BitMine (BMNR) Stock Jumps 10% as Firm Now Holds 3% of Total Ethereum Supply

TLDR

- BitMine purchased 14,618 ETH for $44.34 million on November 28, 2025

- BMNR stock surged 9.79% to $31.74 while Ethereum stayed flat at $3,000

- Company now holds 3.63 million ETH worth $10.39 billion

- BitMine targets 5% of total Ethereum supply as part of long-term strategy

- Institutional ownership jumped from 10 million to 100 million shares in one month

BitMine Immersion Technologies added 14,618 ETH to its treasury on November 28. The purchase cost $44.34 million and came from a BitGo wallet.

Bitmine Immersion Technologies, Inc., BMNR

The Tom Lee-backed company now owns 3.63 million Ethereum tokens. That represents 3% of the entire Ethereum supply. BitMine’s goal is to control 5% of all ETH, approximately 6 million tokens total.

BMNR stock responded positively to the news. Shares closed up 9.79% at $31.74. After-hours trading pushed the stock even higher with a 3.65% gain.

Why BMNR Stock Outperformed Ethereum

The stock market loved BitMine’s purchase more than crypto traders did. While BMNR jumped nearly 10%, Ethereum barely moved from $3,000.

This disconnect tells an interesting story. Investors view BitMine’s accumulation strategy as bullish for the company’s future. The firm is building a massive position in the second-largest cryptocurrency.

Institutional money is flowing into BMNR. Ownership exploded from 10 million shares to 100 million shares in just 30 days. That’s a 10x increase showing major confidence from big players.

BitMine’s holdings are worth roughly $10.39 billion at current ETH prices. The company has an enterprise value of $12.19 billion with a modified net asset value of 1.08.

Recent Buying Spree Continues

This wasn’t BitMine’s only recent purchase. Earlier in the week, the company bought 28,625 ETH worth $82.11 million. The previous day brought another acquisition of 21,537 ETH for $60 million.

These purchases show a clear pattern. BitMine is aggressively accumulating during price weakness. The strategy aligns with Tom Lee’s bullish long-term view on Ethereum.

Corporate Ethereum holdings now total $24.97 billion across all companies. That’s 5.01% of total supply. Institutions are positioning for Ethereum’s role in staking and tokenized assets.

Ethereum Price Action Stays Muted

Despite the buying pressure, ETH traded at $3,019. The price is down 25% from a month ago.

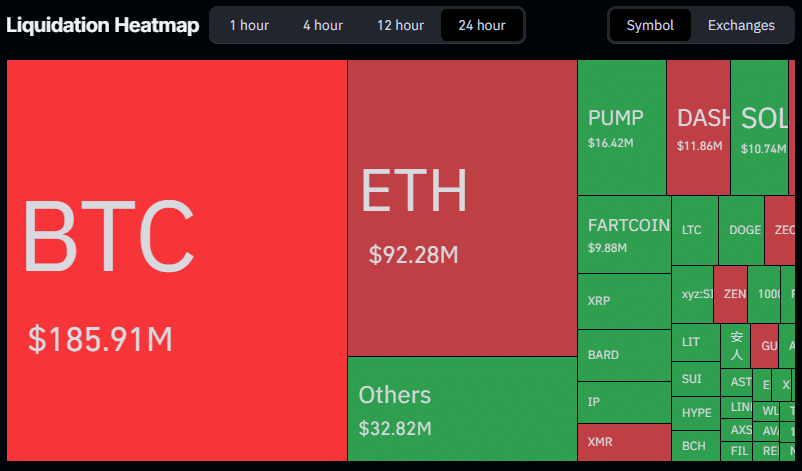

Trading volume dropped 31% in 24 hours. The 24-hour range was tight between $2,987 and $3,043. Traders seem cautious ahead of crypto options expiry.

Several factors explain the flat price. Spot ETH ETF flows have been mixed. Liquidity remains weak in the current market environment.

Futures open interest tells a mixed story. It jumped 0.71% to $36.20 billion over four hours but fell 4% over 24 hours. This suggests uncertainty among derivatives traders.

Some technical analysts see potential for a breakout. An RSI breakout appeared on the ETH/BTC daily chart. Closing above $3,000 for the week could trigger a move toward $3,300-$3,400.

BMNR stock remains down 37% over the past month despite the recent bounce. The correlation with crypto market performance keeps pressure on shares. The broader crypto market fell 22% during this period, dragging BMNR down with it.

BitMine is now halfway to its goal of owning 5% of all Ethereum. The company continues buying regardless of short-term price action.

The post BitMine (BMNR) Stock Jumps 10% as Firm Now Holds 3% of Total Ethereum Supply appeared first on Blockonomi.

You May Also Like

ICP Extends Rally to 35% as Mission 70 White Paper Targets 70% Inflation Cut

Why Little Pepe (LILPEPE) Under $0.003 Is a Better Buy Than Cardano (ADA) Below $3