Best Cryptocurrencies to Purchase Today, December 1 – SUI, XRP, LINK

Highlights:

- SUI is holding its trendline as buyers target $2.40 while market fear remains high.

- XRP is sitting in a key demand zone as buyers defend $2.06 to avoid deeper moves toward $1.88.

- LINK has gained attention as the new ETF launch boosts demand and lifts long-term confidence.

The crypto market has started the month of December in a bearish tone after a flash BTC crash wiped over $144 billion off the market cap. BTC dropped from $91,300 to $87,000 within a few hours without any macroeconomic factors playing in. Analysts argue that liquidity is thin at the moment, and any sell pressure can generate huge liquidations. At press time, the total market cap is down 4.93% to $2.94 trillion. However, the trading volume is up 54.28% to $125.45 billion in the past day.

The crypto market has experienced a total of $640.70 million in liquidations in the last 24 hours, according to CoinGlass data. Meanwhile, the fear and greed index still sits in the fear zone at an index of 20 after plunging to extreme fear last week. With the last month of the year starting on a bearish note, here are the best cryptocurrencies to buy today.

Best Cryptocurrencies to Buy Today

1. Sui (SUI)

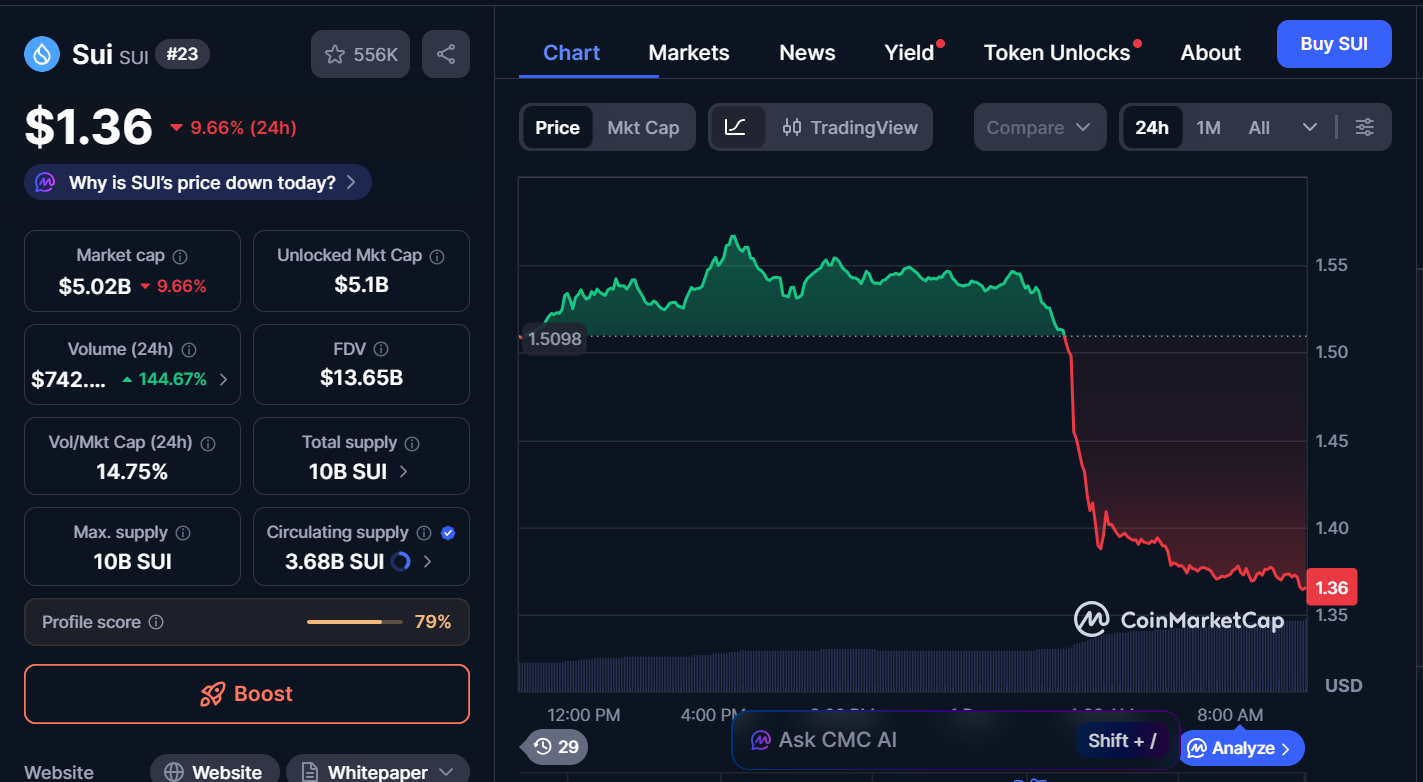

Sui, the native token of the Sui network, is currently trading at around $1.36, with a 9.66% decrease in the past day. However, its trading volume has increased by 144.67% to $742 million, while the market cap stands at $5.02 billion.

Source: CoinMarketCap

Source: CoinMarketCap

SUI has bounced off the long-term trendline again, and this zone now acts as the strongest support on the chart. The price reacted near $1.30 and is trading above the rising structure. This behavior confirms that buyers are still defending the macro trend.

SUI is now targeting the $1.80 zone, which acts as the first major barrier. A break above this area may trigger a stronger push toward $2.40. This level remains critical because it sits near previous breakdown points. If momentum holds, SUI may attempt a broader recovery toward $3.20. However, any rejection near $1.80 could delay the move and force another trendline retest.

2. XRP

XRP is trading at $2.04, a 7.1% decrease in the past day. The market cap of the coin stands at $123.28 billion, and the trading volume is up 86.76% to $3.74 billion. Meanwhile, XRP is down 18% on the monthly chart.

Source: CoinMarketCap

Source: CoinMarketCap

XRP has dropped sharply and is now trading inside a key demand zone near $2.06. Buyers previously defended this area, and the price of XRP has reacted each time the price touched it. This zone now acts as the first line of support.

If buyers hold $2.06, XRP may attempt a recovery toward $2.18. However, a clean break below this region could open the path toward deeper demand zones near $1.88 and $1.78. These levels offer the next meaningful support if selling continues.

3. Chainlink (LINK)

LINK is currently trading at $12.23, with a 6.21% decrease in the last 24 hours. The trading volume of the coin is up by 119.56% to $597 million, while the market cap stands at $8.52 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Chainlink is showing strong recovery potential because fresh institutional demand is building. Grayscale has received clearance to launch the first spot Chainlink ETF. This move gives investors regulated access to LINK through a familiar product. It also arrives as the firm completes its third ETF launch in two weeks. This momentum signals growing confidence in the token.

The GLNK fund also includes staking, which strengthens its appeal but has drawn regulatory attention. Bitwise has already listed a non-staking version, which confirms rising competition for Chainlink exposure. Analysts at Grayscale also highlighted LINK’s role in tokenization and called it a leading asset in the Utilities and Services sector. This narrative supports a sustained rebound in market sentiment.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

EUR/CHF slides as Euro struggles post-inflation data

Zero Knowledge Proof (ZKP) vs DOGE, SHIB, and PEPE: Good Crypto to Buy Now for Structure-Driven Gains