the result was “not too surprising.”

(Source: X)

(Source: X)

Approval for Bitwise’s listing came on Tuesday. NYSE Arca, part of NYSE Group, certified the fund ahead of its debut.

Regulatory filings show the ETF aims to track Dogecoin’s price. The assets will be held by Coinbase Custody Trust Company, LLC.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

DOGE Price Prediction: Is Dogecoin Forming a Breakout Pattern in 2025?

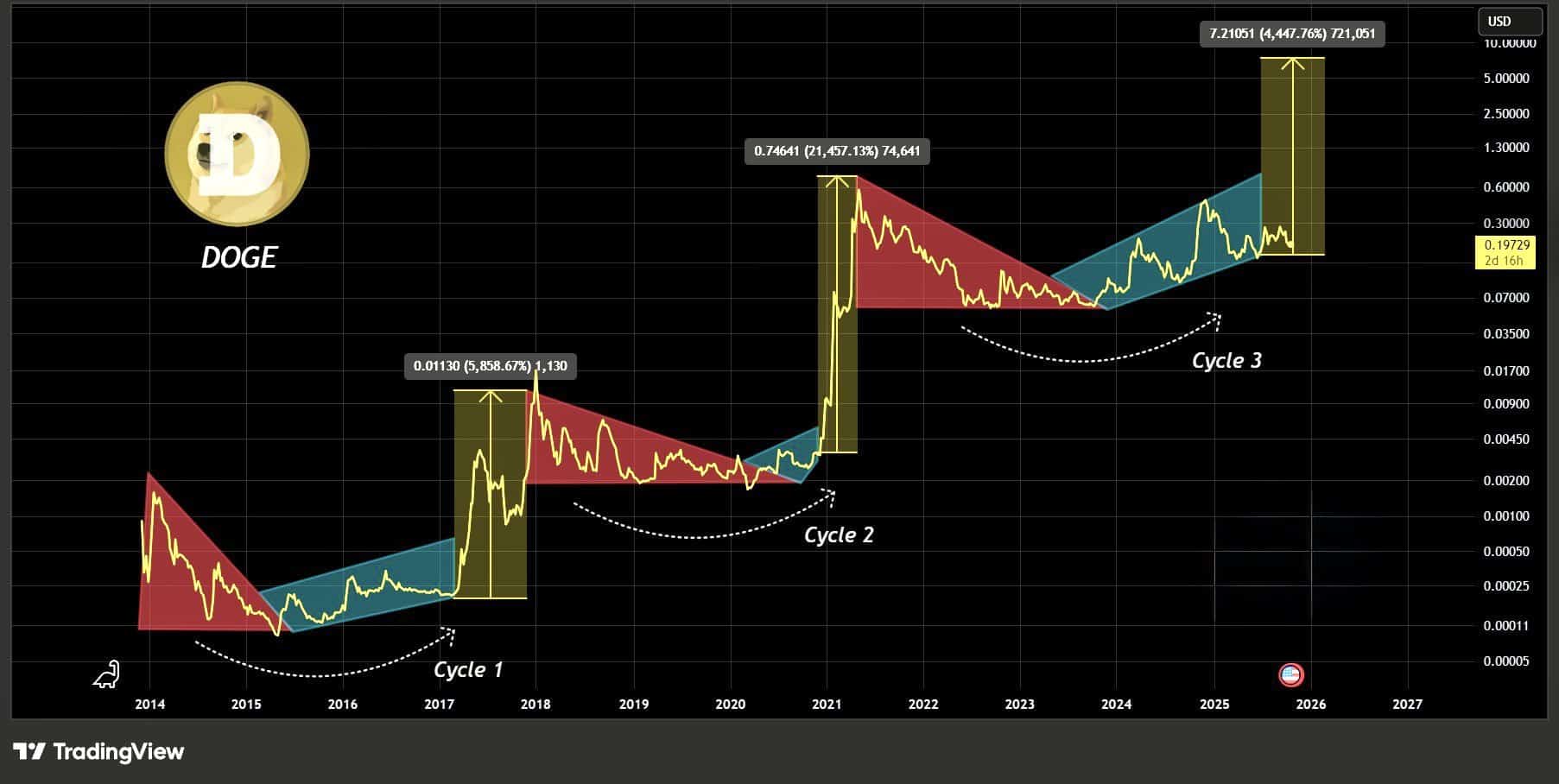

A long-term Dogecoin chart shared by crypto analyst Bark points to what he describes as the start of another high-volatility phase for the memecoin, echoing moves seen in past market cycles.

In his chart, Dogecoin’s history is split into three major cycles. In the first two, DOGE spent long periods in broad accumulation ranges before breaking out into sharp, vertical rallies.

An extended cooldown with fading momentum and a series of lower highs followed each surge. Cycle 1 topped out near $0.011, while Cycle 2 peaked around $0.74.

(Source: X)

(Source: X)

In the current cycle, Dogecoin appears to have carved out a rounded base between 2022 and mid-2023 and is now trading inside a rising channel.

Price action has been grinding higher since then, which Bark interprets as a move away from distribution and into a fresh expansion phase.

The pattern on his chart mirrors earlier breakout zones, where price compressed, then resolved in a strong directional move.

Bark’s prediction extends into 2026, with a highlighted target area above $5 per coin. “The Dogecoin cycle is ready for liftoff. If history repeats itself, the jump will be massive. We could see $5 DOGE in 2026,” he told followers.

Even so, the analysis is based on historical rhythm rather than hard guarantees, and analysts note that past cycle structures do not ensure the same result this time.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

The post What do TradFi See in Dogecoin ETFs? DOGE Price Prediction and Latest DOGE News appeared first on 99Bitcoins.

You May Also Like

Vitalik Buterin Supports Native Rollup Integration on Ethereum

NEAR Price Prediction: Testing Critical $1.88 Resistance with $2.10-$2.35 Targets by February 2026