Gigmile unveils 2025 Impact Report as it closes seed round to accelerate mobility financing across Africa

Gigmile has released its 2025 Impact Report and confirmed the close of its seed round in Q3 2025, marking a defining moment for the mobility financing startup operating across Nigeria and Ghana. The seed round was led by a follow-on investment from ENZA Capital, with backing from Seedstars International Ventures and the Norrsken Africa Fund. It strengthens the company’s position as one of Africa’s most active providers of lease-to-own mobility assets for gig workers.

The Lagos and Accra-based startup was founded in 2022 by former Jumia Country Managers Kayode Adeyinka and Samuel Esiri. In just four years, Gigmile has become a key player in an underserved mobility credit market that locks out millions of delivery riders, ride-hailing drivers, and logistics workers. Traditional banks still demand collateral, credit history, and documents that most gig workers cannot provide. As a result, many skilled workers remain unable to access income-generating vehicles.

Gigmile built Gamma Mobility to fill this gap. The platform finances motorcycles, tricycles, cars, and personal commuting vehicles through a lease-to-own model designed for flexibility and long-term financial inclusion. Daily repayments are capped at one-third of expected earnings, helping riders maintain stability even during slow periods. Insurance, maintenance, repairs, and full licensing are bundled into every lease to remove operational friction that often holds gig workers back.

Key points from Gigmile’s 2025 Impact Report

Key points from Gigmile’s 2025 Impact Report

The company says more than 10,000 vehicles have now been deployed. Of these, 8,500 are active on the platform, and 1,500 riders have completed ownership, creating steady income and long-term economic mobility. Gigmile’s rise has been supported by supply partnerships with Yamaha, TVS, Bajaj, and Hero, giving riders access to durable vehicles adapted for African road conditions.

To date, the company has raised $21 million in combined debt and equity. The capital has allowed Gigmile to expand its fleet, deepen its credit analytics, and scale to 13 cities across Nigeria and Ghana. The firm plans to enter more than 15 new cities in the next year, powered by an evolving automation engine that manages onboarding, risk scoring, rider support, and repayment cycles.

Inside the Gigmile’s 2025 Impact Report

The 2025 Impact Report brings new clarity to Gigmile’s financial and social outcomes across its markets. According to the report, Gamma Mobility has financed more than 8,500 vehicles and enabled over 15,000 gig workers to enter or remain in stable work.

Monthly rider earnings now exceed $2 million, while the platform has deployed more than $18 million worth of financed assets. Gigmile has also provided health insurance to 3,200 riders. Repayment performance stands at 94 per cent, with a 95 per cent utilisation rate, pointing to a model that is both capital-efficient and commercially viable.

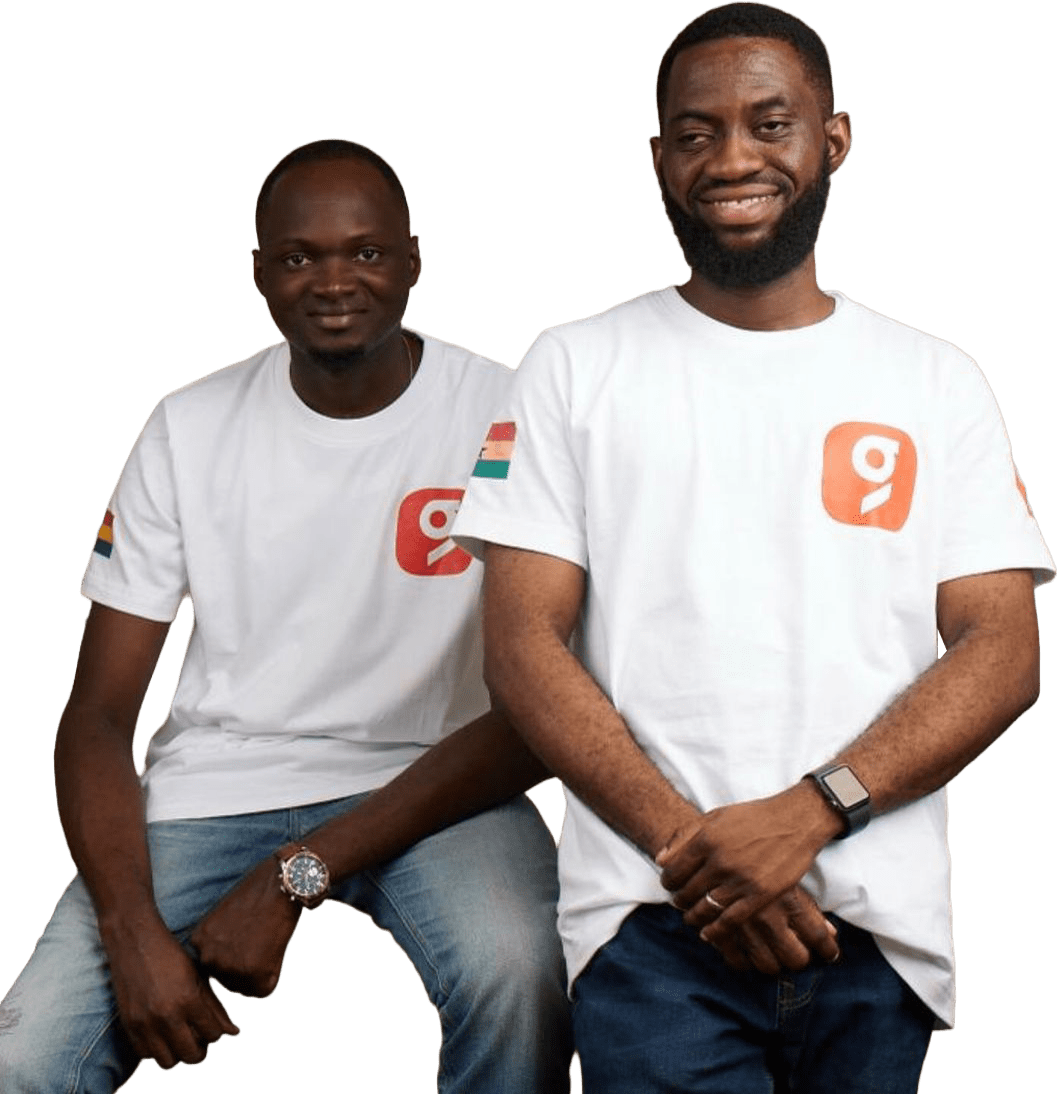

Kayode Adeyinka and Samuel Esiri, co-founders of Gigmile

Kayode Adeyinka and Samuel Esiri, co-founders of Gigmile

The business is preparing to widen its reach beyond gig workers. Personal mobility leasing for salaried professionals, embedded finance products such as bill payments and savings tools, and new clean mobility options including electric and CNG vehicles are already in development. These verticals reflect a growing demand for flexible mobility ownership as African cities expand and transport systems come under pressure.

Speaking on the release of the report, CEO Kayode Adeyinka said, “With this Impact Report, we are proud to show how technology, structured financing, and strong partnerships can unlock economic mobility at scale. Our model proves that mobility financing can be profitable, scalable, and deeply transformational. This funding enables us to serve more riders, onboard more women, and execute on our clean mobility roadmap.”

Gigmile’s 2025 Impact Report

Gigmile’s 2025 Impact Report

Gigmile aims to cross $100 million in financed mobility assets by 2027. With investor interest rising across fintech, climate mobility, and lending infrastructure, the company expects to begin early conversations for a Series A round in 2026.

The 2025 Impact Report is now available for download here, and it provides a full view of the company’s metrics and expansion plans as it enters its next phase of growth.

You can also read: How Spiro is driving Africa’s electric mobility through local engineering and fast charging technology

You May Also Like

XRP price prediction as Standard Chartered cuts 2026 target

This U.S. politician’s suspicious stock trade just returned over 200% in weeks

Pi Network v19–v23 Upgrade: From Experimental Nodes to Enterprise-Ready Infrastructure

Pi Network is undergoing a significant transformation with its ongoing v19–v23 upgrade, signaling a shift from a closed exper